PA Local Tax Form 1605 Bc3

What is the PA Local Tax Form 1605 Bc3

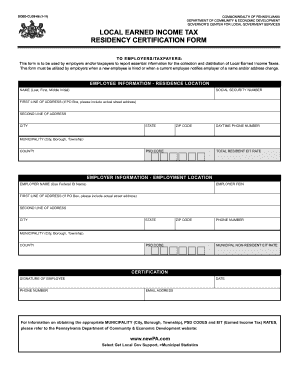

The PA Local Tax Form 1605 Bc3 is a document used by individuals to report local earned income tax. This form is essential for ensuring compliance with local tax regulations in Pennsylvania. It is typically utilized by residents who earn income within their municipality and need to report this income to the appropriate local tax authority. Understanding the purpose of this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the PA Local Tax Form 1605 Bc3

Using the PA Local Tax Form 1605 Bc3 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your total earned income and any local taxes withheld. Finally, review the form for accuracy before submitting it to your local tax authority.

Steps to complete the PA Local Tax Form 1605 Bc3

Completing the PA Local Tax Form 1605 Bc3 requires careful attention to detail. Follow these steps:

- Gather your income documents, such as W-2 forms.

- Enter your personal information accurately.

- Report your total earned income for the year.

- List any local taxes that have been withheld from your paychecks.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the PA Local Tax Form 1605 Bc3

The PA Local Tax Form 1605 Bc3 is legally binding when completed correctly and submitted to the appropriate local tax authority. It is crucial to ensure that all information provided is accurate and truthful, as any discrepancies may lead to legal consequences, including fines or audits. Compliance with local tax laws helps maintain your standing with tax authorities and avoids potential issues in the future.

Filing Deadlines / Important Dates

Filing deadlines for the PA Local Tax Form 1605 Bc3 typically align with the annual tax filing season. It is important to submit the form by the designated deadline to avoid penalties. Generally, the deadline is the same as the federal tax filing deadline, which is usually April fifteenth. However, local jurisdictions may have specific deadlines, so it is advisable to check with your local tax authority for precise dates.

Form Submission Methods (Online / Mail / In-Person)

The PA Local Tax Form 1605 Bc3 can be submitted through various methods to accommodate different preferences. Options typically include:

- Online submission through the local tax authority’s website.

- Mailing a physical copy of the completed form to the appropriate address.

- Submitting the form in person at your local tax office.

Choosing the right submission method can help ensure timely processing of your tax information.

Quick guide on how to complete pa local tax form 1605 bc3

Effortlessly Prepare PA Local Tax Form 1605 Bc3 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides all the resources needed to create, modify, and electronically sign your documents quickly without any hold-ups. Manage PA Local Tax Form 1605 Bc3 on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Modify and Electronically Sign PA Local Tax Form 1605 Bc3

- Find PA Local Tax Form 1605 Bc3 and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Highlight important sections of your documents or obscure sensitive information with features specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign PA Local Tax Form 1605 Bc3 to ensure great communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa local tax form 1605 bc3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA Local Tax Form 1605 Bc3 and why is it important?

The PA Local Tax Form 1605 Bc3 is a crucial document for businesses operating in Pennsylvania, as it helps ensure compliance with local tax regulations. This form is used to report local earned income taxes withheld from employees' wages, making it essential for accurate tax filings and avoiding potential penalties.

-

How can airSlate SignNow help me manage the PA Local Tax Form 1605 Bc3?

airSlate SignNow offers a streamlined solution for managing the PA Local Tax Form 1605 Bc3, allowing businesses to send, sign, and store the document securely. Our platform simplifies the process of obtaining electronic signatures and ensures that your tax documents are organized and easily accessible, promoting compliance.

-

Is airSlate SignNow a cost-effective solution for handling the PA Local Tax Form 1605 Bc3?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses handling the PA Local Tax Form 1605 Bc3. With affordable pricing plans, you can reduce administrative costs while ensuring that your tax documentation processes are efficient and compliant.

-

What features does airSlate SignNow offer for eSigning the PA Local Tax Form 1605 Bc3?

airSlate SignNow provides features like customizable templates, secure electronic signatures, and tracking capabilities specifically for the PA Local Tax Form 1605 Bc3. These features help facilitate a smooth signing process, allowing all parties to easily sign and manage documents from anywhere.

-

Can I integrate airSlate SignNow with other tools for managing the PA Local Tax Form 1605 Bc3?

Absolutely! airSlate SignNow easily integrates with various business tools like CRM systems, accounting software, and cloud storage services, enhancing your workflow for managing the PA Local Tax Form 1605 Bc3. This integration ensures that your tax processes are not only compliant but also efficient.

-

What are the benefits of using airSlate SignNow for the PA Local Tax Form 1605 Bc3?

Using airSlate SignNow for the PA Local Tax Form 1605 Bc3 provides numerous benefits, including faster document turnaround times, improved collaboration among team members, and enhanced security for sensitive tax information. Our platform ensures that you can focus on your core business activities while we handle your documentation needs.

-

Is it safe to use airSlate SignNow for submitting the PA Local Tax Form 1605 Bc3?

Yes, airSlate SignNow prioritizes security and compliance, implementing advanced encryption and authentication measures to protect documents like the PA Local Tax Form 1605 Bc3. You can confidently use our platform for your sensitive tax filings, knowing that your data is secure.

Get more for PA Local Tax Form 1605 Bc3

- Vodafone identity fraud form

- Wheres my rent reimbursement form

- F and b form

- Repo order form 24456286

- City of laredo alarm permit form

- Seller net sheet nc form

- Imm 5710 e application to change conditions extend my stay or remain in canada as a worker imm5710e pdf form

- Do not staple or paper clip rev 081324 ohi form

Find out other PA Local Tax Form 1605 Bc3

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure