ST 389 May the South Carolina Department of Revenue Sctax Form

What is the ST 389 May The South Carolina Department Of Revenue Sctax

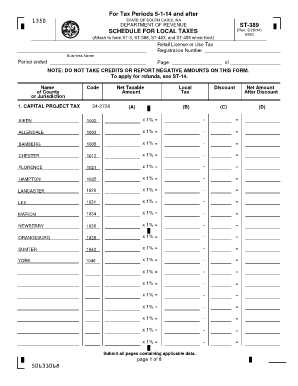

The ST 389 May form is a tax document issued by the South Carolina Department of Revenue. It serves as a declaration for sales and use tax exemptions. This form is crucial for businesses and individuals seeking to claim exemptions on certain purchases or transactions within the state. Understanding its purpose and implications is essential for compliance with state tax regulations.

How to use the ST 389 May The South Carolina Department Of Revenue Sctax

Using the ST 389 May form involves filling it out accurately to ensure that the exemption is valid. Taxpayers must provide necessary information, including the purchaser's details, the type of exemption being claimed, and the specific items or services involved. It is vital to review the instructions carefully to avoid errors that could lead to penalties or denial of the exemption.

Steps to complete the ST 389 May The South Carolina Department Of Revenue Sctax

Completing the ST 389 May form requires several key steps:

- Gather necessary documentation that supports your claim for exemption.

- Fill out the form with accurate information, including your name, address, and the nature of the exemption.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate vendor or agency as required.

Key elements of the ST 389 May The South Carolina Department Of Revenue Sctax

The key elements of the ST 389 May form include:

- Purchaser Information: Details about the individual or business claiming the exemption.

- Type of Exemption: A clear indication of the reason for the exemption, such as resale or manufacturing.

- Signature: The form must be signed by the purchaser or an authorized representative to validate the claim.

Legal use of the ST 389 May The South Carolina Department Of Revenue Sctax

The legal use of the ST 389 May form is governed by South Carolina tax laws. To ensure compliance, it is essential that the form is used only for legitimate exemptions as defined by the law. Misuse of the form can result in penalties, including fines or legal action. Therefore, understanding the legal framework surrounding the use of this form is crucial for all taxpayers.

Form Submission Methods

The ST 389 May form can be submitted in various ways, depending on the requirements of the transaction. Common submission methods include:

- In-Person: Presenting the completed form directly to the vendor or agency.

- Mail: Sending the form via postal service to the appropriate address.

- Online: If applicable, submitting the form electronically through a designated portal.

Quick guide on how to complete st 389 may the south carolina department of revenue sctax

Manage ST 389 May The South Carolina Department Of Revenue Sctax effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle ST 389 May The South Carolina Department Of Revenue Sctax on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to adjust and eSign ST 389 May The South Carolina Department Of Revenue Sctax seamlessly

- Find ST 389 May The South Carolina Department Of Revenue Sctax and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign ST 389 May The South Carolina Department Of Revenue Sctax and guarantee effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 389 may the south carolina department of revenue sctax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 389 May form for the South Carolina Department Of Revenue?

The ST 389 May form is a tax form used by businesses to report transactions subject to use tax to the South Carolina Department Of Revenue. This form is essential for ensuring compliance with state tax laws and helps businesses accurately calculate their tax liabilities.

-

How can airSlate SignNow help with the ST 389 May process?

airSlate SignNow streamlines the process of filling out and submitting the ST 389 May form to the South Carolina Department Of Revenue. With our easy-to-use platform, you can quickly eSign and send documents, simplifying compliance and reducing paperwork hassle.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to suit businesses of all sizes. Whether you need a basic plan or advanced features, you can choose an option that accommodates your needs while ensuring compliance with regulations like the ST 389 May from the South Carolina Department Of Revenue.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various software platforms, enhancing productivity and document management. These integrations can help streamline the process of managing your ST 389 May filings with the South Carolina Department Of Revenue.

-

What benefits does airSlate SignNow offer for businesses managing tax documents?

Using airSlate SignNow to manage tax documents, including the ST 389 May for the South Carolina Department Of Revenue, offers numerous benefits. Businesses enjoy improved efficiency, reduced turnaround times, and enhanced accuracy in document processing.

-

Can I track the status of my ST 389 May submissions with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your ST 389 May submissions to the South Carolina Department Of Revenue. This transparency helps businesses stay informed and ensures timely compliance.

-

Is airSlate SignNow suitable for small businesses dealing with the ST 389 May form?

Yes, airSlate SignNow is particularly suited for small businesses looking to manage their ST 389 May forms efficiently. Our platform is user-friendly and cost-effective, making it ideal for businesses needing to comply with the South Carolina Department Of Revenue without overspending.

Get more for ST 389 May The South Carolina Department Of Revenue Sctax

- Video production request form

- Hylife application form

- Dch 0893 vision approval site state of michigan michigan form

- Form uka unair

- Abandonment of right of way application city of delray beach form

- Financial gap administrator llc cancellation reque form

- Supplemental affidavit to request fee waiver fee103 form

- Form 12 901b3 petition for dissolution of florida courts

Find out other ST 389 May The South Carolina Department Of Revenue Sctax

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement