Income Driven Repayment IDR Plan Request Form

What is the Income Driven Repayment IDR Plan Request

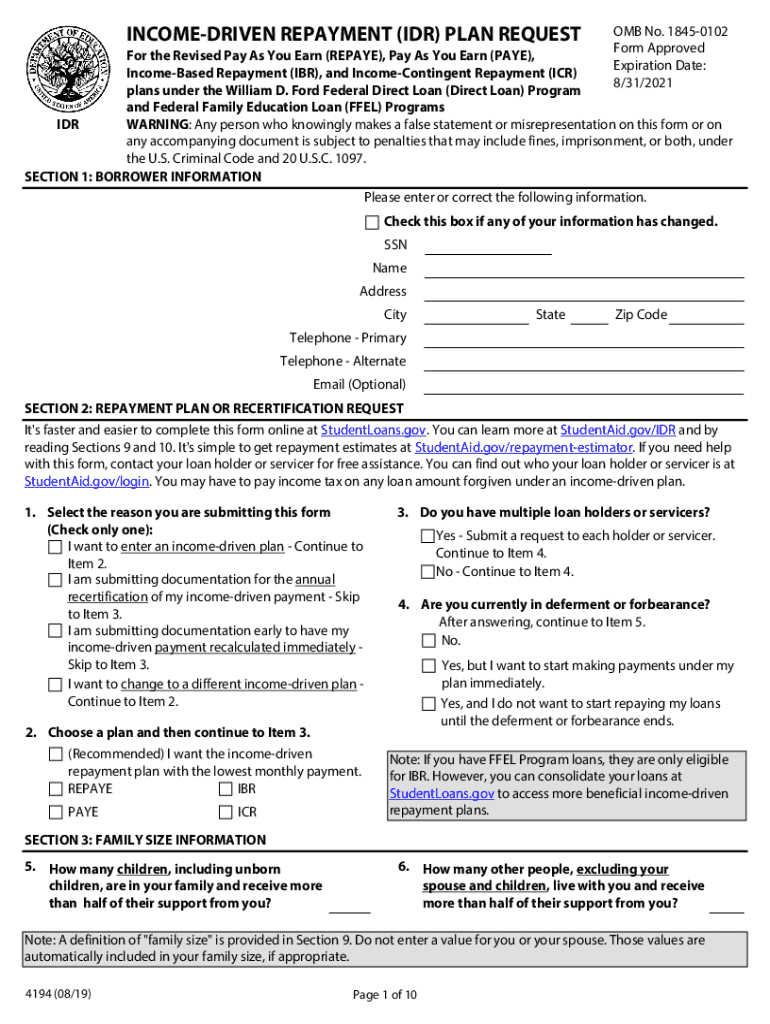

The Income Driven Repayment (IDR) Plan Request is a form that allows borrowers to apply for a repayment plan based on their income and family size. This plan is designed to make student loan payments more manageable by capping monthly payments at a percentage of discretionary income. It is particularly beneficial for those experiencing financial hardship, as it can lead to lower payments and potential loan forgiveness after a set period of consistent payments.

How to Use the Income Driven Repayment IDR Plan Request

To effectively use the Income Driven Repayment IDR Plan Request, borrowers should gather necessary financial information, including income details and family size. The form requires accurate reporting of income, which can include wages, self-employment income, and other sources. Once completed, the form can be submitted to the loan servicer for review. It is essential to follow the instructions carefully to ensure that all required information is provided, as incomplete forms may delay processing.

Steps to Complete the Income Driven Repayment IDR Plan Request

Completing the Income Driven Repayment IDR Plan Request involves several key steps:

- Gather your financial documents, including pay stubs, tax returns, and information about your family size.

- Fill out the form with accurate information regarding your income and expenses.

- Review the completed form to ensure all information is correct and complete.

- Submit the form to your loan servicer via the preferred submission method, whether online, by mail, or in person.

- Follow up with your loan servicer to confirm receipt and processing of your request.

Required Documents

When submitting the Income Driven Repayment IDR Plan Request, borrowers must provide specific documents to support their application. These typically include:

- Most recent tax return or IRS Form 1040.

- Recent pay stubs or proof of income for all household members.

- Documentation of any other income sources, such as unemployment benefits or Social Security.

- Information regarding family size, which may include birth certificates or other identification for dependents.

Eligibility Criteria

To qualify for the Income Driven Repayment IDR Plan, borrowers must meet certain eligibility criteria. These include:

- Having federal student loans, as private loans are not eligible for IDR plans.

- Demonstrating a partial financial hardship based on income and family size.

- Completing the IDR Plan Request form accurately and submitting it to the loan servicer.

Legal Use of the Income Driven Repayment IDR Plan Request

The Income Driven Repayment IDR Plan Request is legally binding when completed and submitted according to federal regulations. It is essential that borrowers understand the implications of their application, as providing false information can lead to penalties, including loss of eligibility for repayment plans or loan forgiveness programs. Compliance with all legal requirements ensures that the request is processed smoothly and protects the borrower's rights.

Quick guide on how to complete income driven repayment idr plan request

Effortlessly Prepare Income Driven Repayment IDR Plan Request on Any Device

The management of online documents has become increasingly favored by organizations and individuals alike. It presents an ideal environmentally friendly option to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, edit, and eSign your documents without delays. Manage Income Driven Repayment IDR Plan Request on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Edit and eSign Income Driven Repayment IDR Plan Request with Ease

- Find Income Driven Repayment IDR Plan Request and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign Income Driven Repayment IDR Plan Request to ensure exceptional communication at any stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income driven repayment idr plan request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income driven repayment plan request?

An income driven repayment plan request is a formal process that allows borrowers to apply for a repayment plan based on their income and family size. This plan helps ensure that loan payments are manageable and is a signNow option for those struggling with student debt.

-

How can airSlate SignNow assist with an income driven repayment plan request?

airSlate SignNow offers an intuitive platform that streamlines the process of submitting your income driven repayment plan request. With eSigning capabilities, you can quickly complete and send all necessary documents, making it easier to manage your repayments.

-

What features does airSlate SignNow provide for handling income driven repayment plan requests?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically designed to support income driven repayment plan requests. These features simplify the submission process and enhance efficiency for users.

-

Is there a cost associated with using airSlate SignNow for my income driven repayment plan request?

airSlate SignNow offers a cost-effective solution with various pricing plans tailored to meet different needs. You can utilize our services for your income driven repayment plan request without the burden of excessive costs.

-

What are the benefits of using airSlate SignNow for my repayment process?

By using airSlate SignNow, you benefit from a seamless and efficient experience when submitting your income driven repayment plan request. The platform's user-friendly interface ensures that you can focus on your financial goals without getting bogged down by paperwork.

-

Can I integrate airSlate SignNow with other financial management tools for my income driven repayment plan request?

Yes, airSlate SignNow offers integrations with various financial management tools to enhance your experience with the income driven repayment plan request. This allows for better data management and streamlined processes across your applications.

-

How long does it take to process an income driven repayment plan request using airSlate SignNow?

The processing time for an income driven repayment plan request may vary based on the specific lender, but using airSlate SignNow can signNowly speed up the submission process. Our platform helps ensure that all necessary documents are submitted accurately and promptly.

Get more for Income Driven Repayment IDR Plan Request

Find out other Income Driven Repayment IDR Plan Request

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF