Liquor Tax Form the City of Huntsville

What is the Liquor Tax Form The City Of Huntsville

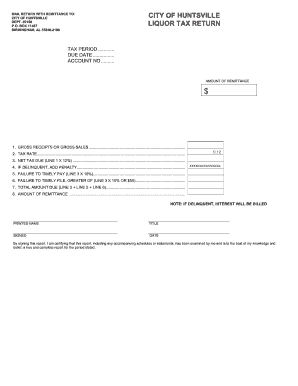

The Liquor Tax Form The City Of Huntsville is a document required for businesses involved in the sale of alcoholic beverages within the city limits. This form is essential for ensuring compliance with local regulations regarding the taxation of liquor sales. It collects necessary information about the business, including its name, address, and the types of alcoholic beverages sold. By submitting this form, businesses contribute to local revenue and adhere to state and municipal laws governing alcohol sales.

How to use the Liquor Tax Form The City Of Huntsville

Using the Liquor Tax Form The City Of Huntsville involves several key steps. First, businesses must obtain the form, which can typically be found on the city’s official website or through local government offices. Once acquired, the business owner or authorized representative should fill out the form accurately, ensuring all required fields are completed. After completion, the form can be submitted electronically or via mail, depending on local guidelines. It is crucial to keep a copy of the submitted form for record-keeping and future reference.

Steps to complete the Liquor Tax Form The City Of Huntsville

Completing the Liquor Tax Form The City Of Huntsville requires careful attention to detail. Here are the steps to follow:

- Obtain the form from the city’s official resources.

- Fill in the business name, address, and contact information.

- Indicate the type of alcoholic beverages sold.

- Provide any additional information requested, such as the business license number.

- Review the form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal use of the Liquor Tax Form The City Of Huntsville

The legal use of the Liquor Tax Form The City Of Huntsville is governed by local and state regulations. This form serves as a declaration of the business’s compliance with liquor tax laws. It is important for businesses to understand that submitting this form is not just a formality; it is a legal requirement that ensures they are operating within the law. Failure to submit the form accurately and on time can result in penalties or fines, highlighting the importance of its proper use.

Required Documents

When completing the Liquor Tax Form The City Of Huntsville, certain documents may be required to support the application. These typically include:

- A valid business license.

- Proof of ownership or lease of the business premises.

- Identification documents for the business owner or authorized representative.

- Any additional permits required for selling alcohol in the city.

Form Submission Methods (Online / Mail / In-Person)

The Liquor Tax Form The City Of Huntsville can be submitted through various methods, depending on the city's regulations. Common submission methods include:

- Online submission via the city’s official website, if available.

- Mailing the completed form to the designated city office.

- In-person submission at the local government office during business hours.

It is advisable to check the specific submission guidelines to ensure compliance with local requirements.

Quick guide on how to complete liquor tax form the city of huntsville

Complete Liquor Tax Form The City Of Huntsville effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Manage Liquor Tax Form The City Of Huntsville on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Liquor Tax Form The City Of Huntsville effortlessly

- Obtain Liquor Tax Form The City Of Huntsville and then click Get Form to initiate.

- Utilize the tools at your disposal to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Revise and eSign Liquor Tax Form The City Of Huntsville and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the liquor tax form the city of huntsville

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Liquor Tax Form The City Of Huntsville?

The Liquor Tax Form The City Of Huntsville is a required document that businesses must submit to report and pay liquor taxes imposed by the city. This form includes essential financial details about the sale of liquor and helps ensure compliance with local regulations. Using airSlate SignNow makes the completion and submission of this form straightforward and efficient.

-

How can airSlate SignNow help with the Liquor Tax Form The City Of Huntsville?

airSlate SignNow offers a seamless platform for completing and eSigning the Liquor Tax Form The City Of Huntsville. With its easy-to-use features, users can fill out the form, collect necessary signatures, and submit it all in one place, saving time and reducing the risk of errors. This streamlines the process signNowly for businesses.

-

Is there a cost associated with filing the Liquor Tax Form The City Of Huntsville through airSlate SignNow?

While airSlate SignNow charges for its services, the cost is generally quite competitive and can save businesses money in other areas, such as reduced paper and administrative costs. Pricing plans are tailored to suit various needs, ensuring that organizations of all sizes can efficiently manage their Liquor Tax Form The City Of Huntsville submissions. A free trial is often available for new users.

-

What features does airSlate SignNow provide for managing the Liquor Tax Form The City Of Huntsville?

airSlate SignNow includes an array of features designed to simplify the management of the Liquor Tax Form The City Of Huntsville, including templates, cloud storage, and automatic notifications. Users can track the status of their submissions in real-time, ensuring that no steps are missed. The platform also supports secure eSigning, making it safer and more reliable.

-

Can I integrate airSlate SignNow with other tools to manage the Liquor Tax Form The City Of Huntsville?

Yes, airSlate SignNow can be easily integrated with other software tools commonly used by businesses, enhancing the overall workflow for the Liquor Tax Form The City Of Huntsville. This includes connectivity with accounting and tax management systems, which can streamline the process further. These integrations allow users to maintain efficient records and improve overall tax compliance.

-

What benefits does using airSlate SignNow provide for the Liquor Tax Form The City Of Huntsville?

Using airSlate SignNow to manage the Liquor Tax Form The City Of Huntsville presents numerous benefits, including enhanced efficiency, improved accuracy, and reduced processing time. The platform's digital capabilities eliminate the need for physical paperwork, ensuring that businesses can focus more on their operations rather than administrative tasks. This empowers businesses to stay compliant with local liquor regulations effectively.

-

How secure is airSlate SignNow for filing the Liquor Tax Form The City Of Huntsville?

airSlate SignNow prioritizes security and utilizes advanced encryption methods to protect user data when filing the Liquor Tax Form The City Of Huntsville. This compliance with industry-standard security protocols ensures that sensitive information remains confidential and secure. Users can trust that their submissions are safeguarded throughout the process.

Get more for Liquor Tax Form The City Of Huntsville

Find out other Liquor Tax Form The City Of Huntsville

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word