What is Wi Tax Form 5k

What is the What Is Wi Tax Form 5k

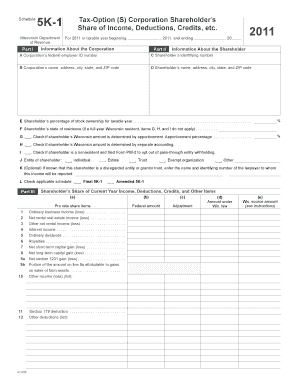

The What Is Wi Tax Form 5k is a tax document used in the state of Wisconsin. It is primarily designed for reporting certain types of income, deductions, and credits to the Wisconsin Department of Revenue. This form is essential for individuals and businesses that need to comply with state tax regulations. Understanding its purpose and requirements is crucial for accurate tax reporting and to avoid potential penalties.

How to use the What Is Wi Tax Form 5k

Using the What Is Wi Tax Form 5k involves several steps to ensure accurate completion and submission. First, gather all necessary documentation related to your income and deductions. Next, fill out the form with the required information, ensuring that all figures are accurate. Once completed, review the form for any errors before submission. You can submit the form electronically or by mail, depending on your preference and the guidelines provided by the Wisconsin Department of Revenue.

Steps to complete the What Is Wi Tax Form 5k

Completing the What Is Wi Tax Form 5k requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant income documents, such as W-2s or 1099s.

- Collect any receipts or records for deductions you plan to claim.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately in the designated sections of the form.

- Calculate your deductions and credits based on the information provided.

- Review the form for accuracy before signing and dating it.

- Submit the form according to the instructions provided, either electronically or by mail.

Legal use of the What Is Wi Tax Form 5k

The What Is Wi Tax Form 5k must be used in accordance with Wisconsin tax laws. It is legally binding when completed accurately and submitted on time. Failure to comply with the legal requirements can result in penalties, including fines or interest on unpaid taxes. It is important to ensure that all information provided is truthful and complete to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the What Is Wi Tax Form 5k typically align with the federal tax deadlines. Generally, individual taxpayers must file their state tax returns by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to deadlines to ensure timely filing and avoid penalties.

Who Issues the Form

The What Is Wi Tax Form 5k is issued by the Wisconsin Department of Revenue. This agency is responsible for administering tax laws and ensuring compliance among taxpayers in the state. For any questions regarding the form or its requirements, taxpayers can contact the Department of Revenue directly for assistance.

Quick guide on how to complete what is wi tax form 5k

Effortlessly Prepare What Is Wi Tax Form 5k on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your files swiftly without any delays. Manage What Is Wi Tax Form 5k on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to Modify and Electronically Sign What Is Wi Tax Form 5k with Ease

- Obtain What Is Wi Tax Form 5k and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant portions of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choosing. Edit and electronically sign What Is Wi Tax Form 5k to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is wi tax form 5k

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What Is Wi Tax Form 5k and why is it important?

What Is Wi Tax Form 5k is a document required for specific tax filings in Wisconsin, detailing various financial information. Understanding this form is crucial for individuals and businesses to ensure compliance with state tax regulations and to avoid penalties.

-

How can airSlate SignNow help with preparing the Wi Tax Form 5k?

airSlate SignNow provides an efficient platform to easily create and eSign the Wi Tax Form 5k. With its user-friendly features, businesses can streamline their document workflows, ensuring accurate and timely submissions.

-

Is there a cost associated with using airSlate SignNow for Wi Tax Form 5k?

Yes, there is a subscription fee for airSlate SignNow, but it offers a cost-effective solution compared to traditional document handling. Investing in a SignNow subscription can save both time and resources while ensuring compliance with forms like the Wi Tax Form 5k.

-

What features does airSlate SignNow offer for handling tax forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time document tracking. These functionalities make managing the Wi Tax Form 5k more efficient, providing users peace of mind during tax season.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing the workflow for preparing the Wi Tax Form 5k. This connectivity allows for quick data transfer, reducing duplicate entries and errors.

-

What benefits does using airSlate SignNow provide for businesses?

Using airSlate SignNow for the Wi Tax Form 5k offers multiple benefits, including increased efficiency, reduced paperwork, and enhanced security. It helps businesses save time and resources while ensuring compliance with tax regulations.

-

Is airSlate SignNow secure for sensitive tax documents?

Yes, airSlate SignNow employs robust security measures to protect sensitive tax documents like the Wi Tax Form 5k. Features such as encryption and secure access controls ensure that your information remains confidential and secure.

Get more for What Is Wi Tax Form 5k

- Selectform

- Simple brand ambassador agreement template form

- Exide life insurance policy bond download form

- Care credit application pdf form

- Oneline bank mesege elert form

- King solomon united tribal republic trust form

- Mutual societies annual return form ar30 for

- Young lives vs cancer referral form tya services v6

Find out other What Is Wi Tax Form 5k

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free