Mortgage Application Form

What is the mortgage application form

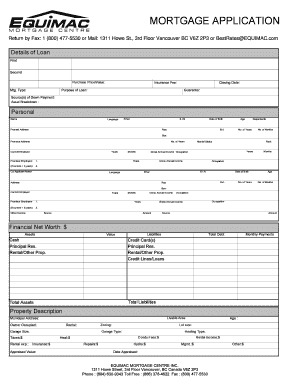

The mortgage application form is a crucial document used by lenders to assess an applicant's eligibility for a mortgage loan. This form collects essential information about the borrower, including personal details, employment history, income, assets, and liabilities. It serves as the foundation for the lender's decision-making process regarding loan approval and terms. Understanding the components of this form is vital for applicants to ensure that they provide accurate and complete information, which can significantly impact their chances of securing financing.

Steps to complete the mortgage application form

Completing the mortgage application form involves several key steps that help ensure accuracy and thoroughness. Start by gathering necessary documentation, such as proof of income, tax returns, and details of existing debts. Next, fill out the form with personal information, including your Social Security number, employment details, and financial history. Be sure to review the form for any errors or omissions before submission, as inaccuracies can lead to delays or denials. Finally, submit the completed form through the preferred method, whether online or via mail, and keep a copy for your records.

Legal use of the mortgage application form

The legal use of the mortgage application form is governed by various regulations that ensure the protection of both the lender and the borrower. To be considered legally binding, the form must be completed accurately and signed by all parties involved. Additionally, compliance with federal and state laws, including the Equal Credit Opportunity Act, is essential to prevent discrimination in lending practices. Utilizing a reliable electronic signature solution can further enhance the legal standing of the application, ensuring that all signatures are verifiable and secure.

Required documents

When completing the mortgage application form, applicants must provide a variety of supporting documents to verify their financial status. Commonly required documents include:

- Proof of income (pay stubs, W-2 forms, or tax returns)

- Bank statements (typically for the last two to three months)

- Documentation of assets (investment accounts, retirement accounts)

- Credit history information (may be obtained by the lender)

- Identification (driver's license or passport)

Having these documents ready can streamline the application process and improve the likelihood of approval.

Form submission methods

The mortgage application form can be submitted through various methods, catering to the preferences of applicants. Common submission options include:

- Online submission via the lender's website or a secure portal

- Mailing a physical copy to the lender's office

- In-person submission at a local branch or office

Each method has its advantages, with online submission often providing quicker processing times and easier tracking of the application status.

Eligibility criteria

Eligibility for a mortgage loan is determined by several criteria outlined in the mortgage application form. Key factors include:

- Credit score: A higher score typically increases the chances of approval and better loan terms.

- Debt-to-income ratio: Lenders assess this ratio to ensure borrowers can manage their monthly payments.

- Employment history: Stable employment and income are crucial for demonstrating financial reliability.

- Down payment: The amount of money put down upfront can influence loan approval and terms.

Understanding these criteria can help applicants prepare their applications more effectively.

Quick guide on how to complete mortgage application form 61459

Prepare Mortgage Application Form seamlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed paperwork, allowing you to access the correct format and secure it in the cloud. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Mortgage Application Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and electronically sign Mortgage Application Form effortlessly

- Obtain Mortgage Application Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which only takes a few seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and hit the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mortgage Application Form and guarantee exceptional communication at any phase of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage application form 61459

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution for a Canada mortgage application?

The airSlate SignNow platform simplifies the Canada mortgage application process by allowing users to create, send, and eSign necessary documents quickly. Its user-friendly interface ensures that both lenders and borrowers can navigate the mortgage application with ease. This streamlined approach enhances efficiency and reduces the overall time for processing.

-

How does airSlate SignNow enhance the Canada mortgage application experience?

By utilizing airSlate SignNow, users can track the progress of their Canada mortgage application in real-time. This feature provides transparency and keeps all parties informed throughout the process. Additionally, automated reminders ensure that no important steps are overlooked.

-

Is there a free trial available for the Canada mortgage application service?

Yes, airSlate SignNow offers a free trial for new users looking to manage their Canada mortgage application. This allows you to explore its features and functionalities without any commitment. Experience how it can simplify your mortgage paperwork before making a decision.

-

What are the pricing options for airSlate SignNow when applying for a Canada mortgage?

airSlate SignNow provides various pricing plans that cater to different needs for the Canada mortgage application process. Pricing is competitively structured, ensuring affordability for individuals and businesses alike. Plans offer flexible options, so you can choose one based on your specific requirements.

-

Can airSlate SignNow integrate with other tools for a Canada mortgage application?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing the workflow for the Canada mortgage application. Whether you are using CRM systems or document management tools, integration options are available to ensure a cohesive process.

-

What features does airSlate SignNow provide for handling a Canada mortgage application?

Key features of airSlate SignNow for the Canada mortgage application include customizable templates, secure eSigning, and document tracking. These features work together to streamline the application process and improve overall efficiency. Users can create templates specifically tailored for mortgage documents.

-

How secure is airSlate SignNow for processing a Canada mortgage application?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the Canada mortgage application. The platform employs advanced encryption and compliant protocols to protect your information. Rest assured knowing your data is safe while you manage your mortgage-related documents.

Get more for Mortgage Application Form

Find out other Mortgage Application Form

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free