Hotel and Lodging Tax over 30 Day Exemption Form Alameda Acgov

What is the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov

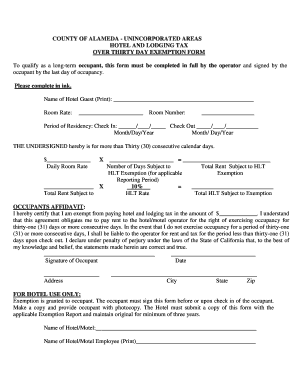

The Hotel and Lodging Tax Over 30 Day Exemption Form Alameda Acgov is a specific document designed for individuals or entities that are renting accommodations for a period exceeding 30 days. This form allows eligible renters to apply for an exemption from the hotel and lodging tax that typically applies to short-term stays. By completing this form, renters can ensure they are not subject to unnecessary tax charges during their extended stay.

How to use the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov

Using the Hotel and Lodging Tax Over 30 Day Exemption Form involves several key steps. First, ensure that you meet the eligibility criteria for the exemption. Then, download the form from a reliable source or obtain it from the relevant local government office. Complete the form by providing accurate information regarding your rental agreement and the duration of your stay. Once filled out, submit the form according to the specified submission methods, which may include online, mail, or in-person options.

Steps to complete the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov

Completing the Hotel and Lodging Tax Over 30 Day Exemption Form requires careful attention to detail. Follow these steps:

- Download or obtain the form from the appropriate source.

- Fill in your personal information, including your name, address, and contact details.

- Provide details of the property you are renting, including the address and rental period.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form through the designated submission method.

Key elements of the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov

Several key elements must be included in the Hotel and Lodging Tax Over 30 Day Exemption Form to ensure its validity. These elements include:

- Personal Information: Accurate details about the renter.

- Property Details: Information regarding the rental property, including the address and rental period.

- Signature: A signature from the renter affirming the truthfulness of the information provided.

- Date: The date on which the form is completed and signed.

Eligibility Criteria

To qualify for the exemption under the Hotel and Lodging Tax Over 30 Day Exemption Form, certain eligibility criteria must be met. Generally, the renter must occupy the lodging for more than 30 consecutive days. Additionally, the rental agreement must be in place, and the property must be classified as a lodging facility. It is essential to review specific local regulations to confirm eligibility.

Form Submission Methods

The Hotel and Lodging Tax Over 30 Day Exemption Form can typically be submitted through various methods. These may include:

- Online Submission: Many jurisdictions allow for digital submission of forms through their official websites.

- Mail: Completed forms can often be sent via postal service to the designated government office.

- In-Person: Renters may also have the option to submit the form in person at local government offices.

Quick guide on how to complete hotel and lodging tax over 30 day exemption form alameda acgov

Complete Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov effortlessly on any gadget

Web-based document organization has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to discover the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without hold-ups. Handle Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov without hassle

- Find Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Select your preferred delivery method for your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from whatever device you prefer. Modify and eSign Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov ensuring effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hotel and lodging tax over 30 day exemption form alameda acgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov?

The Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov is a document that allows eligible guests who stay longer than 30 days in local accommodations to apply for a tax exemption. This form helps property owners and guests by ensuring that the lodging tax is not charged during prolonged stays, making long-term reservations more affordable.

-

How can airSlate SignNow assist with filling out the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov?

airSlate SignNow streamlines the process of filling out the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov by allowing users to eSign documents easily. Our platform provides templates and an intuitive user interface, making it simple to complete and submit the form electronically, saving time and reducing errors.

-

What are the benefits of using airSlate SignNow for the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov?

Using airSlate SignNow for the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov offers numerous benefits, including enhanced efficiency, reduced paperwork, and secure document management. By utilizing our solution, you can ensure that the form is completed accurately while also maintaining compliance with local tax regulations.

-

Is there a cost associated with using airSlate SignNow for the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov?

Yes, there is a pricing structure associated with using airSlate SignNow, which is designed to be cost-effective for businesses of all sizes. The pricing allows you to process important documents like the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov without incurring signNow costs, thus helping you save on administrative expenses.

-

Can airSlate SignNow integrate with other systems to process the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov?

Absolutely! airSlate SignNow can seamlessly integrate with various business systems, enhancing workflows associated with the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov. This integration allows for smooth data transfer between applications, improving the overall efficiency of your operations.

-

What features does airSlate SignNow offer for the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov?

airSlate SignNow provides features such as customizable templates, electronic signatures, and real-time tracking for the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov. These features ensure that you can efficiently manage the entire document process from creation to submission.

-

How secure is the data when using airSlate SignNow for the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov?

Using airSlate SignNow for the Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov ensures that your data is secure. We implement industry-leading security protocols, including encryption and secure cloud storage options, to protect sensitive information throughout the document lifecycle.

Get more for Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov

- English proficiency letter sample pdf form

- Application for retirement form

- Custodian certificate 100069171 form

- Brazil visa application form pdf for nigeria

- Adjusters worksheet form

- Pdffiller child travel concent form

- Proof of guardianship blank form

- Mmc fha full 203k contractor profileresume report form

Find out other Hotel And Lodging Tax Over 30 Day Exemption Form Alameda Acgov

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple