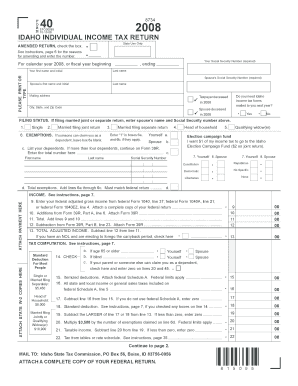

FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN Form

What is the FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN

The FO 40 RM Idaho Individual Income Tax Return is a state-specific tax form used by residents of Idaho to report their annual income and calculate their state tax liability. This form is essential for individuals who earn income in Idaho, as it ensures compliance with state tax laws. The FO 40 RM is designed to capture various income sources, deductions, and credits applicable to Idaho taxpayers.

Steps to complete the FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN

Completing the FO 40 RM Idaho Individual Income Tax Return involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, such as single, married filing jointly, or head of household.

- Fill out the form accurately, entering income, deductions, and credits as required.

- Review the completed form for accuracy, ensuring all information is correct.

- Sign and date the form to validate your submission.

How to obtain the FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN

The FO 40 RM Idaho Individual Income Tax Return can be obtained through various means. Taxpayers can download the form directly from the Idaho State Tax Commission's official website. Additionally, physical copies of the form may be available at local tax offices or public libraries. It is advisable to ensure you are using the most current version of the form to avoid any compliance issues.

Legal use of the FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN

The FO 40 RM Idaho Individual Income Tax Return is legally binding when completed and submitted according to the state's regulations. To ensure its legal validity, taxpayers must provide accurate information and necessary signatures. Electronic submissions are accepted, but they must comply with eSignature laws to be considered valid. Using a reliable eSigning platform can enhance the security and legitimacy of the submission.

Filing Deadlines / Important Dates

Timely filing of the FO 40 RM Idaho Individual Income Tax Return is crucial to avoid penalties. The typical deadline for filing is April 15 of each year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply, which can allow for additional time to file without incurring late fees.

Required Documents

To complete the FO 40 RM Idaho Individual Income Tax Return, taxpayers need to gather several important documents:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Records of any deductions or credits, such as receipts for medical expenses or education costs.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The FO 40 RM Idaho Individual Income Tax Return can be submitted through various methods to accommodate different preferences. Taxpayers can file online using the Idaho State Tax Commission's e-filing system, which is convenient and secure. Alternatively, completed forms can be mailed to the designated address provided on the form. In-person submissions may also be accepted at local tax offices, allowing for direct assistance if needed.

Quick guide on how to complete fo 40 rm idaho individual income tax return

Effortlessly Prepare FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed materials, enabling you to find the correct form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents swiftly and without delays. Manage FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN on any platform with the airSlate SignNow Android or iOS applications and enhance your document-based processes today.

How to Edit and eSign FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN with Ease

- Find FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN and click Get Form to begin.

- Utilize the tools available to fill in your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fo 40 rm idaho individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN?

The FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN is a tax form used by individual residents of Idaho to report their income and compute their state tax liability. Completing this form accurately is crucial to ensure compliance with state tax laws and to avoid any potential penalties. airSlate SignNow can help streamline the e-signing process for this document.

-

How do I fill out the FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN?

Filling out the FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN requires you to gather your income information, tax deductions, and credits. You can conveniently fill out this form online or through a tax software, and airSlate SignNow provides easy tools for e-signing once it's completed. This reduces paperwork and speeds up the submission process.

-

What are the benefits of using airSlate SignNow for my FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN?

Using airSlate SignNow for your FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN simplifies the entire signing process. The platform ensures that your documents are securely stored and easily accessible. Additionally, it offers templates and integrations that make e-signing quick and efficient.

-

How much does it cost to use airSlate SignNow for tax returns?

The cost of using airSlate SignNow for the FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN varies based on the plan you choose. The pricing is affordable and tailored to suit both individual and business needs, making it a cost-effective solution for managing your tax documents. You can explore different pricing tiers directly on our website.

-

Can I integrate airSlate SignNow with other tax software for the FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN?

Yes, airSlate SignNow seamlessly integrates with various tax software solutions. This integration allows you to e-sign your FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN directly from your tax software, streamlining your workflow. It enhances productivity by minimizing the time spent on document management.

-

Is it safe to use airSlate SignNow for my FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN?

Absolutely! airSlate SignNow prioritizes the security of your documents. All e-signatures and data associated with your FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN are protected through advanced encryption methods, ensuring your sensitive information remains confidential and secure.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features such as document templates, team collaboration, and secure e-signing that greatly aid in managing your FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN. These features simplify the process of gathering needed signatures and documents all in one platform. It's designed to adapt to various tax-related workflows.

Get more for FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN

Find out other FO 40 RM IDAHO INDIVIDUAL INCOME TAX RETURN

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer