Form 3588

What is the Form 3588

The Form 3588, also known as the FTB 3588, is a document used by taxpayers in California to request a waiver of penalties for failure to file or pay taxes on time. This form is particularly relevant for individuals and businesses that may have experienced extenuating circumstances affecting their ability to meet tax obligations. Understanding the purpose and function of the Form 3588 is crucial for ensuring compliance with state tax regulations.

How to use the Form 3588

Using the Form 3588 involves several steps to ensure that your request for penalty relief is properly submitted. First, gather all necessary information regarding your tax situation, including any relevant documentation that supports your request. Next, fill out the form accurately, providing details about your circumstances and the reasons for your late filing or payment. Once completed, submit the form to the appropriate tax authority, either electronically or via mail, depending on your preference and the guidelines provided by the California Franchise Tax Board.

Steps to complete the Form 3588

Completing the Form 3588 requires careful attention to detail. Here are the essential steps:

- Obtain the latest version of the Form 3588 from the California Franchise Tax Board's website.

- Fill in your personal information, including your name, address, and Social Security number or taxpayer identification number.

- Provide a clear explanation of the circumstances that led to your inability to file or pay on time.

- Attach any supporting documents that substantiate your claims, such as medical records or financial statements.

- Review the completed form for accuracy and completeness before submission.

- Submit the form according to the instructions, ensuring you keep a copy for your records.

Legal use of the Form 3588

The legal use of the Form 3588 is defined by the regulations set forth by the California Franchise Tax Board. To be considered valid, the form must be filled out completely and submitted within the designated time frame. Additionally, the reasons provided for the penalty waiver must align with acceptable criteria, such as natural disasters, serious illness, or other significant hardships. Ensuring compliance with these legal requirements is essential for the successful approval of your request.

Key elements of the Form 3588

Several key elements are essential for the Form 3588 to be effective:

- Taxpayer Information: Accurate personal details must be provided.

- Reason for Request: A clear and valid explanation for the late filing or payment is necessary.

- Supporting Documentation: Any relevant documents that support the request should be attached.

- Signature: The form must be signed by the taxpayer or their authorized representative.

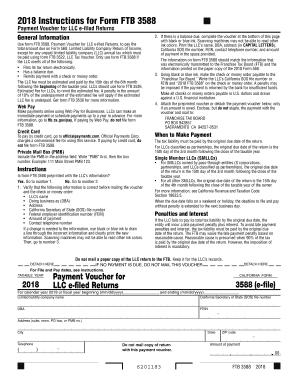

Form Submission Methods

The Form 3588 can be submitted through various methods, depending on the preferences of the taxpayer. Options include:

- Online Submission: Many taxpayers prefer to submit forms electronically through the California Franchise Tax Board's secure portal.

- Mail: The form can also be printed and mailed to the appropriate address specified in the instructions.

- In-Person: Taxpayers may choose to deliver the form in person at designated tax offices.

Quick guide on how to complete form 3588 461317499

Effortlessly Set Up Form 3588 on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any hassles. Manage Form 3588 on any device with airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

How to Edit and Electronically Sign Form 3588 with Ease

- Locate Form 3588 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and select the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form navigation, or errors requiring new document prints. airSlate SignNow simplifies all your document management needs in just a few clicks from any preferred device. Edit and electronically sign Form 3588 and guarantee excellent communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3588 461317499

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 form 3588 and why is it important for businesses?

The 2018 form 3588 is a crucial IRS document that businesses use to request a new Employer Identification Number (EIN). It is important because it helps ensure compliance with tax regulations and facilitates the proper processing of employee taxes. Understanding and completing the 2018 form 3588 correctly can save businesses time and potential legal issues.

-

How can airSlate SignNow assist with the 2018 form 3588?

airSlate SignNow simplifies the process of managing the 2018 form 3588 by enabling users to send and eSign documents electronically. This reduces the hassle of physical paperwork, allowing businesses to get the necessary signatures quickly. With airSlate SignNow, you can securely store and share your form to ensure compliance and easy access.

-

What are the pricing options for using airSlate SignNow for the 2018 form 3588?

airSlate SignNow offers competitive pricing plans that cater to various business needs when handling documents like the 2018 form 3588. Plans often include options for individuals, small businesses, and larger organizations, with features ranging from basic eSigning to advanced workflow automation. Check the airSlate SignNow website for detailed pricing information.

-

What features does airSlate SignNow offer for managing the 2018 form 3588?

airSlate SignNow provides robust features for managing the 2018 form 3588, including electronic signatures, document templates, and real-time tracking of document status. These features enhance efficiency, allowing businesses to streamline their document workflows effectively. Additionally, the platform ensures security and compliance throughout the signing process.

-

What are the benefits of using airSlate SignNow for the 2018 form 3588?

Using airSlate SignNow for the 2018 form 3588 has several benefits, including increased efficiency, improved collaboration, and reduced turnaround times for document processing. The platform enhances user experience with its intuitive interface, making it easy to obtain necessary signatures. Moreover, businesses can save on paper and mailing costs, contributing to a more sustainable operation.

-

Can I integrate airSlate SignNow with other tools I use for the 2018 form 3588?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, allowing you to manage the 2018 form 3588 alongside your existing tools. Integrations with platforms like Google Drive, Dropbox, and CRM systems enable streamlined workflows and easy access to stored documents. This interconnectedness greatly enhances productivity.

-

Is airSlate SignNow secure for handling the 2018 form 3588?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents like the 2018 form 3588. The platform adheres to industry standards to ensure data integrity and confidentiality during the eSigning process. Users can feel confident that their information is safe and secure.

Get more for Form 3588

- Cash verification form 42776657

- Illness or misadventure claim form cronulla high school web1 cronulla h schools nsw edu

- Fort hare online application 48053484 form

- Lien waiver form pdf

- Breastfeeding assessment form

- Implementation plan example form

- E bundesagentur fr arbeit zentrale auslands und fachvermittlung form

- Texas irp acceptable distance records for audit form

Find out other Form 3588

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now