Form W 8eci

What is the Form W-8ECI

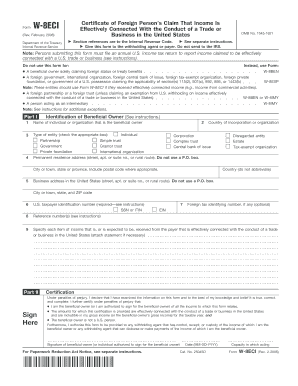

The Form W-8ECI is a tax form used by foreign entities and individuals to certify that their income is effectively connected with a trade or business in the United States. This form is essential for non-U.S. persons who receive income from U.S. sources, allowing them to claim a reduced withholding tax rate or exemption on certain types of income. It is primarily used to ensure compliance with U.S. tax laws and to provide the necessary documentation for tax reporting purposes.

How to obtain the Form W-8ECI

To obtain the Form W-8ECI, individuals and entities can visit the official IRS website, where the form is available for download in PDF format. It is important to ensure that the most current version of the form is used, as updates may occur. Additionally, tax professionals and financial institutions may also provide access to the form, along with guidance on its completion.

Steps to complete the Form W-8ECI

Completing the Form W-8ECI involves several key steps:

- Provide your name and address in the appropriate fields.

- Indicate your country of citizenship or incorporation.

- Specify the type of income you are receiving and confirm that it is effectively connected with a U.S. trade or business.

- Sign and date the form to certify that the information provided is accurate and complete.

It is advisable to consult with a tax professional to ensure compliance with all requirements and to avoid potential errors.

Legal use of the Form W-8ECI

The legal use of the Form W-8ECI is critical for foreign entities and individuals to avoid unnecessary withholding taxes on income connected to U.S. business activities. By submitting this form, taxpayers can establish their eligibility for reduced tax rates under applicable tax treaties. It is essential to keep the form updated and to submit it to the withholding agent or financial institution managing the income to ensure compliance with IRS regulations.

Key elements of the Form W-8ECI

Key elements of the Form W-8ECI include:

- Name and address: Accurate identification of the taxpayer.

- Country of citizenship or incorporation: Necessary for tax treaty benefits.

- Type of income: Specification of the income that is effectively connected with a U.S. trade or business.

- Signature and date: Certification of the information provided.

Each of these elements plays a vital role in ensuring that the form is properly completed and legally valid.

Examples of using the Form W-8ECI

Examples of situations where the Form W-8ECI is used include:

- A foreign corporation receiving rental income from U.S. real estate.

- An individual non-resident alien earning income from a U.S. business partnership.

- A foreign entity providing services to a U.S. company and receiving payment for those services.

In each case, the form helps to establish the connection between the income and U.S. business activities, ensuring compliance with tax obligations.

Quick guide on how to complete form w 8eci

Effortlessly Prepare Form W 8eci on Any Device

Managing online documents has gained immense popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Handle Form W 8eci on any device using the airSlate SignNow applications for Android or iOS and simplify your document-based tasks today.

The easiest method to edit and electronically sign Form W 8eci effortlessly

- Locate Form W 8eci and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form W 8eci to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 8eci

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 8eci and how is it used?

Form W 8eci is an IRS form used by foreign entities to signNow that they are not subject to U.S. tax withholding on certain types of income. This form is essential for non-U.S. applicants who wish to avoid unnecessary tax deductions on income such as dividends and interest received in the U.S. Completing Form W 8eci accurately ensures compliance with U.S. tax regulations.

-

How can airSlate SignNow help with completing Form W 8eci?

airSlate SignNow provides a user-friendly platform that simplifies the process of completing and signing Form W 8eci. With customizable templates and intuitive tools, users can fill out the form quickly and efficiently. Additionally, airSlate SignNow allows for secure electronic signatures to facilitate a smooth submission process.

-

Is airSlate SignNow a cost-effective solution for managing Form W 8eci?

Yes, airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes, making it a cost-effective solution for managing Form W 8eci. Its pricing structure provides flexibility and value, ensuring businesses can handle their documentation needs without overspending. The accessible pricing also includes features that enhance the efficiency of the signing process.

-

What features does airSlate SignNow offer for handling Form W 8eci?

airSlate SignNow offers several features that enhance the management of Form W 8eci, including customizable templates, automated workflows, and tracking capabilities. Users can easily manage document versions and receive real-time notifications about the signing status. This streamlines the process, ensuring compliance and efficiency.

-

Can airSlate SignNow integrate with other applications for Form W 8eci handling?

Absolutely! airSlate SignNow supports integration with numerous applications, which allows users to streamline their processes when managing Form W 8eci. Whether you're using CRM systems or financial software, these integrations can help in syncing data and automating tasks. This enhances overall productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for Form W 8eci?

Using airSlate SignNow for Form W 8eci offers several benefits, including enhanced speed, security, and accuracy in document handling. The platform's easy usability makes it accessible for individuals with varying levels of technical expertise. In addition, the electronic signature feature offers an added layer of convenience, eliminating the need to print, sign, and scan documents.

-

Is my data secure when using airSlate SignNow for Form W 8eci?

Yes, airSlate SignNow prioritizes the security of user data, especially when handling sensitive documents like Form W 8eci. The platform employs advanced encryption protocols and complies with industry standards to protect your information. Users can have peace of mind knowing that their data is safeguarded throughout the signing and management processes.

Get more for Form W 8eci

- Girl scout cookie booth etiquette form

- Mortgage denial letter form

- Mathematics of personal finance sem 1 form

- Rice lake 720i manual espaol pdf form

- Applemdt 5306774 form

- Graphs of proportional relationships independent practice worksheet answer key form

- Construction loan cost breakdown worksheet 100318847 form

- Anson middle school sports form

Find out other Form W 8eci

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney