Tax Exempt Form Ny

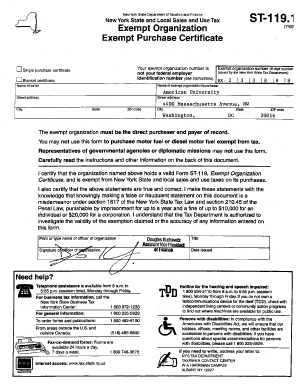

What is the Tax Exempt Form NY?

The tax exempt form NY, often referred to as the NY exemption certificate, is a crucial document for organizations and individuals seeking to avoid paying sales tax on certain purchases in New York. This form allows eligible entities, such as non-profit organizations, to make tax-exempt purchases for specific goods and services that align with their mission. Understanding the purpose and function of this form is essential for compliance with state tax regulations.

How to Use the Tax Exempt Form NY

Utilizing the tax exempt form NY involves several steps to ensure proper execution. First, the eligible entity must complete the form with accurate information, including the name, address, and tax identification number. Next, the form should be presented to the vendor at the time of purchase. It is important to retain a copy of the completed form for record-keeping purposes, as this documentation may be required for audits or compliance checks by tax authorities.

Steps to Complete the Tax Exempt Form NY

Completing the tax exempt form NY requires careful attention to detail. Follow these steps:

- Gather necessary information, including your organization's tax identification number and address.

- Fill out the form accurately, ensuring all fields are completed.

- Sign and date the form to validate it.

- Provide the completed form to the vendor when making a purchase.

Legal Use of the Tax Exempt Form NY

The legal use of the tax exempt form NY is governed by New York State tax laws. To be valid, the form must be used by eligible organizations for purchases directly related to their exempt purpose. Misuse of the form, such as using it for personal purchases or for items not intended for the exempt organization, can result in penalties and fines. Therefore, understanding the legal implications is essential for compliance.

Eligibility Criteria

To qualify for using the tax exempt form NY, organizations must meet specific eligibility criteria. Typically, these include being a registered non-profit organization, a government entity, or an educational institution. Additionally, the purchases made must be directly related to the organization's exempt activities. It is advisable to review the state guidelines to ensure compliance with all eligibility requirements.

Who Issues the Form

The tax exempt form NY is issued by the New York State Department of Taxation and Finance. This department oversees the administration of tax laws and provides the necessary forms for various tax-related purposes. Organizations seeking to use the form must ensure they are registered and recognized by the state to obtain the exemption.

Quick guide on how to complete tax exempt form ny 100078406

Effortlessly Prepare Tax Exempt Form Ny on Any Device

Digital document management has gained traction among businesses and individuals. It offers a superb environmentally friendly alternative to conventional printed and signed paperwork, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without delays. Manage Tax Exempt Form Ny on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Alter and eSign Tax Exempt Form Ny with Ease

- Find Tax Exempt Form Ny and click Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Choose your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, exhausting form searches, or errors that necessitate new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Exempt Form Ny and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exempt form ny 100078406

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax exempt form ny?

A tax exempt form ny is a document that allows qualified individuals or organizations to purchase goods and services without paying sales tax in New York. This form is crucial for eligible entities to avoid unnecessary tax charges and make tax-exempt purchases legally.

-

How can I create a tax exempt form ny using airSlate SignNow?

Creating a tax exempt form ny with airSlate SignNow is simple. You can start by using our templates or design your own form from scratch, ensuring all required fields are covered. Once the form is filled out, it can be easily sent for eSignature, streamlining the process signNowly.

-

Is there a fee for using airSlate SignNow to handle tax exempt form ny?

airSlate SignNow offers competitive pricing that allows you to manage your tax exempt form ny without breaking the bank. We provide various subscription plans to cater to different business sizes and needs, ensuring you get the best value for managing important documents.

-

What features does airSlate SignNow offer for managing tax exempt form ny?

With airSlate SignNow, you can easily create, send, and eSign tax exempt form ny digitally. Our platform features real-time tracking, notifications, and secure storage, making it easy to manage all your essential documents efficiently. Additionally, automatic reminders ensure timely responses to your forms.

-

Can I integrate airSlate SignNow with other software to manage tax exempt form ny?

Yes, airSlate SignNow offers integrations with popular software tools to help manage your tax exempt form ny more effectively. Whether you're using CRM systems or cloud storage services, our platform connects seamlessly, providing an all-in-one solution for your document management needs.

-

How can airSlate SignNow improve the efficiency of handling tax exempt form ny?

Using airSlate SignNow signNowly enhances the efficiency of handling tax exempt form ny by automating repetitive tasks such as sending reminders and tracking signatures. This reduces the time spent on document processing and allows your team to focus on more strategic initiatives.

-

Is airSlate SignNow secure for handling sensitive documents like tax exempt form ny?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure storage, to protect sensitive documents such as tax exempt form ny. Your data is safe with us, ensuring compliance with data protection standards and giving you peace of mind.

Get more for Tax Exempt Form Ny

- Maths key skills form

- Winner claim form the florida lottery 6965264

- Usda child care food program menu planning sheet form

- Form w 4

- Request for new pan card or and changes or correction in pan data taxlawassociates form

- Vaganova syllabus pdf form

- Bksb initial assessment pdf form

- By this means letter form

Find out other Tax Exempt Form Ny

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document