Form P 64a

What is the Form P 64a

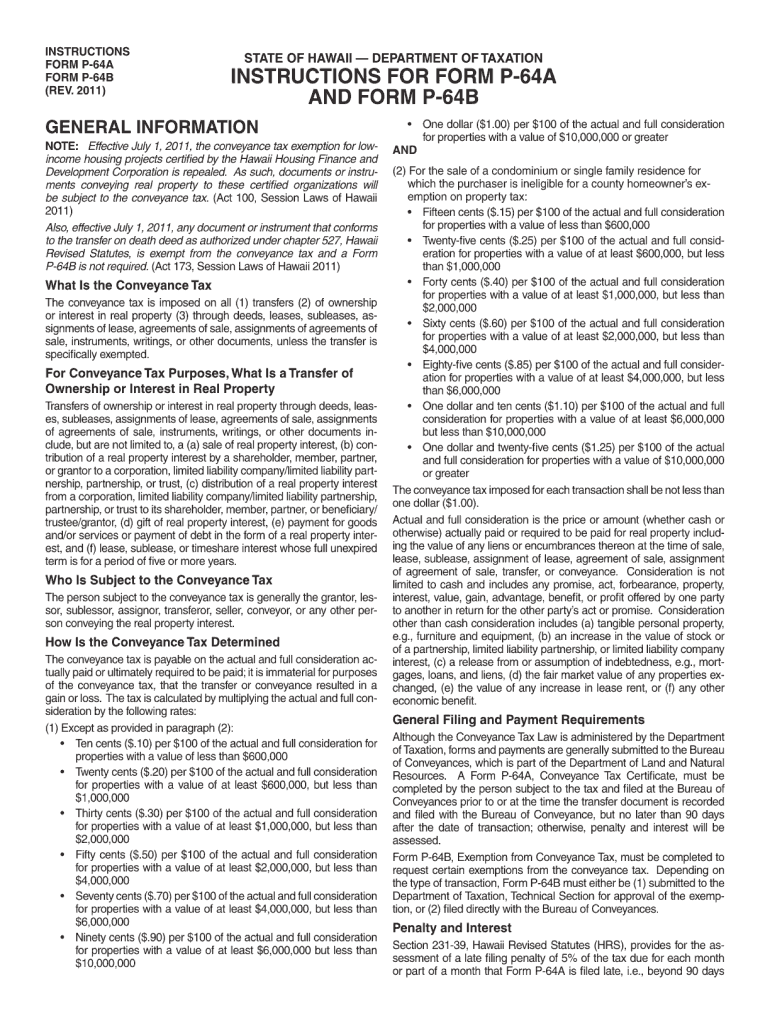

The Form P 64a is a specific document used in various legal and administrative contexts within the United States. It serves as a formal request or declaration, often required by governmental agencies or organizations. Understanding the purpose and requirements of this form is crucial for individuals and businesses alike, as it ensures compliance with applicable regulations and facilitates the proper processing of requests.

How to obtain the Form P 64a

Obtaining the Form P 64a is a straightforward process. The form is typically available through official state or federal agency websites, where it can be downloaded in a printable format. Additionally, some agencies may provide physical copies of the form upon request. It is essential to ensure that you are accessing the most current version of the form to avoid any issues during submission.

Steps to complete the Form P 64a

Completing the Form P 64a requires careful attention to detail. Here are the general steps to follow:

- Download the form from the official source.

- Read the instructions thoroughly to understand the requirements.

- Fill in the necessary personal or business information accurately.

- Review the form for any errors or omissions.

- Sign and date the form as required.

- Submit the completed form according to the specified submission methods.

Legal use of the Form P 64a

The legal use of the Form P 64a is contingent upon its proper completion and submission. When filled out accurately, the form can serve as a legally binding document in various contexts. It is essential to ensure compliance with all relevant laws and regulations when using this form to avoid potential legal issues.

Key elements of the Form P 64a

Several key elements must be included when completing the Form P 64a to ensure its validity. These elements typically include:

- Full name and contact information of the individual or business submitting the form.

- Specific details related to the request or declaration being made.

- Signature of the individual or authorized representative.

- Date of submission.

Form Submission Methods

The Form P 64a can be submitted through various methods, depending on the requirements set by the issuing agency. Common submission methods include:

- Online submission through the agency's official website.

- Mailing the completed form to the designated address.

- In-person submission at the agency's office.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form P 64a can result in significant penalties. These may include fines, delays in processing, or denial of the request made through the form. It is crucial to adhere to all guidelines and deadlines to avoid these consequences.

Quick guide on how to complete form p 64a

Complete Form P 64a effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly and without delays. Handle Form P 64a on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to edit and eSign Form P 64a without hassle

- Locate Form P 64a and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow has specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form P 64a and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form p 64a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form P 64a?

Form P 64a is a document used for specific regulatory purposes, often related to business compliance and reporting. It is essential for businesses to complete this form accurately to meet legal requirements. airSlate SignNow streamlines the eSigning process for Form P 64a, ensuring that all signatures are captured efficiently.

-

How does airSlate SignNow simplify the eSigning of Form P 64a?

airSlate SignNow offers an intuitive interface that makes it easy to upload, send, and eSign Form P 64a. With features like automated reminders and real-time tracking, users can ensure timely completion of the document. This streamlined process helps businesses save time and reduce paperwork.

-

What are the pricing options for using airSlate SignNow for Form P 64a?

airSlate SignNow provides flexible pricing plans to accommodate various business needs, whether you require basic eSigning capabilities or advanced features for handling Form P 64a. By offering pay-as-you-go options and subscription plans, users can select a package that fits their budget. The cost-effectiveness makes it accessible for businesses of all sizes.

-

Can I integrate Form P 64a with other software using airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various CRM systems, cloud storage solutions, and productivity tools. This ensures that when you are working on Form P 64a, you can easily access and manage documents from multiple platforms. The integrations enhance workflow efficiency and data management.

-

What security features does airSlate SignNow offer for Form P 64a?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Form P 64a. The platform uses encryption protocols to safeguard data, along with options for user authentication. This ensures that your documents are protected from unauthorized access.

-

How can airSlate SignNow help in tracking the status of Form P 64a?

With airSlate SignNow, users can track the status of Form P 64a in real-time. You will receive notifications when the document is viewed, signed, or completed, providing full visibility into the signing process. This feature is crucial for businesses that need to stay on top of their document workflows.

-

Is it easy to customize Form P 64a with airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize Form P 64a by adding fields, adjusting layouts, and branding the document according to company needs. Customization options enable businesses to ensure that the document meets their specific requirements while maintaining a professional appearance.

Get more for Form P 64a

Find out other Form P 64a

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed