Form Appendix B 2018-2026

What is the Form Appendix B

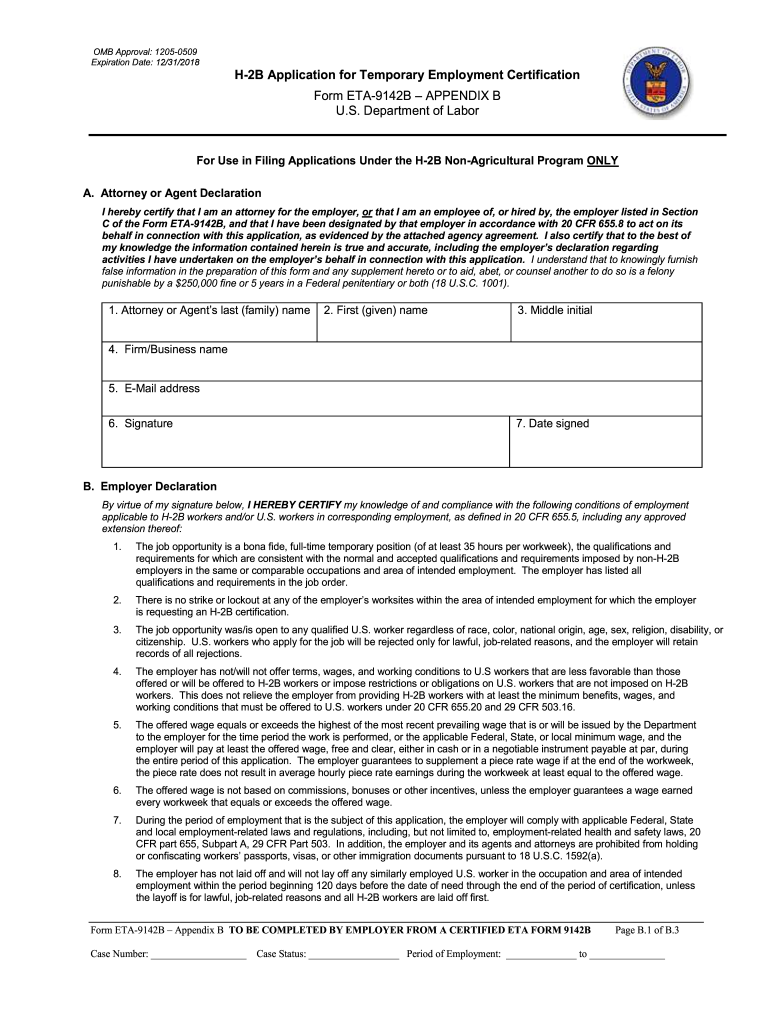

The Form Appendix B, also known as ETA 9142B, is a crucial document used in various immigration processes, particularly for employers seeking to hire foreign workers under specific visa categories. This form is part of the broader ETA 9142 series, which is essential for demonstrating compliance with labor certification requirements. The Appendix B section specifically outlines the job details, including the duties, requirements, and conditions of employment. It serves as a supporting document that provides additional context to the primary application.

How to use the Form Appendix B

Using the Form Appendix B involves several steps to ensure that all necessary information is accurately provided. First, gather all relevant details about the job position, including the job title, responsibilities, and qualifications required. Next, complete the form by filling in the required fields, ensuring that all information aligns with the job description. It's essential to review the completed form for accuracy before submission, as any discrepancies can lead to delays or complications in the application process.

Steps to complete the Form Appendix B

Completing the Form Appendix B requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from a reliable source.

- Fill in the employer's information, including name, address, and contact details.

- Provide a detailed description of the job, including specific duties and required qualifications.

- Include information about the working conditions and any special requirements.

- Review the form for completeness and accuracy.

- Submit the form according to the specified guidelines, whether online or via mail.

Legal use of the Form Appendix B

The legal use of the Form Appendix B is vital for employers to comply with U.S. immigration laws. This form must be used in conjunction with the primary ETA 9142 application to ensure that all labor certification requirements are met. Employers must ensure that the information provided is truthful and accurate, as misrepresentation can lead to severe penalties, including fines or denial of the application. It is advisable to consult with legal experts in immigration law to navigate the complexities of the process.

Key elements of the Form Appendix B

Understanding the key elements of the Form Appendix B is essential for proper completion. The form typically includes:

- Employer information: Name, address, and contact details.

- Job title and description: A clear outline of the position and responsibilities.

- Qualifications: Required skills, education, and experience for the job.

- Working conditions: Details about the work environment and any specific conditions.

- Salary information: The offered wage and benefits associated with the position.

Form Submission Methods

Submitting the Form Appendix B can be done through various methods, depending on the requirements set forth by the relevant authorities. Common submission methods include:

- Online submission through designated government portals.

- Mailing the completed form to the appropriate office.

- In-person submission at local immigration offices, if applicable.

It is crucial to follow the specific guidelines for submission to ensure that the application is processed efficiently.

Quick guide on how to complete form eta 9142b appendix b us department of labor

Discover the most efficient method to complete and endorse your Form Appendix B

Are you still spending time preparing your official documents on paper rather than handling them online? airSlate SignNow offers a superior way to fill out and endorse your Form Appendix B and related forms for public services. Our advanced eSignature platform equips you with all the necessary tools to manage documents swiftly and in compliance with official standards - robust PDF editing, management, protection, signing, and sharing features are all available within a user-friendly interface.

Only a few actions are needed to fill out and endorse your Form Appendix B:

- Upload the editable template to the editor via the Get Form button.

- Review the information you need to include in your Form Appendix B.

- Navigate through the fields utilizing the Next option to avoid missing anything.

- Employ Text, Check, and Cross tools to fill in the blanks with your details.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Conceal sections that are irrelevant anymore.

- Select Sign to create a legally valid eSignature using whichever method you prefer.

- Add the Date beside your signature and finalize your task with the Done button.

Store your completed Form Appendix B in the Documents section of your profile, download it, or upload it to your chosen cloud storage. Our platform also offers versatile form sharing options. No need to print your documents when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

FAQs

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

How can I take my child (16yrs) to the U.S if my immigrant visa is approved? My husband, a US citizen, filled out form I 130 for me and mentioned this child as migrating in future.

Just petition using a I-130 yourself. Read the instructions very carefully. I am not sure but it’s possible that the affidavit of support will need to be filled by your husband since he is the citizen and he filled one for you - again, check the instructions very carefully. It should be a pretty clear, straightforward process.Your child is still well below the age limit and should be fine. If there are any problems, do the same thing you did with your own process - use the numbers you are given to check on the process and if you see it stuck call to make sure they have everything they need early.It is my understanding that the age limit of the child is based on the petition date, so go ahead and do it.You still have plenty of time at 16, just don’t delay.

-

How do exhibition teams like the Blue Angels time stadium flyovers to sync with the last syllable of S.S.B? Also, from miles out, and at those speeds, how do they co-ordinate their form-ups during airshow performances?

"How do exhibition teams like Blue Angels time stadium flyovers to sync with last syllable of S.S.B? Also, from miles out and at those speeds, how do they co-ordinate their form-ups during airshow performances?"One thing the military dose very well is arrive on time! At air shows the Blue Angels also have a team member on the ground so I guess they may have one in the stadium? The fly over aircraft circle just out of sight a few miles from the fly over point then drop down and flyover at the appointed time! Use to hear the fly over aircraft circling around before the game then see them appear just after the National Anthem.

-

As a recent graduate with a B.S. in Physics(low grades), how do I measure the worth of my hourly labor? What kind of work should I do if returning to school for a masters is out of the question?

Two questions why did you go to university in the first place and why did you choose your field.The number of this type of question amazes me how people choose to study, field selected and earning power of that field.Amazing,. After writing 3–4 years thesis they fail to analyse basic info that a non graduate evaluate first before starting work or universityFor the umpteen time I will be briefAs a graduate check Google for jobs in your field, what the salary is and if you want to apply ho for it.If you want to study further then if you gave the means to support go for itMost people who can support themselves continue with master, while those that cannot seek employment first then study when life is stableWhat exactly is your direction, where you see yourself in five yearsWhat plans you gave in the next five yearsI suggest you give up uni as all this stuff I mentioned you would have went through it in uni with friends or family. This is not rocket science

-

How long is the waiting time for the issuance of an immigrant visa (Form I-130) of a petition approved in 2014 by the U.S. Citizenship and Immigration Services then sent to the Department of State National Visa Center for consular action?

The same length as a piece of string!Seriously though, you have not given enough information.See Forums online showing typical processing times I-130 Tracker. Petition for Alien Relative Tracker. Family Based Immigration TrackerIt would depend upon many things:What was the priority dateHave you had biometrics processedWhich ConsulateWhat is/are the citizenship(s) of the applicant and of his family?What category has the sponsor applied for?Are there likely to be security clearance issues - this is especially the case with applicants from India, Pakistan, Middle East and Asia where many have similar names and local government bureaucracy is technologically outdated - especially from countries considered by DOS to be high risk of terrorism.If your case is outside the typical wait times and you are sure you have the correct priority date and all approvals then either you or your sponsor should seek help from the office of the Congressman where they reside or in whose district you will be residing.

Create this form in 5 minutes!

How to create an eSignature for the form eta 9142b appendix b us department of labor

How to generate an eSignature for your Form Eta 9142b Appendix B Us Department Of Labor in the online mode

How to make an eSignature for your Form Eta 9142b Appendix B Us Department Of Labor in Chrome

How to generate an eSignature for putting it on the Form Eta 9142b Appendix B Us Department Of Labor in Gmail

How to make an electronic signature for the Form Eta 9142b Appendix B Us Department Of Labor straight from your smart phone

How to make an eSignature for the Form Eta 9142b Appendix B Us Department Of Labor on iOS

How to make an eSignature for the Form Eta 9142b Appendix B Us Department Of Labor on Android

People also ask

-

What is the purpose of the form appendix b fill?

The form appendix b fill is designed to help businesses easily complete and submit necessary documentation. It streamlines the process, ensuring that all required fields are accurately filled out, ultimately speeding up the workflow.

-

How can airSlate SignNow help with form appendix b fill?

airSlate SignNow simplifies the form appendix b fill process by providing intuitive tools for eSignature and document management. You can easily upload, complete, and send forms, ensuring compliance and reducing errors in document handling.

-

Is there a cost associated with using airSlate SignNow for form appendix b fill?

Yes, there is a pricing structure for using airSlate SignNow, but it is designed to be cost-effective. Different plans are available to suit varying business needs, ensuring that you only pay for what you use when filling out your form appendix b.

-

What features does airSlate SignNow offer for efficient form appendix b fill?

airSlate SignNow offers several features for efficient form appendix b fill, including customizable templates, eSignature capabilities, and real-time collaboration. These tools enhance productivity and ensure that your forms are filled accurately and promptly.

-

Can I integrate airSlate SignNow with other tools to assist with form appendix b fill?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your ability to fill out forms effectively. This integration allows for a smooth workflow, connecting your existing systems with the form appendix b fill process.

-

What are the benefits of using airSlate SignNow for form appendix b fill compared to traditional methods?

Using airSlate SignNow for form appendix b fill offers numerous benefits over traditional methods, such as increased efficiency, reduced paperwork, and enhanced tracking capabilities. This modern solution allows for quicker turnaround times and better document accuracy.

-

Is airSlate SignNow user-friendly for completing form appendix b fill?

Yes, airSlate SignNow is designed to be user-friendly, allowing even those without technical skills to navigate the form appendix b fill process easily. The intuitive interface and guided steps make it simple to complete forms accurately and efficiently.

Get more for Form Appendix B

- Aamva barcode format

- Hp1 form

- Payroll timesheets process map pdf ucop form

- Application for a mexican restaurant form

- Tucson water must receive a correct backflow prevention assembly test report by the compliance due date tucsonaz form

- Tc 20s forms utah s corporation tax

- Not to exceed contract template form

- Nonprofit executive director contract template form

Find out other Form Appendix B

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now