Tennessee Close Estatetax Wajver Form

What is the Tennessee Close Estatetax Wajver Form

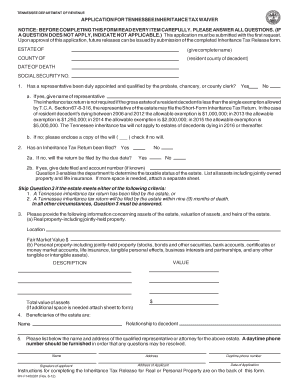

The Tennessee Close Estatetax Wajver Form is a legal document used in the state of Tennessee to request a waiver of estate taxes. This form is typically utilized by the executors or administrators of an estate to formally notify the state of their intention to waive certain estate tax obligations. It is essential for ensuring compliance with state tax regulations while facilitating the efficient transfer of assets to beneficiaries.

How to use the Tennessee Close Estatetax Wajver Form

Using the Tennessee Close Estatetax Wajver Form involves a series of straightforward steps. First, gather all necessary information regarding the estate, including asset valuations and beneficiary details. Next, accurately complete the form, ensuring all required fields are filled out. After completing the form, it must be signed by the appropriate parties, typically the executor or administrator of the estate. Finally, submit the form to the relevant state tax authority, either online or by mail, depending on the submission options available.

Steps to complete the Tennessee Close Estatetax Wajver Form

Completing the Tennessee Close Estatetax Wajver Form requires careful attention to detail. Follow these steps:

- Gather all necessary documentation related to the estate, including tax assessments and valuations.

- Fill out the form accurately, providing complete information about the estate and its beneficiaries.

- Review the form for any errors or omissions before signing.

- Ensure that the form is signed by the executor or administrator, as required by law.

- Submit the completed form to the appropriate state tax authority, adhering to any specific submission guidelines.

Legal use of the Tennessee Close Estatetax Wajver Form

The legal use of the Tennessee Close Estatetax Wajver Form is crucial for ensuring that the waiver is recognized by state authorities. The form must be completed in accordance with Tennessee state laws and regulations governing estate taxes. Proper execution of the form provides legal protection for the executor or administrator, as it documents their intent to waive tax obligations and ensures compliance with state requirements.

Key elements of the Tennessee Close Estatetax Wajver Form

Understanding the key elements of the Tennessee Close Estatetax Wajver Form is essential for accurate completion. Important components include:

- Identification of the estate, including the name and date of death of the deceased.

- Details about the executor or administrator, including contact information.

- Information regarding the assets of the estate and their valuations.

- A declaration of intent to waive estate taxes, along with any relevant justifications.

- Signature of the executor or administrator, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Tennessee Close Estatetax Wajver Form are critical to ensure compliance with state tax regulations. Typically, the form must be submitted within a specific timeframe following the death of the estate holder. It is advisable to check with the Tennessee Department of Revenue for the most current deadlines and any changes to filing requirements. Missing these deadlines can result in penalties or complications in the estate settlement process.

Quick guide on how to complete tennessee close estatetax wajver form

Easily Prepare Tennessee Close Estatetax Wajver Form on Any Device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and eSign your documents without any delays. Handle Tennessee Close Estatetax Wajver Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

Effortlessly Modify and eSign Tennessee Close Estatetax Wajver Form

- Obtain Tennessee Close Estatetax Wajver Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with specialized tools available from airSlate SignNow.

- Create your signature using the Sign tool, which is quick and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you'd like to share your form: via email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Modify and eSign Tennessee Close Estatetax Wajver Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tennessee close estatetax wajver form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tennessee Close Estatetax Wajver Form?

The Tennessee Close Estatetax Wajver Form is a document that allows taxpayers to request a waiver for the estate tax due in Tennessee. This form is essential for individuals seeking to ensure a smoother estate settlement process. Understanding this form's requirements helps homeowners and estate planners manage tax obligations more effectively.

-

How can airSlate SignNow help with the Tennessee Close Estatetax Wajver Form?

airSlate SignNow streamlines the process of filling out and eSigning the Tennessee Close Estatetax Wajver Form. Our platform enables users to create, edit, and send documents securely, making it easier to manage estate tax waivers. This efficient workflow can save you valuable time during the estate planning process.

-

Are there any costs associated with using airSlate SignNow for the Tennessee Close Estatetax Wajver Form?

Using airSlate SignNow comes with a range of pricing plans tailored to meet diverse business needs. While there may be a nominal fee associated with accessing premium features, the cost is signNowly lower than traditional document management methods. By investing in this service, you ensure a cost-effective solution for managing the Tennessee Close Estatetax Wajver Form.

-

What features does airSlate SignNow offer for signing the Tennessee Close Estatetax Wajver Form?

airSlate SignNow offers features such as easy document editing, customizable templates, and secure eSigning. Users can also track the status of their Tennessee Close Estatetax Wajver Form, receive notifications, and store documents securely in the cloud. These features enhance workflow efficiency and ensure compliance with legal requirements.

-

Can airSlate SignNow integrate with other software for handling the Tennessee Close Estatetax Wajver Form?

Yes, airSlate SignNow offers numerous integrations with popular software applications, making it easy to incorporate the Tennessee Close Estatetax Wajver Form into your existing workflow. Users can integrate with CRM systems, document storage solutions, and marketing platforms. This flexibility allows for a seamless transition and enhanced productivity.

-

What are the benefits of using airSlate SignNow for the Tennessee Close Estatetax Wajver Form?

Using airSlate SignNow for the Tennessee Close Estatetax Wajver Form provides multiple benefits, including increased efficiency and reduced errors in document management. The platform’s user-friendly interface ensures that users can complete the form quickly. Additionally, the secure eSigning process enhances the safety and compliance of your transactions.

-

Is airSlate SignNow secure for handling the Tennessee Close Estatetax Wajver Form?

Yes, airSlate SignNow prioritizes your data security while handling the Tennessee Close Estatetax Wajver Form. We implement advanced encryption protocols and adhere to strict privacy regulations to protect your information. Users can sign and manage documents with confidence, knowing their data is secure.

Get more for Tennessee Close Estatetax Wajver Form

Find out other Tennessee Close Estatetax Wajver Form

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer