New Rental Property Information Sheet Rev 3 10 21

What is the new rental property information sheet rev 3 10 21

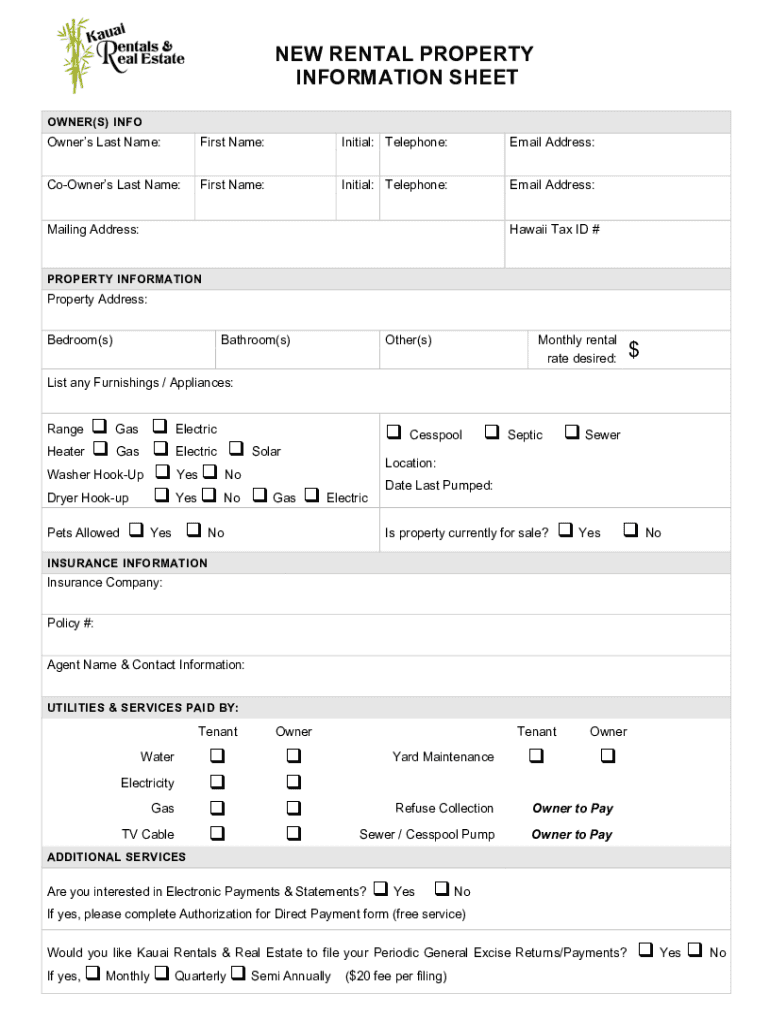

The new rental property information sheet rev 3 10 21 is a comprehensive document designed to collect essential details about rental properties. It serves as a standardized form that landlords and property managers can use to provide potential tenants with vital information regarding the property. This sheet typically includes sections for property descriptions, rental terms, amenities, and contact information. By utilizing this form, landlords can ensure that they communicate all necessary details clearly and effectively, fostering transparency and trust with prospective renters.

How to use the new rental property information sheet rev 3 10 21

Using the new rental property information sheet rev 3 10 21 is straightforward. Start by filling in the property details, including the address, type of property, and rental price. Next, include information about the lease terms, such as the duration of the lease, security deposit requirements, and any additional fees. It is essential to provide a comprehensive list of amenities available to tenants, such as parking, laundry facilities, and access to public transportation. Finally, ensure that all contact information is accurate so that interested parties can easily reach out for further inquiries.

Key elements of the new rental property information sheet rev 3 10 21

The new rental property information sheet rev 3 10 21 contains several key elements that are crucial for both landlords and tenants. These elements typically include:

- Property Address: The complete address of the rental property.

- Rental Price: The monthly rent amount and any additional costs.

- Lease Terms: Duration of the lease, renewal options, and termination clauses.

- Amenities: Features such as appliances, parking, and recreational facilities.

- Contact Information: Details for the landlord or property manager for inquiries.

Including these elements ensures that all relevant information is conveyed to potential tenants, minimizing misunderstandings and enhancing the rental process.

Steps to complete the new rental property information sheet rev 3 10 21

Completing the new rental property information sheet rev 3 10 21 involves several clear steps:

- Gather all necessary information about the property, including its specifications and rental terms.

- Fill out the form accurately, ensuring that each section is completed with the relevant details.

- Review the information for accuracy and completeness before finalizing the document.

- Share the completed sheet with potential tenants, either in printed form or electronically.

Following these steps helps ensure that the rental property information sheet is effective and informative.

Legal use of the new rental property information sheet rev 3 10 21

The new rental property information sheet rev 3 10 21 is legally valid when completed correctly and used in compliance with applicable laws. It is essential for landlords to ensure that the information provided is accurate and truthful to avoid potential legal disputes. The sheet should also comply with local housing regulations and fair housing laws to ensure that all prospective tenants are treated equitably. By adhering to these legal guidelines, landlords can protect themselves and foster a positive rental experience.

How to obtain the new rental property information sheet rev 3 10 21

Obtaining the new rental property information sheet rev 3 10 21 can be done through several methods. Many property management organizations provide templates online that can be downloaded and customized. Additionally, landlords can create their own version of the sheet using word processing software, ensuring that all necessary elements are included. For those who prefer a more streamlined approach, electronic signature platforms can facilitate the creation and sharing of this document, allowing for easy updates and distribution.

Quick guide on how to complete new rental property information sheet rev 3 10 21

Effortlessly prepare New Rental Property Information Sheet rev 3 10 21 on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without holdups. Manage New Rental Property Information Sheet rev 3 10 21 on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

Ways to modify and eSign New Rental Property Information Sheet rev 3 10 21 effortlessly

- Obtain New Rental Property Information Sheet rev 3 10 21 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method of sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign New Rental Property Information Sheet rev 3 10 21 to ensure excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new rental property information sheet rev 3 10 21

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a rental property information sheet?

A rental property information sheet is a comprehensive document that provides essential details about a rental property. This sheet typically includes information such as the property's location, amenities, rental terms, and contact information. Using airSlate SignNow, you can easily create and manage your rental property information sheets to streamline your renting process.

-

How can airSlate SignNow help me with my rental property information sheet?

airSlate SignNow offers a user-friendly platform that enables you to create, edit, and share your rental property information sheets seamlessly. The platform allows for electronic signatures, making it convenient for potential renters to sign documents quickly. With airSlate SignNow, managing rental property information becomes faster and more efficient.

-

Is there a cost associated with creating a rental property information sheet using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, including a solution for creating rental property information sheets. The plans are designed to be cost-effective, ensuring that you get the best services without breaking the bank. Check our website for the latest pricing details tailored for your needs.

-

What features does airSlate SignNow provide for creating rental property information sheets?

airSlate SignNow comes with numerous features that facilitate the creation of rental property information sheets. Features include customizable templates, optional electronic signature integrations, document storage, and sharing capabilities. These tools ensure that your rental property information sheets are both professional and efficiently managed.

-

Can I integrate airSlate SignNow with other applications for my rental property information sheet?

Absolutely! airSlate SignNow offers integration capabilities with various applications that can enhance the management of your rental property information sheets. You can connect with tools such as CRM systems and other document management platforms to streamline your workflows further. This integration makes it easy to access and share your rental property information seamlessly.

-

How does using airSlate SignNow benefit my rental property management?

Using airSlate SignNow to manage your rental property information sheets streamlines your entire rental process. It allows for quick communication, easy sharing of important documents, and faster lease signing. With this solution, you can save time and reduce paperwork while ensuring that all necessary information is available to your potential renters.

-

Are rental property information sheets customizable in airSlate SignNow?

Yes, rental property information sheets created in airSlate SignNow are highly customizable. You can modify templates to include specific details about your property, add your branding, and tailor the layout to fit your needs. This customization ensures that your rental property information sheets accurately represent your offerings.

Get more for New Rental Property Information Sheet rev 3 10 21

- Torque it exam booking form

- Fsco family law form 2 commission des services financiers de l fsco gov on

- Pep loans form

- Transition planning form example

- Bill blank the science guy form

- Nm statement of borrowers benefits homebridge wholesale form

- Illinois form reg 1fill out and use this pdf

- Publication 115 county motor fuel tax publication 115 county motor fuel tax form

Find out other New Rental Property Information Sheet rev 3 10 21

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement