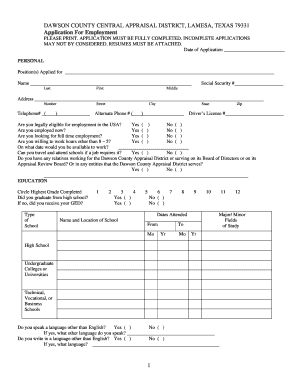

Dawson County Appraisal District Form

What is the Dawson County Appraisal District

The Dawson County Appraisal District is a governmental entity responsible for determining the value of properties within Dawson County, Texas. This district plays a crucial role in the local taxation process by appraising real and personal property. The values determined by the appraisal district are used to calculate property taxes, which fund essential services such as education, public safety, and infrastructure. Understanding the functions of this district is vital for property owners, as it directly impacts their tax obligations and property rights.

How to use the Dawson County Appraisal District

Using the Dawson County Appraisal District involves accessing various resources and services it offers. Property owners can find information regarding property appraisals, tax rates, and exemptions. The district provides an online portal where users can search for property records, view appraisal values, and check the status of their property taxes. Additionally, residents can contact the district directly for assistance with specific inquiries or to resolve disputes related to property valuations.

Steps to complete the Dawson County Appraisal District

Completing the necessary forms related to the Dawson County Appraisal District typically involves several steps:

- Gather relevant property information, including ownership details and property descriptions.

- Access the appropriate forms through the Dawson County Appraisal District website or office.

- Fill out the forms accurately, ensuring all required information is provided.

- Submit the completed forms either online, by mail, or in person, depending on the specific requirements.

- Keep a copy of the submitted forms for your records.

Legal use of the Dawson County Appraisal District

The legal use of the Dawson County Appraisal District is governed by Texas property tax laws. Property owners have the right to appeal their property valuations if they believe the appraised value is incorrect. The district follows specific legal procedures to ensure fair assessments and compliance with state regulations. Understanding these legal frameworks helps property owners navigate the appraisal process effectively and ensures their rights are protected.

Required Documents

When interacting with the Dawson County Appraisal District, certain documents may be required. Commonly needed documents include:

- Proof of ownership, such as a deed or title.

- Previous tax statements or appraisal notices.

- Documentation supporting any claims for exemptions, such as homestead exemption applications.

- Any relevant correspondence with the appraisal district.

Form Submission Methods (Online / Mail / In-Person)

The Dawson County Appraisal District offers multiple methods for submitting forms. Property owners can choose to submit their documents online through the district's website, which provides a convenient option for many. Alternatively, forms can be mailed directly to the district's office. For those who prefer face-to-face interaction, in-person submissions are also accepted during regular business hours. Each method has its own advantages, allowing users to select the one that best suits their needs.

Eligibility Criteria

Eligibility criteria for various programs and exemptions offered by the Dawson County Appraisal District can vary. Generally, property owners must meet specific conditions to qualify for tax exemptions, such as the homestead exemption or agricultural use valuation. These criteria often include residency requirements, property usage, and ownership status. It is important for property owners to review the eligibility requirements for each program to ensure they can take advantage of available benefits.

Quick guide on how to complete dawson county appraisal district

Complete Dawson County Appraisal District effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Dawson County Appraisal District on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Dawson County Appraisal District with ease

- Locate Dawson County Appraisal District and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Dawson County Appraisal District and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dawson county appraisal district

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the Dawson County Appraisal District offer?

The Dawson County Appraisal District provides property appraisal services for residential and commercial properties within Dawson County. Their mission is to ensure accurate assessments that reflect current market values, helping property owners understand their tax obligations and property values.

-

How can I contact the Dawson County Appraisal District?

You can contact the Dawson County Appraisal District by visiting their official website, where you can find phone numbers and email addresses for specific inquiries. For immediate assistance, consider calling their main office or visiting in person during business hours to speak with a representative.

-

What is the process for appealing my property appraisal with the Dawson County Appraisal District?

If you believe your property has been appraised unfairly, you can file an appeal with the Dawson County Appraisal District. This process involves submitting a notice of protest, where you can provide evidence supporting your claim that your property's appraised value is incorrect.

-

How often does the Dawson County Appraisal District reassess properties?

The Dawson County Appraisal District reassesses properties annually to ensure that assessments reflect changes in the real estate market and property values. This annual assessment process allows the district to maintain accurate property valuations and ensure fairness in tax assessments.

-

Are there any fees associated with the services of the Dawson County Appraisal District?

Most services provided by the Dawson County Appraisal District, such as property assessments and tax information, are offered at no charge. However, if you require specific services or documents, there may be nominal fees involved, which you can find detailed on their official website.

-

How does the Dawson County Appraisal District determine property values?

The Dawson County Appraisal District determines property values using a combination of methodologies, including sales data comparisons, cost analysis, and income approaches. These methods ensure that property appraisals are fair and reflective of the current market conditions.

-

Can I access property appraisal information online through the Dawson County Appraisal District?

Yes, the Dawson County Appraisal District provides an online portal where property owners can access appraisal information, tax records, and other relevant data. This user-friendly platform makes it easy for residents to view their property details and stay informed.

Get more for Dawson County Appraisal District

Find out other Dawson County Appraisal District

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast