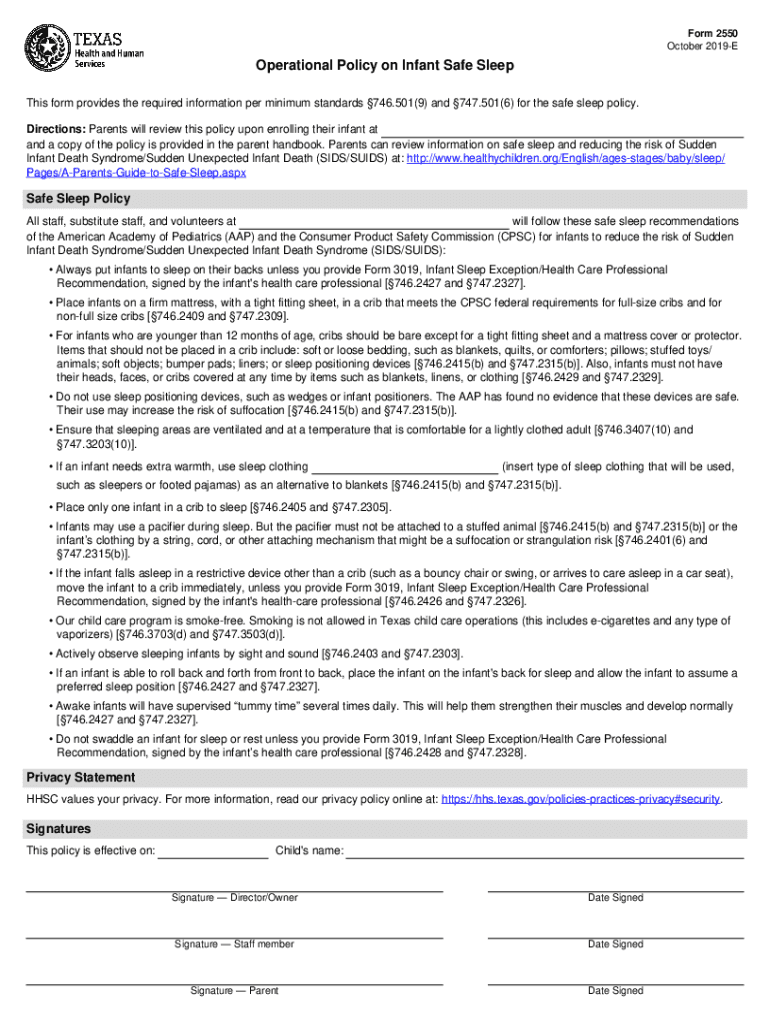

Form 2550

What is the Form 2550

The Form 2550 is a specific tax form used by businesses in the United States to report and claim certain deductions or credits. This form is essential for ensuring compliance with federal tax regulations and helps streamline the process of tax filing. It is particularly relevant for businesses looking to optimize their tax obligations while adhering to the guidelines set forth by the Internal Revenue Service (IRS).

How to use the Form 2550

Using the Form 2550 involves several key steps. First, gather all necessary financial documents, including income statements and expense records. Next, accurately fill out the form with the required information, ensuring that all figures are correct and verifiable. After completing the form, review it for any errors before submission. The form can be submitted electronically or via mail, depending on your preference and the requirements of the IRS.

Steps to complete the Form 2550

Completing the Form 2550 requires a systematic approach. Follow these steps for a smooth process:

- Gather all relevant financial documentation.

- Access the Form 2550 from the IRS website or a trusted source.

- Fill in your business information, including the name, address, and taxpayer identification number.

- Report all income and deductions accurately.

- Double-check all entries for accuracy.

- Submit the completed form electronically or by mail, following the IRS guidelines.

Legal use of the Form 2550

The legal use of the Form 2550 is crucial for maintaining compliance with IRS regulations. When completed accurately, this form serves as a legally binding document that supports your claims for deductions or credits. It is important to ensure that all information provided is truthful and substantiated by appropriate documentation to avoid potential legal issues or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2550 vary based on the type of business entity and the specific tax year. Generally, businesses must submit the form by the due date of their tax return, which is typically April 15 for most entities. It is advisable to check the IRS website for any updates or changes to deadlines, as missing these dates can result in penalties or interest charges.

Who Issues the Form

The Form 2550 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. As the governing body for tax regulations, the IRS provides guidelines and updates related to the form, ensuring that businesses have the necessary information to comply with federal tax laws.

Quick guide on how to complete form 2550

Effortlessly Prepare Form 2550 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and eSign your documents without interruptions. Handle Form 2550 on any device using airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

How to Edit and eSign Form 2550 with Ease

- Find Form 2550 and click on Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of your documents or redact sensitive details with tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal authority as a conventional handwritten signature.

- Review the details and then click the Done button to finalize your changes.

- Choose your preferred method to send your form: via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and eSign Form 2550 and guarantee excellent communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2550

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2550 and how can airSlate SignNow help?

Form 2550 is a tax form used in the Philippines for filing value-added tax (VAT). airSlate SignNow simplifies the process by allowing you to easily create, send, and eSign your form 2550, ensuring compliance and accuracy. With our user-friendly interface, submitting your tax documents becomes hassle-free.

-

Is airSlate SignNow effective for managing multiple form 2550 submissions?

Yes, airSlate SignNow is designed to handle multiple submissions of form 2550 efficiently. Our platform allows you to organize and track multiple documents, making it easy to manage deadlines and maintain compliance. You can securely store your completed forms and access them anytime.

-

What features does airSlate SignNow offer for form 2550 preparation?

AirSlate SignNow offers features such as customizable templates, electronic signatures, and document tracking for preparing your form 2550. These tools streamline the filing process, reducing errors and saving time. You can also collaborate with your team members in real-time.

-

How much does airSlate SignNow cost for users needing form 2550?

airSlate SignNow provides competitive pricing plans tailored for businesses needing to manage form 2550 submissions. Depending on your chosen plan, pricing can vary, but we ensure cost-effective solutions without compromising on features. You can explore our plans to find the best fit for your needs.

-

Can I integrate airSlate SignNow with other software for handling form 2550?

Absolutely! airSlate SignNow supports integration with various software applications, improving your workflow for managing form 2550. This means you can connect with accounting software, CRMs, and other productivity tools to streamline your processes, making document management seamless.

-

What are the benefits of using airSlate SignNow for form 2550?

Using airSlate SignNow for form 2550 offers numerous benefits, including reduced paperwork, enhanced security, and faster processing times. By going digital, you can ensure your submissions are secure and compliant with regulations. Plus, electronic signatures save you time compared to traditional signing methods.

-

Is airSlate SignNow user-friendly for beginners dealing with form 2550?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for beginners handling form 2550. Our intuitive interface guides you through the process of creating and eSigning documents with ease. You can also rely on our customer support for assistance if needed.

Get more for Form 2550

- Costume contest form

- Vineland social maturity scale ppt form

- Vraag nu uw colruyt kaart aan colruyt form

- Assisted living facility resident characteristic roster and sample selection attachment d dshs wa form

- Coba annuity fund form

- Am0530 form

- Authorization for usedisclosure of protected heal form

- Approved form 11a xls

Find out other Form 2550

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now