Withdrawal Form Accuplan V1 06152010 Self Directed IRA

What is the Withdrawal Form Accuplan V1 06152010 Self Directed IRA

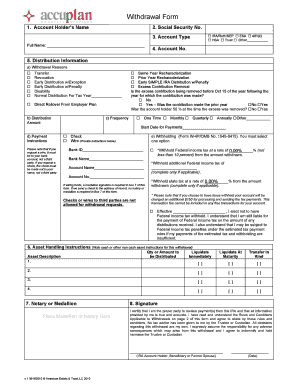

The Withdrawal Form Accuplan V1 06152010 is a specific document designed for individuals utilizing a Self Directed IRA. This form allows account holders to request withdrawals from their retirement accounts, enabling them to access their funds in accordance with IRS regulations. It is essential for users to understand that this form is tailored to meet the requirements set forth by the IRS, ensuring that all withdrawals are compliant with tax laws.

Steps to complete the Withdrawal Form Accuplan V1 06152010 Self Directed IRA

Completing the Withdrawal Form Accuplan V1 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your account details and the amount you wish to withdraw. Next, fill out the form completely, ensuring that you provide accurate personal information and specify the type of withdrawal. After completing the form, review it for any errors before submitting it. Finally, submit the form through the designated method, whether online, by mail, or in person, as per the instructions provided.

Legal use of the Withdrawal Form Accuplan V1 06152010 Self Directed IRA

The Withdrawal Form Accuplan V1 is legally recognized when it adheres to the guidelines established by the IRS. To ensure its legal validity, the form must be completed accurately, and all required signatures must be obtained. Additionally, it is crucial to comply with any state-specific regulations that may apply. Using a reliable platform like signNow can help maintain the integrity of the document, providing electronic signatures that meet legal standards.

Key elements of the Withdrawal Form Accuplan V1 06152010 Self Directed IRA

Several key elements must be included in the Withdrawal Form Accuplan V1 to ensure it is valid and effective. These elements include:

- Account Holder Information: Full name, address, and contact details.

- Withdrawal Amount: The specific amount being requested for withdrawal.

- Type of Withdrawal: Indication of whether the withdrawal is a distribution or transfer.

- Signature: Required signatures to authorize the withdrawal.

- Date: The date the form is completed and submitted.

How to obtain the Withdrawal Form Accuplan V1 06152010 Self Directed IRA

The Withdrawal Form Accuplan V1 can typically be obtained through your account administrator or financial institution. Many institutions provide downloadable versions of the form on their websites, ensuring easy access for account holders. If you cannot find the form online, consider contacting customer service for assistance in obtaining the necessary documentation.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the Withdrawal Form Accuplan V1. Users can choose to submit the form online through a secure portal, which often provides immediate confirmation of receipt. Alternatively, the form can be mailed to the appropriate address, but this may introduce delays. In-person submission is also an option for those who prefer direct interaction with their financial institution. Each method has its advantages, and users should select the one that best suits their needs.

Quick guide on how to complete withdrawal form accuplan v1 06152010 self directed ira

Effortlessly Create Withdrawal Form Accuplan V1 06152010 Self Directed IRA on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly without any delays. Manage Withdrawal Form Accuplan V1 06152010 Self Directed IRA on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Withdrawal Form Accuplan V1 06152010 Self Directed IRA with Ease

- Obtain Withdrawal Form Accuplan V1 06152010 Self Directed IRA and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or an invite link, or download it to your computer.

Forget about misplaced or lost documents, lengthy form searches, or mistakes that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Withdrawal Form Accuplan V1 06152010 Self Directed IRA and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the withdrawal form accuplan v1 06152010 self directed ira

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iras v1 and how does it help businesses?

Iras v1 is an advanced eSignature software solution offered by airSlate SignNow, designed to streamline document signing processes. It enables businesses to send, sign, and manage documents efficiently, reducing turnaround times and minimizing paperwork. With iras v1, users can enhance their productivity and focus on core business activities.

-

What features does iras v1 offer?

Iras v1 includes a range of powerful features such as customizable templates, in-person signing, and mobile compatibility. Users benefit from real-time notifications, document tracking, and robust security measures to protect sensitive information. These features collectively enhance the user experience and improve workflow efficiency.

-

How much does iras v1 cost?

Pricing for iras v1 varies based on the plan chosen, with options for individuals, small teams, and enterprises. Each plan offers flexibility to suit different business needs, ensuring that users get the most value for their investment. airSlate SignNow aims to provide a cost-effective solution for any size organization.

-

Can iras v1 integrate with other business tools?

Yes, iras v1 seamlessly integrates with various business applications such as Google Workspace, Salesforce, and Microsoft Office. This integration allows for a smooth transition between platforms, enhancing efficiency and productivity. Users can manage their documents within their preferred tools without any hassle.

-

How secure is the iras v1 eSigning process?

The iras v1 eSigning process is designed with security in mind, employing industry-standard encryption and authentication protocols. airSlate SignNow ensures that all documents are protected during transmission and storage. This commitment to security helps businesses maintain compliance with regulations and safeguard sensitive information.

-

Is it easy to get started with iras v1?

Getting started with iras v1 is simple and user-friendly. The platform offers an intuitive interface and helpful resources to guide users through the setup process. Additionally, airSlate SignNow provides excellent customer support to assist with any questions or concerns that may arise during onboarding.

-

What are the benefits of using iras v1 for remote teams?

Iras v1 is particularly beneficial for remote teams, as it allows users to sign documents from anywhere, at any time. This flexibility helps maintain workflow continuity despite geographic distances. By using iras v1, teams can collaborate effectively and reduce the time spent on administrative tasks.

Get more for Withdrawal Form Accuplan V1 06152010 Self Directed IRA

Find out other Withdrawal Form Accuplan V1 06152010 Self Directed IRA

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure