Form VA 8453 Tax Virginia

What is the Form VA 8453 Tax Virginia

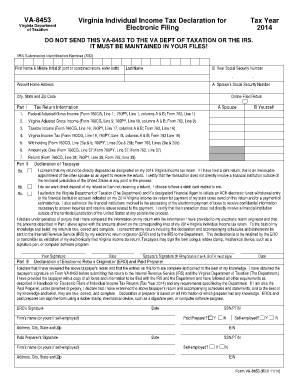

The Form VA 8453 Tax Virginia is a document used by taxpayers in Virginia to authorize the electronic filing of their state tax returns. This form serves as a declaration that the information provided in the electronic submission is accurate and complete. It is crucial for ensuring compliance with state tax regulations and provides a legal basis for the submission of tax information electronically.

How to use the Form VA 8453 Tax Virginia

To use the Form VA 8453 Tax Virginia, taxpayers must first complete their state tax return using approved tax preparation software. Once the return is finalized, the form must be signed electronically. This electronic signature confirms the taxpayer's agreement with the information submitted. After signing, the form is submitted along with the electronic tax return to the Virginia Department of Taxation.

Steps to complete the Form VA 8453 Tax Virginia

Completing the Form VA 8453 Tax Virginia involves several key steps:

- Gather all necessary tax documents, including income statements and deductions.

- Fill out your state tax return using tax preparation software.

- Access the Form VA 8453 within the software once your return is ready for submission.

- Provide the required information, including your name, Social Security number, and the tax year.

- Sign the form electronically to validate your submission.

- Submit the form along with your electronic tax return.

Legal use of the Form VA 8453 Tax Virginia

The legal use of the Form VA 8453 Tax Virginia is governed by both state and federal laws regarding electronic signatures. To be considered legally binding, the electronic signature must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This ensures that the form is recognized as a valid document for tax purposes, similar to its paper counterpart.

Key elements of the Form VA 8453 Tax Virginia

The key elements of the Form VA 8453 Tax Virginia include:

- Taxpayer Information: Name, address, and Social Security number.

- Tax Year: The specific year for which the tax return is being filed.

- Signature: An electronic signature that confirms the accuracy of the information provided.

- Filing Status: Indication of whether the taxpayer is filing individually or jointly.

Form Submission Methods (Online / Mail / In-Person)

The Form VA 8453 Tax Virginia can be submitted electronically alongside the state tax return. While electronic submission is the most common method, taxpayers also have the option to print the form and submit it by mail if they prefer a paper filing. In-person submission is generally not available for this form, as it is designed for electronic processing to streamline the tax filing process.

Quick guide on how to complete form va 8453 tax virginia

Complete Form VA 8453 Tax Virginia effortlessly on any device

Web-based document management has become favored among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers since you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Handle Form VA 8453 Tax Virginia on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Form VA 8453 Tax Virginia with ease

- Locate Form VA 8453 Tax Virginia and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form VA 8453 Tax Virginia to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form va 8453 tax virginia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form VA 8453 Tax Virginia?

Form VA 8453 Tax Virginia is a declaration form used to authorize electronic filing of tax returns in Virginia. This form allows you to electronically submit your federal and state tax documents securely. Understanding this form is crucial for compliance with state tax regulations.

-

How can airSlate SignNow help with Form VA 8453 Tax Virginia?

airSlate SignNow simplifies the eSigning process for Form VA 8453 Tax Virginia by offering an intuitive platform for signing and submitting documents. Users can easily fill out and sign this form online, making tax filing seamless and efficient. This reduces paperwork and enhances the filing experience.

-

What are the pricing options for using airSlate SignNow with Form VA 8453 Tax Virginia?

airSlate SignNow offers competitive pricing plans that cater to different business needs, whether you're an individual or a large organization. Each plan includes access to features essential for managing forms like Form VA 8453 Tax Virginia effectively. Check our website for the most current pricing and subscription details.

-

Can I store documents like Form VA 8453 Tax Virginia securely with airSlate SignNow?

Yes, airSlate SignNow ensures that all documents, including Form VA 8453 Tax Virginia, are stored securely in the cloud. Our platform uses advanced encryption methods to protect sensitive information. This ensures that your tax documents are safe and easily accessible when needed.

-

What integrations does airSlate SignNow offer for handling Form VA 8453 Tax Virginia?

airSlate SignNow integrates seamlessly with various applications to streamline the handling of Form VA 8453 Tax Virginia. You can connect with tools like Google Drive, Dropbox, and CRM systems to automate document management. This integration capability enhances productivity and simplifies workflows.

-

Do I need any special skills to use airSlate SignNow for Form VA 8453 Tax Virginia?

No, airSlate SignNow is designed to be user-friendly, requiring no special skills to use. With its intuitive interface, anyone can easily fill out and sign Form VA 8453 Tax Virginia without extensive training. This makes it accessible for all users, regardless of technical ability.

-

What are the benefits of using airSlate SignNow for Form VA 8453 Tax Virginia?

Using airSlate SignNow for Form VA 8453 Tax Virginia offers numerous benefits, including reduced turnaround time for document signing and ease of access. The platform enhances collaboration by allowing multiple parties to sign and submit forms electronically. This ultimately leads to faster processing of your tax returns.

Get more for Form VA 8453 Tax Virginia

Find out other Form VA 8453 Tax Virginia

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast