DR 312 Form

What is the DR 312

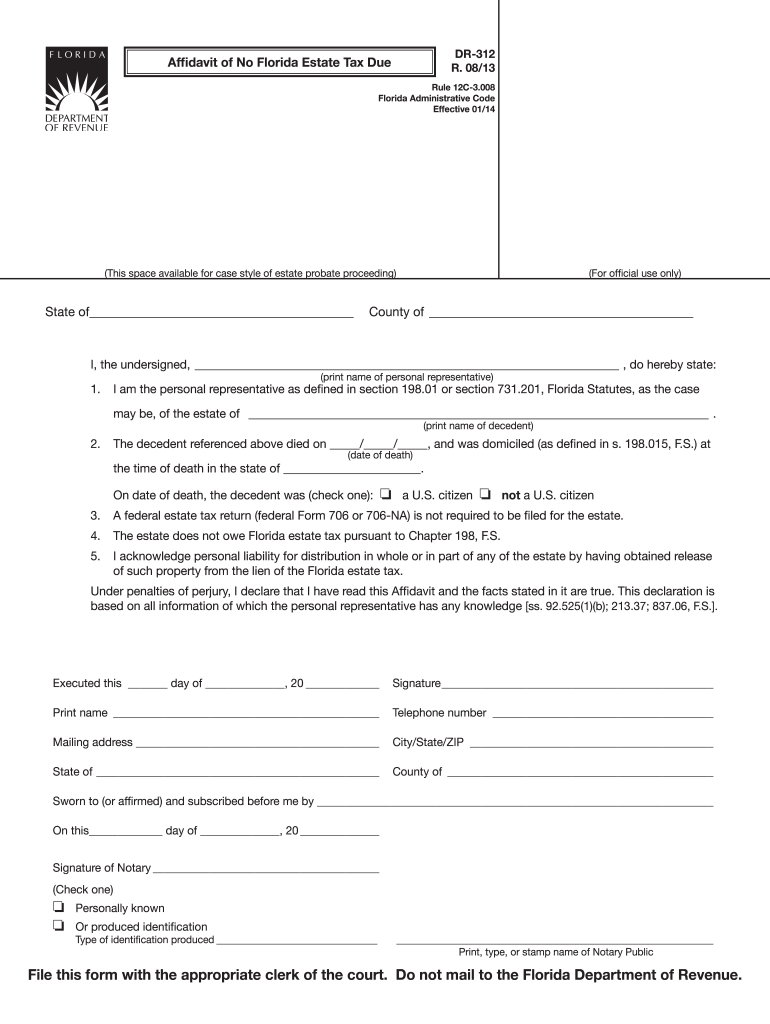

The DR 312 is an official form used in Florida, known as the Affidavit of No Estate Tax. This document is essential for individuals who are settling an estate and need to certify that no estate taxes are due. By completing this form, the executor or personal representative can confirm that the estate qualifies for exemption from Florida estate taxes, which can streamline the process of transferring assets to beneficiaries.

How to use the DR 312

To utilize the DR 312 effectively, the individual responsible for the estate must fill out the form accurately. The form requires specific information about the deceased, including their name, date of death, and details about the estate. Once completed, the affidavit must be signed and notarized to ensure its legal validity. This notarization adds a layer of authenticity, confirming that the signatures are genuine and the document is executed properly.

Steps to complete the DR 312

Completing the DR 312 involves several key steps:

- Gather necessary information about the deceased and the estate.

- Download the DR 312 form from the Florida Department of Revenue website.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Sign the form in the presence of a notary public.

- Submit the completed affidavit to the appropriate county office or court as required.

Legal use of the DR 312

The legal use of the DR 312 is crucial for ensuring compliance with Florida estate tax laws. By filing this affidavit, the executor or personal representative declares that no estate taxes are owed, which can prevent potential legal disputes among beneficiaries. It is important to understand that submitting this form does not exempt the estate from other tax obligations; it specifically addresses estate tax liabilities.

Key elements of the DR 312

Key elements of the DR 312 include:

- Identification of the decedent, including full name and date of death.

- Details regarding the estate, such as asset valuations and liabilities.

- A declaration stating that no estate tax is due.

- Signature of the personal representative and notarization.

Required Documents

When completing the DR 312, certain documents may be required to support the affidavit. These can include:

- The death certificate of the decedent.

- Documentation of the estate's assets and liabilities.

- Proof of identity for the personal representative.

Form Submission Methods (Online / Mail / In-Person)

The DR 312 can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission via the Florida Department of Revenue's website.

- Mailing the completed form to the appropriate county office.

- In-person delivery to the local probate court or county office.

Quick guide on how to complete dr 312

Effortlessly prepare DR 312 on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally-friendly substitute for conventional printed and signed paperwork, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Manage DR 312 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

The simplest method to modify and electronically sign DR 312 without any hassle

- Find DR 312 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign DR 312 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 312

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an affidavit of no estate tax Florida?

An affidavit of no estate tax Florida is a legal document that asserts that the decedent's estate does not owe estate taxes to the state of Florida. This document can streamline the estate settlement process by clarifying tax obligations to the heirs and beneficiaries.

-

How much does it cost to file an affidavit of no estate tax Florida?

The cost of filing an affidavit of no estate tax Florida can vary based on the jurisdiction and associated filing fees. Generally, fees are modest, and many opt for eSign solutions like airSlate SignNow to minimize costs and enhance efficiency.

-

What are the benefits of using airSlate SignNow for an affidavit of no estate tax Florida?

Using airSlate SignNow for your affidavit of no estate tax Florida allows you to electronically sign and send documents seamlessly. The platform is user-friendly, cost-effective, and ensures that your documents are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other software to manage my affidavit of no estate tax Florida?

Yes, airSlate SignNow offers integration with various software applications, enhancing your document management process. This compatibility allows you to streamline workflows, especially when dealing with legal documents like the affidavit of no estate tax Florida.

-

Is my affidavit of no estate tax Florida secure when using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring your affidavit of no estate tax Florida and other documents are protected. The platform uses encryption and secure access controls to keep sensitive information safe.

-

What features should I look for when choosing a solution for an affidavit of no estate tax Florida?

When selecting a solution for your affidavit of no estate tax Florida, look for features like e-signature capabilities, document templates, mobile access, and secure storage options. airSlate SignNow provides all these features to enhance your document workflow.

-

How does airSlate SignNow enhance the process of submitting an affidavit of no estate tax Florida?

airSlate SignNow simplifies the submission process for an affidavit of no estate tax Florida by enabling electronic signatures and fast document routing. This efficiency reduces the time spent on paperwork and expedites estate settlement.

Get more for DR 312

Find out other DR 312

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History