Federal Tax Withholding Form W 4, Azasrs

What is the Federal Tax Withholding Form W-4, Azasrs

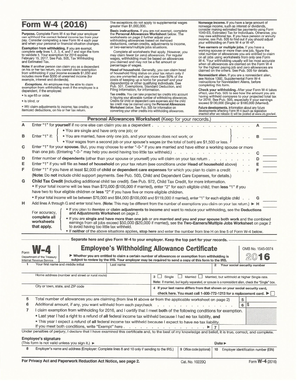

The Federal Tax Withholding Form W-4, Azasrs, is a crucial document used by employees in the United States to inform their employers about the amount of federal income tax to withhold from their paychecks. This form allows individuals to adjust their withholding based on personal circumstances, such as marital status, number of dependents, and additional income. By accurately completing the W-4, employees can ensure that they do not overpay or underpay their taxes throughout the year, which can affect their tax refund or liability during tax season.

Steps to complete the Federal Tax Withholding Form W-4, Azasrs

Completing the Federal Tax Withholding Form W-4, Azasrs involves several important steps:

- Personal Information: Begin by entering your name, address, Social Security number, and filing status.

- Multiple Jobs or Spouse Works: If applicable, indicate if you have more than one job or if your spouse works, as this will affect your withholding.

- Claim Dependents: List any dependents you are claiming, as this can reduce your taxable income.

- Other Adjustments: Consider any additional adjustments for other income or deductions that may apply to your situation.

- Signature: Finally, sign and date the form to validate it.

How to use the Federal Tax Withholding Form W-4, Azasrs

The Federal Tax Withholding Form W-4, Azasrs is used primarily by employees to communicate their tax withholding preferences to their employer. Once completed, the form should be submitted to the payroll department of your workplace. Employers will use the information provided to calculate the appropriate amount of federal income tax to withhold from your paycheck. It is advisable to review and update your W-4 whenever your financial situation changes, such as a new job, marriage, or the birth of a child.

Legal use of the Federal Tax Withholding Form W-4, Azasrs

The Federal Tax Withholding Form W-4, Azasrs is legally binding when completed accurately and submitted to your employer. It complies with federal regulations set by the Internal Revenue Service (IRS). To ensure that the form is legally recognized, it must be signed and dated by the employee. Employers are required to keep this form on file for their records and to ensure compliance with federal tax withholding laws.

IRS Guidelines

The IRS provides specific guidelines for completing the Federal Tax Withholding Form W-4, Azasrs. These guidelines include instructions on how to determine your filing status, how to calculate the number of allowances you can claim, and how to account for additional income or deductions. It is essential to refer to the latest IRS publications or the IRS website for updates, as tax laws and regulations may change. Following these guidelines helps ensure that your withholding is accurate and compliant with federal tax law.

Form Submission Methods (Online / Mail / In-Person)

The Federal Tax Withholding Form W-4, Azasrs can be submitted using various methods, depending on your employer's policies. Common submission methods include:

- Online: Many employers provide an online portal where employees can fill out and submit their W-4 electronically.

- Mail: If your employer requires a physical copy, you can print the completed form and mail it directly to the payroll department.

- In-Person: You may also have the option to hand-deliver the form to your employer’s HR or payroll office.

Quick guide on how to complete federal tax withholding form w 4 azasrs

Effortlessly Complete Federal Tax Withholding Form W 4, Azasrs on Any Device

The management of documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, edit, and eSign your documents without any delays. Manage Federal Tax Withholding Form W 4, Azasrs on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Easily Modify and eSign Federal Tax Withholding Form W 4, Azasrs

- Locate Federal Tax Withholding Form W 4, Azasrs and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form: by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Federal Tax Withholding Form W 4, Azasrs and ensure excellent communication throughout your form processing with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the federal tax withholding form w 4 azasrs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Federal Tax Withholding Form W 4, Azasrs?

The Federal Tax Withholding Form W 4, Azasrs is a document that helps employees specify their tax withholding preferences for federal income taxes. It lets employers know how much federal tax to withhold from an employee's paycheck. This simple yet essential form ensures that your tax withholding aligns with your financial situation.

-

How can airSlate SignNow help with the Federal Tax Withholding Form W 4, Azasrs?

airSlate SignNow provides a user-friendly platform for completing and eSigning the Federal Tax Withholding Form W 4, Azasrs. You can easily fill out the form online and send it securely for signatures, streamlining the administrative process. This saves time and reduces the chances of errors, ensuring compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the Federal Tax Withholding Form W 4, Azasrs?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. The plans are designed to be cost-effective, providing access to essential features for managing the Federal Tax Withholding Form W 4, Azasrs efficiently. Explore our subscription options to find the best fit for your organization.

-

What features does airSlate SignNow offer for the Federal Tax Withholding Form W 4, Azasrs?

airSlate SignNow includes a range of features that enhance the experience of managing the Federal Tax Withholding Form W 4, Azasrs. These features include template creation, automated reminders for signatures, and secure cloud storage for easy document access. These functionalities ensure that your tax documents are handled promptly and securely.

-

Can I integrate airSlate SignNow with other software for managing the Federal Tax Withholding Form W 4, Azasrs?

Absolutely! airSlate SignNow integrates seamlessly with various applications, making it easy to manage the Federal Tax Withholding Form W 4, Azasrs alongside your existing tools. With integrations for CRM, HR, and other software, you can streamline workflows and improve efficiency in document management.

-

What are the benefits of eSigning the Federal Tax Withholding Form W 4, Azasrs with airSlate SignNow?

eSigning the Federal Tax Withholding Form W 4, Azasrs with airSlate SignNow offers several benefits, including enhanced security and reduced turnaround time. The electronic signature process ensures that your documents are signed quickly and securely, minimizing delays and improving overall productivity. Additionally, you maintain an organized electronic record of all submissions.

-

Is airSlate SignNow user-friendly for submitting the Federal Tax Withholding Form W 4, Azasrs?

Yes, airSlate SignNow is designed with user experience in mind, making it easy even for those who are not tech-savvy. The intuitive interface allows users to navigate seamlessly through the process of completing and eSigning the Federal Tax Withholding Form W 4, Azasrs. This ensures that everyone can handle their tax documentation effectively.

Get more for Federal Tax Withholding Form W 4, Azasrs

Find out other Federal Tax Withholding Form W 4, Azasrs

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast