2 12% Homestead Exemption Application Form Dte 105c

What is the 2 12% Homestead Exemption Application Form Dte 105c

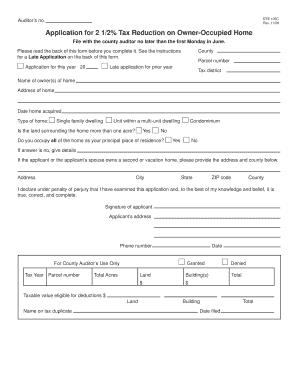

The 2 12% Homestead Exemption Application Form Dte 105c is a specific document used by homeowners in the United States to apply for a homestead exemption. This exemption reduces the taxable value of a property, providing financial relief to eligible homeowners. The form is typically required by local tax authorities to determine eligibility based on criteria such as ownership status and residency. Understanding the purpose and requirements of this form is essential for homeowners seeking to benefit from property tax reductions.

How to use the 2 12% Homestead Exemption Application Form Dte 105c

Using the 2 12% Homestead Exemption Application Form Dte 105c involves completing the form accurately and submitting it to the appropriate local tax authority. Homeowners should gather necessary information, including property details and personal identification, before starting the application process. Once the form is filled out, it can be submitted electronically or via traditional mail, depending on local regulations. Ensuring that all required fields are completed and that supporting documents are included will help streamline the approval process.

Steps to complete the 2 12% Homestead Exemption Application Form Dte 105c

Completing the 2 12% Homestead Exemption Application Form Dte 105c involves several key steps:

- Gather necessary documents, such as proof of ownership and identification.

- Fill out the form with accurate information regarding the property and homeowner.

- Review the completed form for any errors or missing information.

- Submit the form according to local guidelines, either online or by mail.

- Keep a copy of the submitted form and any correspondence for your records.

Eligibility Criteria

Eligibility for the 2 12% Homestead Exemption typically includes several criteria that homeowners must meet. Generally, applicants must be the legal owner of the property and use it as their primary residence. Additional factors may include income limits, age requirements, or disability status, which can vary by state or locality. It is important for applicants to review their local regulations to ensure they meet all eligibility requirements before submitting the application.

Form Submission Methods

The 2 12% Homestead Exemption Application Form Dte 105c can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission via the local tax authority's website.

- Mailing a physical copy of the completed form to the designated office.

- In-person submission at local government offices, if available.

Homeowners should check their local tax authority's website for specific instructions and any deadlines associated with submission.

Key elements of the 2 12% Homestead Exemption Application Form Dte 105c

The 2 12% Homestead Exemption Application Form Dte 105c includes several key elements that applicants must complete. These typically include:

- Property address and legal description.

- Owner's name and contact information.

- Details regarding the use of the property as a primary residence.

- Signature of the applicant, certifying the accuracy of the information provided.

Providing accurate and complete information in these sections is crucial for the successful processing of the application.

Quick guide on how to complete 2 12 homestead exemption application form dte 105c

Effortlessly Prepare 2 12% Homestead Exemption Application Form Dte 105c on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without any holdups. Manage 2 12% Homestead Exemption Application Form Dte 105c on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Method to Alter and eSign 2 12% Homestead Exemption Application Form Dte 105c Effortlessly

- Obtain 2 12% Homestead Exemption Application Form Dte 105c and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and select the Done button to save your updates.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign 2 12% Homestead Exemption Application Form Dte 105c and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2 12 homestead exemption application form dte 105c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2 12% Homestead Exemption Application Form Dte 105c?

The 2 12% Homestead Exemption Application Form Dte 105c is a document that allows homeowners to apply for a property tax exemption, reducing their tax liability. Completing this form can result in signNow savings on yearly property taxes for eligible homeowners.

-

How do I complete the 2 12% Homestead Exemption Application Form Dte 105c?

To complete the 2 12% Homestead Exemption Application Form Dte 105c, gather necessary documents such as proof of ownership, income verification, and residency status. The form should be filled out accurately and submitted to your local tax authority to ensure you receive the appropriate exemption.

-

What are the benefits of filing the 2 12% Homestead Exemption Application Form Dte 105c?

Filing the 2 12% Homestead Exemption Application Form Dte 105c can signNowly lower your property tax bill, making homeownership more affordable. Additionally, it helps you maintain financial stability by reducing yearly expenses associated with property taxes.

-

Is there a fee to submit the 2 12% Homestead Exemption Application Form Dte 105c?

Typically, there is no fee to submit the 2 12% Homestead Exemption Application Form Dte 105c; however, it's essential to check with your local tax authority for any specific regulations or requirements that might apply.

-

Can I eSign the 2 12% Homestead Exemption Application Form Dte 105c?

Yes, the 2 12% Homestead Exemption Application Form Dte 105c can be electronically signed using eSignature solutions like airSlate SignNow. This makes the submission process convenient and quick, ensuring your application is processed without delays.

-

What documents do I need to accompany the 2 12% Homestead Exemption Application Form Dte 105c?

When filing the 2 12% Homestead Exemption Application Form Dte 105c, you may need to provide documentation such as proof of residency, income statements, and identification. Ensure that all documents are current and accurately reflect your situation to support your application.

-

How can airSlate SignNow assist me with the 2 12% Homestead Exemption Application Form Dte 105c?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the 2 12% Homestead Exemption Application Form Dte 105c. With its cost-effective solution, users can streamline the application process and ensure a secure submission.

Get more for 2 12% Homestead Exemption Application Form Dte 105c

Find out other 2 12% Homestead Exemption Application Form Dte 105c

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later