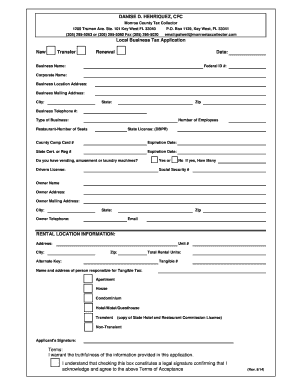

Application for Local Business Tax Monroe County Tax Collector Form

What is the Application For Local Business Tax Monroe County Tax Collector

The Application For Local Business Tax Monroe County Tax Collector is a necessary document for businesses operating within Monroe County, Florida. This application allows local authorities to assess and collect taxes from businesses, ensuring compliance with local tax regulations. The form captures essential information about the business, including its name, address, ownership structure, and type of services offered. Completing this application is crucial for obtaining the necessary licenses and permits to operate legally within the county.

Steps to complete the Application For Local Business Tax Monroe County Tax Collector

Completing the Application For Local Business Tax Monroe County Tax Collector involves several key steps:

- Gather necessary information about your business, including ownership details and operational address.

- Access the application form through the Monroe County Tax Collector's official resources.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online, by mail, or in person, as per the guidelines provided by the Tax Collector's office.

How to use the Application For Local Business Tax Monroe County Tax Collector

Using the Application For Local Business Tax Monroe County Tax Collector requires careful attention to detail. Start by filling out the form with accurate information about your business. Make sure to include all relevant details, such as your business structure, ownership, and contact information. After completing the form, you can eSign it using a secure electronic signature platform, ensuring that your submission is legally binding. This method not only streamlines the process but also enhances the security of your sensitive information.

Required Documents

When completing the Application For Local Business Tax Monroe County Tax Collector, several documents may be required to support your application. These typically include:

- Proof of business registration, such as Articles of Incorporation or a business license.

- Identification documents for the business owner(s), such as a driver's license or passport.

- Any relevant permits or licenses specific to your business type.

- Financial statements or tax returns may also be requested for certain business types.

Eligibility Criteria

Eligibility to file the Application For Local Business Tax Monroe County Tax Collector generally includes having a physical business presence in Monroe County. This means that your business must operate from a location within the county and comply with local zoning laws. Additionally, businesses must adhere to state and federal regulations, including any specific requirements related to their industry. It is essential to verify that your business meets these criteria before submitting the application.

Form Submission Methods (Online / Mail / In-Person)

The Application For Local Business Tax Monroe County Tax Collector can be submitted through various methods, providing flexibility for business owners. The available submission options typically include:

- Online: Many counties offer an online portal for submitting applications, which allows for quicker processing.

- Mail: You can print the completed form and send it via postal service to the designated Tax Collector's office.

- In-Person: Submitting the form in person at the Tax Collector's office is also an option, allowing for immediate confirmation of receipt.

Quick guide on how to complete application for local business tax monroe county tax collector

Effortlessly Prepare Application For Local Business Tax Monroe County Tax Collector on Any Device

Digital document management has become increasingly popular among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely save it online. airSlate SignNow provides you with all the essential tools to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Application For Local Business Tax Monroe County Tax Collector on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Application For Local Business Tax Monroe County Tax Collector with Ease

- Find Application For Local Business Tax Monroe County Tax Collector and click Get Form to begin.

- Utilize the tools available to submit your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, frustrating form searches, and errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Application For Local Business Tax Monroe County Tax Collector and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for local business tax monroe county tax collector

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Local Business Tax Monroe County Tax Collector?

The Application For Local Business Tax Monroe County Tax Collector is a document required by local authorities to register a business in Monroe County. It ensures that your business complies with local taxation laws and regulations. By submitting this application, you can legally operate your business within the county.

-

How can airSlate SignNow assist with the Application For Local Business Tax Monroe County Tax Collector?

airSlate SignNow simplifies the process of completing and signing the Application For Local Business Tax Monroe County Tax Collector. Our platform allows you to fill out the application digitally, ensuring accuracy and saving time. You can easily eSign the document and submit it directly to the Monroe County Tax Collector.

-

What are the costs associated with using airSlate SignNow for the application process?

Using airSlate SignNow for the Application For Local Business Tax Monroe County Tax Collector is cost-effective with various pricing plans available. Our plans cater to different business sizes and needs, ensuring you only pay for what you use. Visit our pricing page for detailed information on costs and features.

-

Are there any features specifically designed for the Application For Local Business Tax Monroe County Tax Collector?

Yes, airSlate SignNow offers features tailored for the Application For Local Business Tax Monroe County Tax Collector, including customizable templates and automated reminders for submission deadlines. These features streamline the process, making it easier to manage your application and stay compliant with local regulations.

-

Who can benefit from the Application For Local Business Tax Monroe County Tax Collector?

Any new or existing business operating in Monroe County can benefit from the Application For Local Business Tax Monroe County Tax Collector. This application is crucial for businesses looking to ensure compliance with local tax laws. By utilizing airSlate SignNow, businesses can manage the application process efficiently.

-

Can I integrate airSlate SignNow with other tools when submitting my Application For Local Business Tax Monroe County Tax Collector?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and applications. This capability allows you to streamline your entire workflow, from document creation to submission of the Application For Local Business Tax Monroe County Tax Collector, enhancing productivity.

-

What benefits does electronic signing offer for the Application For Local Business Tax Monroe County Tax Collector?

Electronic signing offers several benefits for the Application For Local Business Tax Monroe County Tax Collector, including faster processing times and reduced paperwork. With airSlate SignNow, you can eSign documents securely and from anywhere, ensuring that your application is submitted promptly and efficiently.

Get more for Application For Local Business Tax Monroe County Tax Collector

Find out other Application For Local Business Tax Monroe County Tax Collector

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free