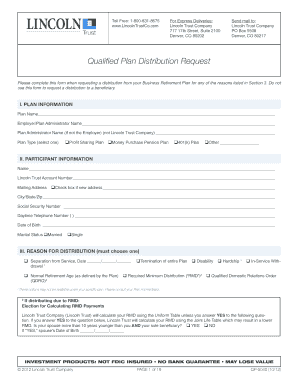

Plan of Distribution of Trust Form

What is the Plan Of Distribution Of Trust Form

The Plan Of Distribution Of Trust Form is a legal document that outlines how the assets within a trust will be distributed upon the trustor's death or the termination of the trust. This form is essential for ensuring that the trust's assets are allocated according to the trustor's wishes, providing clarity and preventing disputes among beneficiaries. It typically includes details about the beneficiaries, the specific assets they will receive, and any conditions attached to the distributions. Understanding this form is crucial for individuals involved in estate planning and trust management.

Steps to complete the Plan Of Distribution Of Trust Form

Completing the Plan Of Distribution Of Trust Form involves several important steps to ensure accuracy and compliance with legal requirements. First, gather all necessary information regarding the trust and its assets, including property details, financial accounts, and any other relevant items. Next, clearly identify the beneficiaries and specify the assets each will receive. It is vital to include any conditions or stipulations that may apply to the distributions. After filling out the form, review it thoroughly for any errors or omissions. Finally, ensure that the form is signed and dated by the appropriate parties, as required by state law.

Legal use of the Plan Of Distribution Of Trust Form

The legal use of the Plan Of Distribution Of Trust Form is governed by state laws and regulations. This form must be executed according to the legal standards of the jurisdiction in which the trust is established. This often includes requirements for notarization or witnesses to validate the document. Ensuring that the form complies with these legal standards is crucial for its enforceability. Additionally, the form should be kept in a secure location and shared with relevant parties, such as the trustee and beneficiaries, to prevent any misunderstandings regarding the trust's distribution plan.

Key elements of the Plan Of Distribution Of Trust Form

Several key elements must be included in the Plan Of Distribution Of Trust Form to ensure it is comprehensive and legally binding. These elements typically include:

- Trustor Information: Name and contact details of the person who created the trust.

- Trustee Information: Name and contact details of the individual or entity responsible for managing the trust.

- Beneficiary Details: Names and relationships of individuals or entities receiving assets from the trust.

- Asset Distribution: A detailed list of assets and how they will be divided among beneficiaries.

- Conditions: Any specific conditions or requirements for distribution, such as age restrictions or milestones.

How to use the Plan Of Distribution Of Trust Form

Using the Plan Of Distribution Of Trust Form involves several steps to ensure it serves its intended purpose. Start by reviewing the trust document to understand the overall structure and intent. Next, fill out the form with accurate information regarding the beneficiaries and asset distribution. Once completed, it is advisable to consult with a legal professional to confirm that the form meets all necessary legal requirements. After obtaining the necessary approvals and signatures, distribute copies of the completed form to the trustee and beneficiaries to ensure everyone is informed of the distribution plan.

Examples of using the Plan Of Distribution Of Trust Form

Examples of using the Plan Of Distribution Of Trust Form can illustrate its practical applications. For instance, a parent may use the form to specify that their home will be passed to their children equally upon their death. Another example could involve a grandparent designating funds from a trust to be used for a grandchild's education. These examples demonstrate how the form can be tailored to fit individual circumstances and ensure that the trustor's wishes are honored in the distribution of assets.

Quick guide on how to complete plan of distribution of trust form

Complete Plan Of Distribution Of Trust Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage Plan Of Distribution Of Trust Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Plan Of Distribution Of Trust Form easily

- Obtain Plan Of Distribution Of Trust Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Plan Of Distribution Of Trust Form while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the plan of distribution of trust form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Plan Of Distribution Of Trust Form?

A Plan Of Distribution Of Trust Form is a legal document that outlines how assets will be distributed among beneficiaries from a trust. It ensures clarity and legal compliance during the distribution process, making it essential for efficient estate planning.

-

How can airSlate SignNow help with my Plan Of Distribution Of Trust Form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your Plan Of Distribution Of Trust Form securely. This functionality streamlines the entire process, ensuring that your trust distributions are executed quickly and accurately.

-

Is there a cost associated with using airSlate SignNow for the Plan Of Distribution Of Trust Form?

Yes, airSlate SignNow offers competitive pricing plans suitable for individuals and businesses. You can choose a plan that best meets your needs for managing the Plan Of Distribution Of Trust Form and benefit from cost-effective document management solutions.

-

What features does airSlate SignNow provide for the Plan Of Distribution Of Trust Form?

Features include customizable document templates, secure eSigning, real-time tracking, and audit trails for your Plan Of Distribution Of Trust Form. These tools enhance the efficiency of handling critical legal documents, ensuring accuracy and compliance.

-

Can I integrate airSlate SignNow with my existing software for managing trust forms?

Absolutely! airSlate SignNow offers seamless integrations with various CRM, accounting, and document management software. This capability allows you to manage your Plan Of Distribution Of Trust Form alongside your other business operations efficiently.

-

What are the benefits of using airSlate SignNow for the Plan Of Distribution Of Trust Form?

Using airSlate SignNow allows for quicker processing times, enhanced security, and reduced paper usage for your Plan Of Distribution Of Trust Form. This results in improved workflow efficiency while ensuring that your document management remains eco-friendly.

-

Is my data safe when using airSlate SignNow for the Plan Of Distribution Of Trust Form?

Yes, your data is secure with airSlate SignNow. They employ advanced encryption and compliance measures that protect your sensitive information while processing your Plan Of Distribution Of Trust Form, providing peace of mind.

Get more for Plan Of Distribution Of Trust Form

- Catholic profession of faith printable form

- Philmont participant information worksheet

- Worked examples to eurocode 2 volume 2 form

- Form approved o m b 2060 0095 united states environmental protection agency declaration form importation of motor vehicles and

- Hawaii form n 301

- Purolator letter of authorization form

- Gad 7 scale general anxiety disorder 7 item form

- Please include a completed r44 form as

Find out other Plan Of Distribution Of Trust Form

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage