1099g Louisiana Form

What is the 1099g Louisiana

The 1099g Louisiana is a tax form used to report certain types of income received by individuals and businesses in Louisiana. This form is specifically issued by the Louisiana Department of Revenue and is primarily utilized to report state tax refunds, credits, or offsets that taxpayers receive. It is essential for individuals who have received these payments to accurately report them on their federal tax returns, as they may affect the taxpayer's overall tax liability.

How to obtain the 1099g Louisiana

To obtain the 1099g Louisiana form, taxpayers can access it through the Louisiana Department of Revenue's official website. The form is available for download in a printable format. Additionally, individuals who have received a state tax refund or credit will typically receive a copy of the 1099g by mail. If a taxpayer does not receive their form, they can contact the Louisiana Department of Revenue for assistance in obtaining a copy.

Steps to complete the 1099g Louisiana

Completing the 1099g Louisiana requires careful attention to detail to ensure accuracy. Here are the steps to follow:

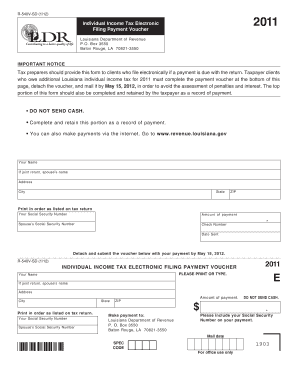

- Gather necessary information, including your Social Security number or Employer Identification Number (EIN).

- Locate the amount of the state tax refund or credit from your tax records.

- Fill in the taxpayer information section, including your name, address, and identification number.

- Enter the amount of the refund or credit in the appropriate box on the form.

- Review the completed form for accuracy before submitting it with your federal tax return.

Legal use of the 1099g Louisiana

The 1099g Louisiana is legally binding when filled out correctly and submitted in compliance with IRS regulations. Taxpayers must report the income listed on this form on their federal tax returns to avoid potential penalties. It is important to retain a copy of the form for personal records, as it serves as proof of income received from the state.

Key elements of the 1099g Louisiana

Several key elements are essential to understanding the 1099g Louisiana:

- Taxpayer Information: This includes the name, address, and identification number of the taxpayer.

- Income Amount: The specific amount of state tax refund, credit, or offset received.

- State Information: The form indicates that it is issued by the Louisiana Department of Revenue.

- Year of Issue: The tax year for which the form is applicable.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the 1099g Louisiana. Typically, the form must be submitted along with the federal tax return by April 15 of the following year. Taxpayers should also keep an eye on any changes in deadlines announced by the IRS or the Louisiana Department of Revenue, particularly in response to unforeseen circumstances that may affect tax filing.

Quick guide on how to complete 1099g louisiana

Easily Prepare 1099g Louisiana on Any Device

The management of documents online has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage 1099g Louisiana on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The Easiest Way to Modify and eSign 1099g Louisiana Effortlessly

- Find 1099g Louisiana and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize key parts of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal significance as a traditional wet ink signature.

- Review all the details and press the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign 1099g Louisiana to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099g louisiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099 G in Louisiana?

A 1099 G in Louisiana is a tax form used to report certain types of government payments, such as unemployment benefits and tax refunds. If you received state unemployment benefits, you will likely receive a 1099 G Louisiana form. Understanding this form is essential for accurate tax filing.

-

How can airSlate SignNow help with 1099 G Louisiana forms?

airSlate SignNow allows you to easily send and eSign your 1099 G Louisiana forms securely online. This streamlines the process, making it convenient to manage your tax documents on time. Plus, with airSlate SignNow, you can keep your paperwork organized and accessible.

-

Are there any fees associated with using airSlate SignNow for 1099 G Louisiana?

airSlate SignNow offers various pricing plans, including a free trial, to accommodate different needs. You can manage your 1099 G Louisiana forms without worrying about hidden fees. Our straightforward pricing ensures you only pay for what you need.

-

Can I integrate airSlate SignNow with my accounting software for 1099 G Louisiana?

Yes, airSlate SignNow can be easily integrated with various accounting software platforms, making it simple to manage your 1099 G Louisiana documents. This integration enables seamless data transfer, reducing the risk of errors in your tax filings. You can focus more on your business rather than paperwork.

-

What features does airSlate SignNow offer for handling 1099 G Louisiana?

airSlate SignNow provides features like customizable templates, eSignature capabilities, and document tracking specifically for 1099 G Louisiana forms. These features enhance efficiency and ensure your documents are signed and returned promptly. This makes managing your tax-related documents a breeze.

-

Is airSlate SignNow secure for handling sensitive documents like 1099 G Louisiana?

Absolutely. airSlate SignNow employs top-level encryption and security measures to keep your 1099 G Louisiana forms safe. You can trust our platform to protect your sensitive tax documents throughout the signing process. Your privacy and security are our top priorities.

-

How can I access my 1099 G Louisiana forms using airSlate SignNow?

Accessing your 1099 G Louisiana forms is very simple with airSlate SignNow. Once you upload your documents to our secure platform, you can view, edit, or eSign them anytime from any device. The user-friendly interface ensures you can quickly navigate your tax documents without hassle.

Get more for 1099g Louisiana

Find out other 1099g Louisiana

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template