Car Allowance Claim Form DOC

What is the car allowance claim form doc

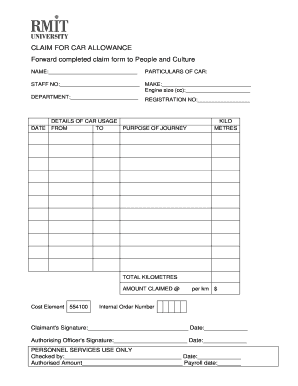

The car allowance claim form doc is an essential document used by employees who receive a car allowance as part of their compensation package. This form allows employees to claim reimbursement for expenses related to the use of their personal vehicle for work purposes. It typically includes details such as the employee's name, the vehicle used, the purpose of the trips, and the mileage driven. By submitting this form, employees can ensure they receive the financial support intended for their work-related driving expenses.

How to use the car allowance claim form doc

Using the car allowance claim form doc involves several straightforward steps. First, gather all necessary information, including trip details and mileage records. Next, fill out the form accurately, ensuring all required fields are completed. After completing the form, review it for any errors or omissions. Finally, submit the form according to your employer's guidelines, which may include online submission, email, or physical delivery. Keeping a copy of the submitted form for your records is advisable.

Steps to complete the car allowance claim form doc

Completing the car allowance claim form doc requires careful attention to detail. Start by entering your personal information, including your name and employee ID. Next, document each trip by providing the date, purpose, and mileage for each journey. If your employer requires receipts for any expenses, attach them to the form. Once all information is filled in, sign and date the form to certify its accuracy. Ensure that you submit the form within any specified deadlines to avoid delays in reimbursement.

Key elements of the car allowance claim form doc

The key elements of the car allowance claim form doc typically include the following:

- Employee Information: Name, employee ID, and contact details.

- Vehicle Details: Make, model, and year of the vehicle used.

- Trip Information: Dates, purposes, and mileage for each trip.

- Expense Receipts: Attachments for any related expenses, if required.

- Signature: A declaration of accuracy signed by the employee.

Legal use of the car allowance claim form doc

The legal use of the car allowance claim form doc is crucial for both employees and employers. This document serves as a record of expenses incurred while performing job-related duties, which can be important for tax purposes. Employers must ensure that the form complies with relevant tax regulations to avoid potential legal issues. Employees should keep copies of submitted forms and any supporting documents to maintain accurate records in case of audits or disputes.

IRS Guidelines

IRS guidelines regarding car allowances and related expenses are essential for employees to understand. The IRS allows employees to deduct certain vehicle expenses if they meet specific criteria. It is important to familiarize yourself with the current tax laws and regulations concerning vehicle deductions to ensure compliance. Employees should consult IRS publications or a tax professional for detailed information regarding allowable deductions and the proper documentation required.

Quick guide on how to complete car allowance claim form doc

Complete Car Allowance Claim Form doc effortlessly on any device

Web-based document administration has become favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Car Allowance Claim Form doc on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

How to alter and eSign Car Allowance Claim Form doc effortlessly

- Obtain Car Allowance Claim Form doc and then click Get Form to begin.

- Employ the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which requires seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Modify and eSign Car Allowance Claim Form doc and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the car allowance claim form doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a car allowance in a job?

A car allowance in a job is a fixed amount of money employers provide to employees to cover vehicle-related expenses, such as fuel and maintenance. This compensation helps offset the costs of using a personal vehicle for work purposes. Understanding what is a car allowance in a job can aid in budgeting personal expenses and clarifying compensation structures.

-

How is a car allowance taxed?

A car allowance in a job is typically considered taxable income and is subject to federal and state tax regulations. Employees should ensure they account for this additional income when filing taxes. It's important to understand the tax implications of what is a car allowance in a job to avoid surprises during tax season.

-

What expenses does a car allowance cover?

A car allowance in a job generally covers costs such as fuel, maintenance, insurance, and depreciation. Employers often provide this allowance to help employees manage the financial burden of using their personal vehicle for work. Knowing what is a car allowance in a job assists employees in budgeting these expenses effectively.

-

Is a car allowance a better option than mileage reimbursement?

Choosing between a car allowance in a job and mileage reimbursement depends on individual circumstances. A car allowance offers predictable income which can simplify budgeting, while mileage reimbursement directly compensates for business-related driving. Evaluating the benefits of both options can help employees make informed decisions regarding their transportation costs.

-

Can a car allowance be negotiated in a job offer?

Yes, a car allowance in a job can often be negotiated as part of the employment package. If using a personal vehicle for work is essential to your role, discussing a car allowance can be beneficial. Understanding what is a car allowance in a job allows candidates to confidently negotiate their compensation packages.

-

How can I calculate my car allowance amount?

To calculate a car allowance in a job, consider factors like average mileage driven for work, fuel costs, and maintenance expenses. By estimating these costs, you can propose a reasonable allowance amount to your employer or better understand the allowance you receive. Clear calculations give insights into what is a car allowance in a job and ensure fair compensation.

-

What are the benefits of receiving a car allowance?

Receiving a car allowance in a job can provide employees with additional financial flexibility and independence. It helps cover essential vehicle-related expenses, leading to reduced out-of-pocket costs for work transportation. Knowing the benefits of what is a car allowance in a job can enhance overall job satisfaction and employee engagement.

Get more for Car Allowance Claim Form doc

- Ex parte application form

- Chp 108 form pdf

- Clinical decision making case studies in maternity and womens health pdf form

- Commercial account vehicle update form thruway ny

- Orbit tvet college brits campus brits form

- Orea form 270 emarketrealestate com

- Blm fission vs fusion research guide sheet teach nuclear teachnuclear form

- Request for wage adjustment dllr maryland form

Find out other Car Allowance Claim Form doc

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online