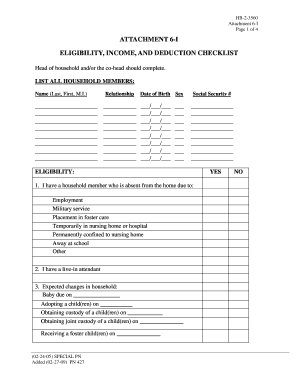

ATTACHMENT 6 I ELIGIBILITY INCOME and DEDUCTION CHECKLIST Form

What is the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST

The ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST is a crucial document used to determine eligibility for various programs and benefits. This form helps individuals and organizations assess their income and allowable deductions, ensuring compliance with relevant regulations. It is often required for applications related to financial assistance, tax credits, or other government benefits, making it essential for accurate reporting of financial information.

How to use the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST

Using the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST involves several steps to ensure that all necessary information is accurately captured. Begin by gathering all relevant financial documents, including income statements, tax returns, and records of deductions. Carefully follow the instructions provided on the checklist to fill out each section, ensuring that all figures are accurate and reflect your current financial situation. This form can be completed digitally, allowing for easier submission and storage.

Steps to complete the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST

Completing the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST requires attention to detail. Follow these steps:

- Gather all necessary documents, including income verification and deduction records.

- Review the checklist for specific instructions on each section.

- Fill in your personal information accurately.

- List all sources of income, ensuring no omissions.

- Detail all eligible deductions, providing necessary documentation.

- Review the completed form for accuracy before submission.

Legal use of the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST

The ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST serves a legal purpose in documenting financial eligibility. When properly completed and submitted, it can be used as evidence in applications for government benefits or financial assistance. To ensure its legal standing, it is important to comply with all relevant regulations and guidelines, including providing accurate information and maintaining proper records of any supporting documentation.

Required Documents

To successfully complete the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST, several documents are typically required:

- Recent pay stubs or income statements.

- Tax returns from the previous year.

- Records of any additional income sources, such as rental or investment income.

- Documentation for allowable deductions, including medical expenses or educational costs.

Eligibility Criteria

Eligibility for the benefits associated with the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST is determined by specific criteria. These may include:

- Income level relative to federal or state guidelines.

- Household size and composition.

- Type of deductions being claimed.

- Compliance with any additional program-specific requirements.

Quick guide on how to complete attachment 6 i eligibility income and deduction checklist

Complete ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST across any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to adjust and electronically sign ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST effortlessly

- Obtain ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight signNow sections of your documents or obscure sensitive information with tools specifically created for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from the device of your choice. Adjust and electronically sign ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the attachment 6 i eligibility income and deduction checklist

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST?

The ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST is a comprehensive document designed to help users assess eligibility for various income and deduction scenarios. By providing a clear overview, it allows users to accurately determine the necessary documentation and information to proceed with financial applications. Utilizing airSlate SignNow simplifies this process, making it easier to manage and eSign necessary paperwork.

-

How does airSlate SignNow enhance the use of the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST?

airSlate SignNow provides a streamlined platform for using the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST, offering features like easy document sharing and eSigning. Users can collaboratively fill out and revise the checklist while having secure access to it at any time. This efficiency helps eliminate delays in processing and enhances overall productivity.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business needs and sizes. Whether you are a small business needing basic features or an enterprise requiring advanced functionalities, there's a plan for you. Our competitive pricing ensures that you have access to essential tools for efficiently handling the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST without breaking the bank.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow allows seamless integration with multiple software tools, enhancing the overall user experience when working with the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST. You can easily connect with popular applications like Google Drive, Salesforce, and more. This flexibility ensures that your workflow remains uninterrupted and efficient.

-

What are the key features of airSlate SignNow that benefit users of the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST?

Key features of airSlate SignNow include user-friendly document editing, customizable templates, and advanced security options. These features enhance the overall experience for users working with the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST by providing a secure environment for eSigning and sharing documents. This helps in maintaining compliance and protecting sensitive information.

-

Is there support available for using the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST?

Yes, airSlate SignNow offers dedicated customer support to assist users with any queries regarding the ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST. Our knowledgeable support team is available through various channels to ensure you receive timely assistance. Whether you need help with features or troubleshooting, we are here to support you.

-

How can I ensure the security of my ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST documents?

Security is a top priority at airSlate SignNow. The platform uses industry-standard encryption and compliance protocols to protect your ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST documents. Regular audits and adherence to security best practices ensure that your sensitive information remains safe from unauthorized access.

Get more for ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST

Find out other ATTACHMENT 6 I ELIGIBILITY INCOME AND DEDUCTION CHECKLIST

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship