Arizona Form a 4 Spanish

What is the Arizona Form A 4 Spanish

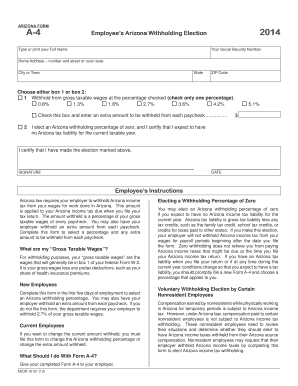

The Arizona Form A 4 Spanish is a state-specific withholding form used by employers to determine the amount of state income tax to withhold from employees' wages. This form is essential for employees who prefer to communicate in Spanish, ensuring they understand their tax obligations. The form captures necessary personal information, including the employee's name, address, and Social Security number, along with their withholding preferences.

How to use the Arizona Form A 4 Spanish

To utilize the Arizona Form A 4 Spanish, employees must complete the form accurately and submit it to their employer. The form provides options for claiming allowances, which directly affect the amount withheld from their paychecks. Employees should review their financial situation annually or when significant life changes occur, such as marriage or the birth of a child, to ensure appropriate withholding levels.

Steps to complete the Arizona Form A 4 Spanish

Completing the Arizona Form A 4 Spanish involves several key steps:

- Obtain a copy of the form from your employer or download it from the Arizona Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the number of allowances you wish to claim based on your personal tax situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Legal use of the Arizona Form A 4 Spanish

The Arizona Form A 4 Spanish is legally recognized for tax withholding purposes in the state of Arizona. It complies with state regulations, ensuring that employers can accurately withhold the correct amount of state income tax from employees' wages. Proper completion and submission of this form are crucial for maintaining compliance with state tax laws.

Key elements of the Arizona Form A 4 Spanish

Key elements of the Arizona Form A 4 Spanish include:

- Personal Information: Name, address, and Social Security number.

- Withholding Allowances: The number of allowances claimed, which influences the withholding amount.

- Signature: The employee's signature certifying the accuracy of the information provided.

- Date: The date the form is completed and signed.

Filing Deadlines / Important Dates

It is important for employees to submit the Arizona Form A 4 Spanish to their employers promptly, especially at the beginning of the tax year or when there are changes in their personal circumstances. Employers are required to process the form and adjust withholding accordingly, typically by the next payroll cycle. Staying aware of state tax deadlines can help avoid potential penalties for under-withholding.

Quick guide on how to complete arizona form a 4 spanish

Prepare Arizona Form A 4 Spanish effortlessly on any device

Digital document administration has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any holdups. Manage Arizona Form A 4 Spanish on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Arizona Form A 4 Spanish easily

- Locate Arizona Form A 4 Spanish and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Arizona Form A 4 Spanish and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form a 4 spanish

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form A 4 Spanish, and why is it important?

The Arizona Form A 4 Spanish is a crucial document for employees in Arizona to declare their withholding status. It ensures that the correct amount of state tax is withheld from their paychecks. Understanding this form helps employees manage their tax payments effectively in Spanish.

-

How can airSlate SignNow help with the Arizona Form A 4 Spanish?

airSlate SignNow allows users to easily create, send, and eSign the Arizona Form A 4 Spanish. Our platform simplifies the paperwork process, making it faster and more efficient. Users can complete forms digitally, ensuring accuracy and saving time.

-

Is there a cost to use airSlate SignNow for the Arizona Form A 4 Spanish?

Yes, airSlate SignNow offers a range of pricing plans to fit different business needs, including options for handling the Arizona Form A 4 Spanish. You can choose a plan that complements your volume of document management. Our cost-effective solutions make eSigning accessible for everyone.

-

What features does airSlate SignNow offer for managing the Arizona Form A 4 Spanish?

airSlate SignNow provides features like customizable templates, secure eSignature options, and real-time tracking for the Arizona Form A 4 Spanish. These features enable users to streamline their document management and enhance productivity. The intuitive interface makes it easy for anyone to use.

-

Can I integrate airSlate SignNow with other tools for managing the Arizona Form A 4 Spanish?

Absolutely! airSlate SignNow seamlessly integrates with various tools, allowing you to manage the Arizona Form A 4 Spanish alongside other business applications. This interoperability enhances workflow and ensures that documents are organized and accessible across your systems.

-

How secure is using airSlate SignNow for eSigning the Arizona Form A 4 Spanish?

Security is paramount at airSlate SignNow. We implement advanced encryption protocols to protect sensitive data, including the Arizona Form A 4 Spanish. Our platform complies with industry standards for electronic signatures, ensuring that your documents are safe and legally binding.

-

What benefits can businesses expect by using airSlate SignNow for the Arizona Form A 4 Spanish?

By using airSlate SignNow for the Arizona Form A 4 Spanish, businesses can expect increased efficiency and reduced turnaround times. Our platform eliminates the need for paper, leading to cost savings and a lower environmental impact. Additionally, the ease of use fosters better compliance and employee satisfaction.

Get more for Arizona Form A 4 Spanish

Find out other Arizona Form A 4 Spanish

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement