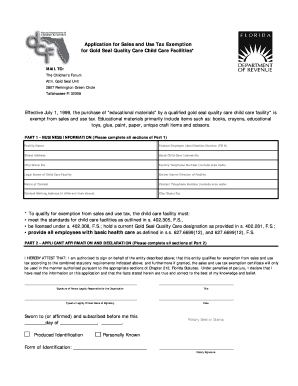

Florida Department of Revenue Application for Sales and Use Tax Exemption for Gold Seal Quality Form

Understanding the Florida Department of Revenue Application for Sales and Use Tax Exemption

The Florida Department of Revenue Application for Sales and Use Tax Exemption is a crucial document for businesses seeking to claim exemptions from sales tax on specific purchases. This form, often referred to as the Florida tax exempt form, allows eligible organizations to avoid paying sales tax on items that are necessary for their operations. The application is particularly relevant for non-profit organizations, government entities, and certain educational institutions that qualify under Florida law.

Steps to Complete the Florida Tax Exempt Form

Completing the Florida tax exempt form requires careful attention to detail to ensure compliance with state regulations. Here are the essential steps:

- Gather necessary information, including your organization’s name, address, and tax identification number.

- Identify the specific purchases for which you are claiming exemption.

- Complete all required sections of the form accurately, ensuring that all details align with your organization's official records.

- Sign and date the form, as an unsigned application cannot be processed.

- Submit the form to the appropriate state department, either online or via mail, depending on your preference.

Eligibility Criteria for the Florida Tax Exempt Form

To qualify for the Florida tax exempt form, organizations must meet specific eligibility criteria established by the state. Generally, the following entities may apply:

- Non-profit organizations recognized under section 501(c)(3) of the Internal Revenue Code.

- Government agencies at the federal, state, or local level.

- Certain educational institutions, including public schools and universities.

- Religious organizations that meet specific criteria as outlined by the Florida Department of Revenue.

Legal Use of the Florida Tax Exempt Form

The legal use of the Florida tax exempt form is governed by state laws and regulations. Organizations must ensure that they use the form strictly for qualifying purchases. Misuse of the exemption can lead to penalties, including fines and back taxes owed. It is important to keep accurate records of all exempt purchases and maintain documentation that supports the exemption claims.

Form Submission Methods

Organizations have several options for submitting the Florida tax exempt form. The methods include:

- Online Submission: Many organizations prefer to submit their applications electronically through the Florida Department of Revenue's website.

- Mail: Completed forms can be sent via postal service to the designated address provided by the Department of Revenue.

- In-Person: Some organizations may choose to deliver their applications directly to a local Department of Revenue office.

Required Documents for Submission

When submitting the Florida tax exempt form, organizations must include certain supporting documents to validate their claims. These may include:

- A copy of the organization’s IRS determination letter, if applicable.

- Proof of the organization’s tax-exempt status.

- Any additional documentation that supports the nature of the purchases being claimed for exemption.

Quick guide on how to complete florida department of revenue application for sales and use tax exemption for gold seal quality form

Effortlessly Prepare Florida Department Of Revenue Application For Sales And Use Tax Exemption For Gold Seal Quality Form on Any Device

Digital document management has gained signNow traction among organizations and individuals. It offers an excellent eco-conscious substitute for conventional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Florida Department Of Revenue Application For Sales And Use Tax Exemption For Gold Seal Quality Form on any device through airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Florida Department Of Revenue Application For Sales And Use Tax Exemption For Gold Seal Quality Form with Ease

- Locate Florida Department Of Revenue Application For Sales And Use Tax Exemption For Gold Seal Quality Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form hunts, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Edit and eSign Florida Department Of Revenue Application For Sales And Use Tax Exemption For Gold Seal Quality Form to ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the florida department of revenue application for sales and use tax exemption for gold seal quality form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Florida tax exempt form?

The Florida tax exempt form is a document that allows qualifying entities to make purchases without paying sales tax in the state of Florida. This form is essential for organizations like charities, government agencies, and non-profits to ensure compliance and avoid unnecessary costs. Understanding how to complete and use the form can help your business save money and streamline purchasing processes.

-

How can I obtain a Florida tax exempt form?

To obtain a Florida tax exempt form, you can download it from the Florida Department of Revenue's website or request one from a supplier or vendor. Make sure to fill it out correctly with your organization's information before presenting it at the time of purchase. Using airSlate SignNow can streamline this process, allowing you to easily send and eSign your tax exempt forms.

-

How does airSlate SignNow help with Florida tax exempt forms?

airSlate SignNow provides an efficient platform for managing and eSigning Florida tax exempt forms. With its user-friendly interface, you can quickly prepare, send, and securely sign documents without any hassle. This feature enhances your workflow, ensuring that you stay organized and compliant with tax exemption regulations.

-

Are there any costs associated with using airSlate SignNow for Florida tax exempt forms?

airSlate SignNow offers various pricing plans, making it a cost-effective solution for managing Florida tax exempt forms and other documents. By choosing the plan that best fits your business needs, you'll gain access to comprehensive features, including eSigning capabilities and document tracking. Evaluate our pricing structure to find the most suitable option for your organization.

-

Can I integrate airSlate SignNow with other software for managing Florida tax exempt forms?

Yes, airSlate SignNow seamlessly integrates with a variety of other software solutions, enhancing your ability to manage Florida tax exempt forms. Whether it's accounting software or document management systems, these integrations allow for better data sharing and streamlined workflows. This functionality is crucial for businesses looking to optimize their processes and maintain compliance.

-

What features does airSlate SignNow offer for Florida tax exempt forms?

airSlate SignNow offers several features that simplify the handling of Florida tax exempt forms, including customizable templates, real-time collaboration, and secure eSigning. These tools enhance the efficiency of your document management while ensuring that you stay compliant with state regulations. Utilizing these features can signNowly reduce the time spent on administrative tasks.

-

What are the benefits of using airSlate SignNow for Florida tax exempt forms?

Using airSlate SignNow for Florida tax exempt forms provides numerous benefits, such as improved efficiency, reduced paperwork, and enhanced compliance. By digitizing the process, you minimize the risk of errors and expedite approvals, ultimately saving time and resources. This enables your business to focus on its core operations while managing tax-exempt transactions more effectively.

Get more for Florida Department Of Revenue Application For Sales And Use Tax Exemption For Gold Seal Quality Form

- Fire experience form print

- Linkee questions pdf form

- Illinois notary application pdf form

- Declaration of interest statement example form

- Vintek dob form

- Csclcd 272 0114 michigan department of licensing and regulatory affairs corporations securities ampamp form

- Mission flight planbriefing form vawg cap

- Counsell therapy contract template form

Find out other Florida Department Of Revenue Application For Sales And Use Tax Exemption For Gold Seal Quality Form

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will