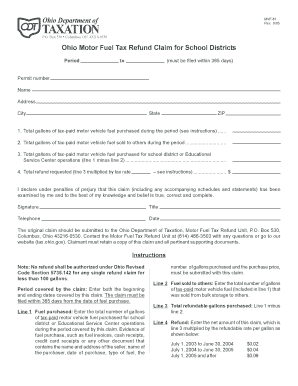

Ohio Motor Fuel Tax Refund Claim for School Districts Form

What is the Ohio Motor Fuel Tax Refund Claim For School Districts Form

The Ohio Motor Fuel Tax Refund Claim for School Districts Form is a specific document used by school districts in Ohio to request a refund for motor fuel taxes paid on fuel used for eligible purposes. This form is crucial for school districts that operate vehicles for transportation, maintenance, or other official duties. By filing this claim, districts can recover a portion of the taxes they have paid, which can then be reinvested into educational resources and services.

How to use the Ohio Motor Fuel Tax Refund Claim For School Districts Form

To effectively use the Ohio Motor Fuel Tax Refund Claim for School Districts Form, follow these steps:

- Gather all necessary documentation, including receipts for fuel purchases and records of vehicle usage.

- Complete the form with accurate information, ensuring all required fields are filled out correctly.

- Submit the form as per the guidelines provided, either electronically or via mail, depending on the preferred submission method.

Steps to complete the Ohio Motor Fuel Tax Refund Claim For School Districts Form

Completing the Ohio Motor Fuel Tax Refund Claim for School Districts Form involves several key steps:

- Begin by downloading the form from the appropriate state resources.

- Fill in the school district's name, address, and contact information.

- Provide detailed information regarding the fuel purchases, including dates, amounts, and purposes for which the fuel was used.

- Attach all supporting documents, such as fuel receipts and usage logs.

- Review the completed form for accuracy before submission.

Eligibility Criteria

Eligibility for filing the Ohio Motor Fuel Tax Refund Claim for School Districts Form is determined by specific criteria. School districts must demonstrate that the fuel in question was purchased for use in vehicles that are primarily used for official school purposes. Additionally, the fuel must not have been used for any taxable activities, such as transportation for hire. It is essential for districts to maintain accurate records to support their claims.

Form Submission Methods

The Ohio Motor Fuel Tax Refund Claim for School Districts Form can be submitted through various methods:

- Online submission via the state’s designated portal, if available.

- Mailing the completed form and supporting documents to the appropriate state agency.

- In-person submission at designated state offices, ensuring all documents are properly organized.

Key elements of the Ohio Motor Fuel Tax Refund Claim For School Districts Form

Understanding the key elements of the Ohio Motor Fuel Tax Refund Claim for School Districts Form is vital for successful completion:

- Identification of the school district, including name and address.

- Details of fuel purchases, including quantity and cost.

- Specific purposes for which the fuel was used, ensuring compliance with eligibility criteria.

- Signature of an authorized representative, confirming the accuracy of the information provided.

Quick guide on how to complete ohio motor fuel tax refund claim for school districts form 28432877

Complete Ohio Motor Fuel Tax Refund Claim For School Districts Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as a superb environmentally friendly substitute for conventional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and eSign your documents quickly and without delay. Handle Ohio Motor Fuel Tax Refund Claim For School Districts Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to edit and eSign Ohio Motor Fuel Tax Refund Claim For School Districts Form effortlessly

- Obtain Ohio Motor Fuel Tax Refund Claim For School Districts Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to store your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Ohio Motor Fuel Tax Refund Claim For School Districts Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio motor fuel tax refund claim for school districts form 28432877

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio Motor Fuel Tax Refund Claim For School Districts Form?

The Ohio Motor Fuel Tax Refund Claim For School Districts Form is designed for educational institutions to recover tax expenses on fuel used for eligible activities. Completing this form allows school districts to ensure they receive the refunds they are entitled to, making it a vital tool for budget management.

-

How can airSlate SignNow help with the Ohio Motor Fuel Tax Refund Claim For School Districts Form?

With airSlate SignNow, users can easily fill out, sign, and send the Ohio Motor Fuel Tax Refund Claim For School Districts Form electronically. The platform streamlines the process, reducing the time and effort required to manage these important documents, ultimately ensuring a smoother refund experience.

-

What features does airSlate SignNow offer for submitting tax refund claims?

airSlate SignNow offers various features such as customizable templates, eSigning capability, and secure document storage. These tools specifically help in effectively managing the Ohio Motor Fuel Tax Refund Claim For School Districts Form, ensuring all necessary information is accurately captured.

-

Is airSlate SignNow cost-effective for schools filing the Ohio Motor Fuel Tax Refund Claim?

Yes, airSlate SignNow provides a cost-effective solution tailored for schools. Its pricing plans are designed to accommodate various budgets, ensuring that even small school districts can efficiently handle the Ohio Motor Fuel Tax Refund Claim For School Districts Form without incurring signNow costs.

-

How secure is the information I input into the Ohio Motor Fuel Tax Refund Claim For School Districts Form?

airSlate SignNow prioritizes user security by implementing robust encryption methods and compliance with industry standards. You can rest assured that the information you provide when completing the Ohio Motor Fuel Tax Refund Claim For School Districts Form is safeguarded against unauthorized access.

-

What integrations does airSlate SignNow offer to streamline the refund claim process?

airSlate SignNow seamlessly integrates with various applications, including Google Drive and Dropbox, facilitating easier document management. These integrations enhance the filing process for the Ohio Motor Fuel Tax Refund Claim For School Districts Form, allowing users to access their files conveniently.

-

Can multiple users collaborate on the Ohio Motor Fuel Tax Refund Claim For School Districts Form?

Absolutely! airSlate SignNow allows multiple users to collaborate on documents in real-time. This feature is especially useful for school districts working together on the Ohio Motor Fuel Tax Refund Claim For School Districts Form, ensuring that all stakeholders can contribute efficiently.

Get more for Ohio Motor Fuel Tax Refund Claim For School Districts Form

- Eap ii application miscellaneous services bls international visa form

- Ipc boeing form

- Dekalb county department of watershed management dekalbcountyga form

- Merck serono a4 letterhead template form

- Form 61 100494629

- Jpmorgan chase procurement card account application form uhv

- Provincial neonatal retro transfer record bpcmchb pcmch on form

- Hsmv 83390 form

Find out other Ohio Motor Fuel Tax Refund Claim For School Districts Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors