Credit Application Form Feb

What is the Credit Application Form Feb

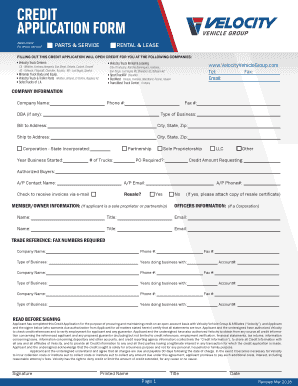

The Credit Application Form Feb is a specialized document used by individuals or businesses seeking credit from financial institutions or lenders. This form collects essential information such as personal identification details, financial history, and creditworthiness indicators. By completing this form, applicants provide lenders with the necessary data to assess their eligibility for credit products, including loans or credit lines. The form is crucial for initiating the credit evaluation process and is often a prerequisite for obtaining financing.

How to use the Credit Application Form Feb

Using the Credit Application Form Feb involves several straightforward steps. First, gather all required information, including your personal details, income, and employment status. Next, access the form through a secure platform that allows for electronic completion and submission. Fill out the form carefully, ensuring that all information is accurate and complete. Once filled, review the form for any errors before submitting it electronically. This method enhances efficiency and allows for quicker processing by the lender.

Steps to complete the Credit Application Form Feb

Completing the Credit Application Form Feb requires attention to detail. Follow these steps for a successful submission:

- Gather necessary documentation, including proof of income and identification.

- Access the form through a reliable electronic platform.

- Fill in personal information, including your name, address, and Social Security number.

- Provide financial details, such as monthly income, expenses, and existing debts.

- Review all entries for accuracy and completeness.

- Submit the form electronically, ensuring you receive confirmation of receipt.

Legal use of the Credit Application Form Feb

The legal use of the Credit Application Form Feb is governed by federal and state regulations. For the form to be considered legally binding, it must be completed accurately and submitted through compliant electronic means. The use of electronic signatures is permitted under laws such as the ESIGN Act and UETA, provided that the signer has consented to use electronic records. Ensuring compliance with these regulations is essential for the validity of the application and the protection of both the applicant and the lender.

Key elements of the Credit Application Form Feb

Several key elements are integral to the Credit Application Form Feb. These include:

- Personal Information: Name, address, and Social Security number.

- Employment Details: Current employer, job title, and duration of employment.

- Financial Information: Monthly income, expenses, and existing debts.

- Credit History: Previous loans, credit cards, and payment history.

- Signature: An electronic signature confirming the accuracy of the provided information.

Form Submission Methods

The Credit Application Form Feb can be submitted through various methods, enhancing accessibility for applicants. Common submission methods include:

- Online Submission: Completing and submitting the form electronically through a secure platform.

- Mail: Printing the completed form and sending it via postal service to the lender.

- In-Person: Delivering the form directly to a branch of the lending institution.

Quick guide on how to complete credit application form feb

Complete Credit Application Form Feb effortlessly on any device

Digital document management has become favored among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate template and securely save it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without delays. Manage Credit Application Form Feb on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign Credit Application Form Feb with ease

- Find Credit Application Form Feb and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from your preferred device. Modify and electronically sign Credit Application Form Feb and ensure clear communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit application form feb

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Credit Application Form Feb and how can it benefit my business?

The Credit Application Form Feb is a streamlined electronic document that allows businesses to gather necessary financial information from applicants. By utilizing this form, you can enhance efficiency, reduce paperwork, and expedite the credit approval process. This solution ultimately helps businesses maintain a smoother cash flow and better decision-making.

-

How can I create a Credit Application Form Feb using airSlate SignNow?

Creating a Credit Application Form Feb with airSlate SignNow is simple and intuitive. You can use our template library to customize the form, adding your branding and necessary fields. Once designed, you can easily share the form with applicants via email or a shareable link for seamless data collection.

-

Is the Credit Application Form Feb secure for my applicants’ information?

Yes, the Credit Application Form Feb is built with robust security features to protect sensitive information. airSlate SignNow implements encryption, secure cloud storage, and compliance with data protection regulations. This ensures your applicants’ data remains confidential and secure throughout the signing process.

-

What are the key features of the Credit Application Form Feb offered by airSlate SignNow?

Key features of the Credit Application Form Feb include custom field creation, integration with payment processors, and eSignature capabilities. Additionally, you can track the status of applications in real time and automate reminders for follow-ups. This makes the credit application process more efficient and manageable.

-

Are there pricing options for using the Credit Application Form Feb with airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that can accommodate different business needs for the Credit Application Form Feb. Depending on the size of your organization and required features, you can select a plan that provides optimal value. For specific pricing queries, visit our pricing page or contact our sales team for personalized assistance.

-

Can I integrate the Credit Application Form Feb with other software tools?

Absolutely! The Credit Application Form Feb can be easily integrated with various software applications such as CRM systems, payment gateways, and accounting tools. This integration allows for seamless data transfer and enhances workflow efficiency, enabling you to keep all data synchronized across platforms.

-

How does the eSignature feature work with the Credit Application Form Feb?

With airSlate SignNow, the eSignature feature for the Credit Application Form Feb allows applicants to sign documents electronically in a legally binding manner. Users can add their signatures quickly and securely, removing the need for printing or scanning. This not only speeds up the application process but also improves user experience.

Get more for Credit Application Form Feb

- Family day care admission and arrangements co rice mn form

- Food order form

- Vertical and horizontal shifts worksheet form

- Volunteer recruitment plan template form

- Zusatzblatt kiz 5b form

- Phoenix health plans prior authorization form

- Mdh tb risk assessment form

- Creating asthma friendly schools in montana form

Find out other Credit Application Form Feb

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy