Ky Fillable in 725 Form

What is the Ky Fillable In 725 Form

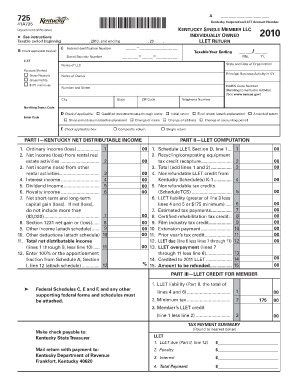

The Ky Fillable In 725 Form is a specific document used in Kentucky for tax purposes. This form is essential for individuals and businesses to report certain financial information to the state. It serves as a means to ensure compliance with state tax regulations and is often required for various tax-related activities.

How to use the Ky Fillable In 725 Form

Using the Ky Fillable In 725 Form involves several straightforward steps. First, you need to download the form from a reliable source. Once you have the form, fill it out with accurate information regarding your income and deductions. After completing the form, review it for any errors. Finally, submit the form according to the instructions provided, which may include online submission or mailing it to the appropriate tax authority.

Steps to complete the Ky Fillable In 725 Form

Completing the Ky Fillable In 725 Form requires careful attention to detail. Here are the steps to follow:

- Download the form from a trusted source.

- Fill in your personal information, including name, address, and Social Security number.

- Report your income sources accurately, ensuring all figures are correct.

- Include any applicable deductions or credits.

- Review the completed form for accuracy.

- Submit the form as per the guidelines provided.

Legal use of the Ky Fillable In 725 Form

The legal use of the Ky Fillable In 725 Form is crucial for ensuring compliance with Kentucky tax laws. When filled out correctly, this form can serve as a legally binding document that reflects your financial obligations to the state. It is important to follow all instructions and regulations associated with the form to avoid potential penalties or issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Ky Fillable In 725 Form are critical to avoid late fees or penalties. Typically, the form must be submitted by the designated tax deadline, which may vary depending on whether you are filing as an individual or a business. It is advisable to check the Kentucky Department of Revenue's official calendar for specific dates to ensure timely submission.

Required Documents

To complete the Ky Fillable In 725 Form, certain documents may be required. These typically include:

- Proof of income, such as W-2s or 1099 forms.

- Documentation for any deductions claimed, like receipts or statements.

- Identification information, including Social Security numbers.

Having these documents ready will facilitate a smoother completion of the form.

Quick guide on how to complete ky fillable in 725 form

Complete Ky Fillable In 725 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly, without setbacks. Handle Ky Fillable In 725 Form on any platform using airSlate SignNow Android or iOS applications and streamline any document-related processes today.

The easiest way to modify and eSign Ky Fillable In 725 Form with ease

- Locate Ky Fillable In 725 Form and click Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, arduous form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Alter and eSign Ky Fillable In 725 Form to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ky fillable in 725 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ky Fillable In 725 Form?

The Ky Fillable In 725 Form is a specific document used in Kentucky for various purposes including tax reporting and identification. It allows users to fill out necessary information electronically, ensuring accuracy and efficiency. With airSlate SignNow, you can easily manage and complete your Ky Fillable In 725 Form online.

-

How can I fill out the Ky Fillable In 725 Form digitally?

Filling out the Ky Fillable In 725 Form digitally is simple with airSlate SignNow. You can upload the form to our platform, fill in the necessary fields digitally, and save your progress. Our tools ensure that the information you enter is secure and easily accessible.

-

Is airSlate SignNow a cost-effective solution for using the Ky Fillable In 725 Form?

Yes, airSlate SignNow provides a cost-effective solution for managing the Ky Fillable In 725 Form and other documents. We offer competitive pricing plans to meet the needs of businesses of all sizes. With our subscription, you get access to various features that enhance document workflow and signing.

-

What features does airSlate SignNow offer for the Ky Fillable In 725 Form?

AirSlate SignNow offers several features for the Ky Fillable In 725 Form, including eSignature capabilities, document templates, and file sharing options. Our platform allows you to customize the form as needed and track the signing process in real time. These features streamline the completion of your documents.

-

Can I integrate airSlate SignNow with other software for the Ky Fillable In 725 Form?

Absolutely! AirSlate SignNow allows for seamless integration with various software applications. Whether you are using CRM software or cloud storage services, you can easily integrate to enhance your workflow and improve the handling of the Ky Fillable In 725 Form and other documents.

-

What are the benefits of using airSlate SignNow for the Ky Fillable In 725 Form?

Using airSlate SignNow for the Ky Fillable In 725 Form offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform simplifies the signing and filing process, making it quicker and more reliable. Plus, you can access your documents anytime, anywhere.

-

Is technical support available for using the Ky Fillable In 725 Form on airSlate SignNow?

Yes, airSlate SignNow provides robust technical support for all users. Our support team is available to assist you with any issues related to the Ky Fillable In 725 Form or other platform functionalities. We strive to ensure you have a smooth experience using our services.

Get more for Ky Fillable In 725 Form

Find out other Ky Fillable In 725 Form

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy