Fillable Online PC Form AG PDF RHB Bank Fax Email Print

What is cover note insurance?

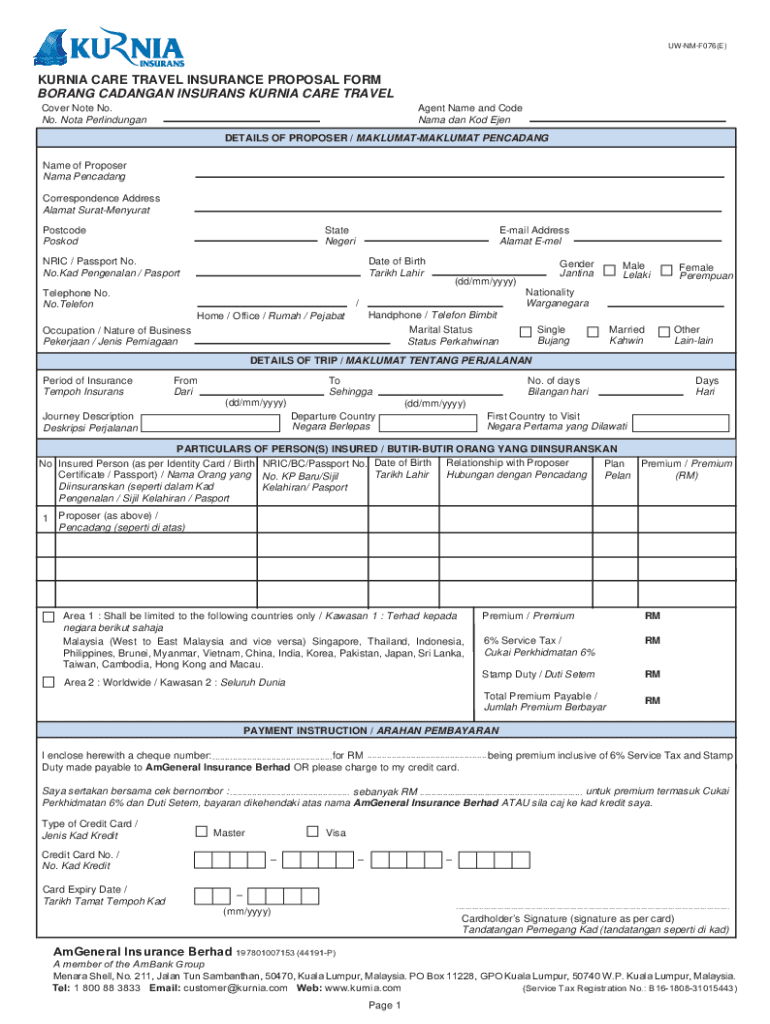

A cover note insurance is a temporary document issued by an insurance provider that serves as proof of insurance coverage until a formal policy is issued. It outlines the essential details of the insurance agreement, including the type of coverage, the insured parties, and the effective dates. This document is particularly useful in situations where immediate proof of insurance is required, such as for vehicle registration or loan applications. While it is not a substitute for a full insurance policy, it provides peace of mind to policyholders during the interim period.

Key elements of a cover note insurance

Understanding the key elements of a cover note insurance is crucial for both insurers and insured parties. The main components typically include:

- Insured parties: Names of individuals or entities covered by the insurance.

- Coverage details: A description of the type of insurance, such as auto, home, or liability insurance.

- Effective dates: The start and end dates of the coverage period.

- Policy number: A temporary or assigned policy number for reference.

- Limitations and exclusions: Specific conditions under which the coverage may not apply.

Steps to complete a cover note insurance

Completing a cover note insurance involves several straightforward steps. Here is a general guide:

- Gather necessary information: Collect personal details, such as names, addresses, and contact information of all insured parties.

- Choose coverage type: Determine the type of insurance needed based on individual requirements.

- Contact your insurance provider: Reach out to your chosen insurance company to request a cover note.

- Provide required documentation: Submit any necessary documents, such as identification and proof of prior insurance, if applicable.

- Review the cover note: Ensure all details are accurate before finalizing the document.

- Receive the cover note: Obtain the cover note insurance from your provider, either digitally or in print.

Legal use of a cover note insurance

A cover note insurance is legally recognized as a valid form of proof of insurance coverage in many situations. However, it is important to understand that it is temporary and does not replace a full insurance policy. In legal contexts, such as during traffic stops or loan processing, presenting a cover note can fulfill the requirement for proof of insurance. It is advisable to keep a copy of the cover note until the official policy is received.

Digital vs. paper version of cover note insurance

Cover note insurance can be issued in both digital and paper formats, each with its advantages. Digital versions are easily accessible and can be stored on mobile devices, making them convenient for quick reference. They can also be shared electronically with relevant parties. On the other hand, paper versions may be preferred for traditional processes or when a physical document is required. Regardless of the format, it is essential to ensure that the information is accurate and that the document is stored securely.

Examples of using a cover note insurance

Cover note insurance is commonly used in various scenarios, including:

- Auto insurance: When purchasing a vehicle, a cover note may be required to register the car before the full policy is issued.

- Real estate transactions: Buyers may need to provide proof of homeowner's insurance to secure a mortgage.

- Business operations: Companies might present a cover note when bidding for contracts that require proof of liability insurance.

Quick guide on how to complete fillable online pc form ag pdf rhb bank fax email print

Prepare Fillable Online PC Form AG pdf RHB Bank Fax Email Print effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can locate the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Handle Fillable Online PC Form AG pdf RHB Bank Fax Email Print on any device using airSlate SignNow's Android or iOS apps and simplify any document-centric process today.

How to modify and eSign Fillable Online PC Form AG pdf RHB Bank Fax Email Print effortlessly

- Obtain Fillable Online PC Form AG pdf RHB Bank Fax Email Print and click on Get Form to commence.

- Use the tools provided to complete your document.

- Flag pertinent sections of your documents or obscure sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to share your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Alter and eSign Fillable Online PC Form AG pdf RHB Bank Fax Email Print and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online pc form ag pdf rhb bank fax email print

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cover note insurance and how does it work?

Cover note insurance is a temporary insurance document that provides proof of coverage until a formal policy is issued. It allows policyholders to begin their insurance coverage immediately, ensuring they are protected from the moment they need it. With airSlate SignNow, you can easily manage and sign these important documents online.

-

How much does cover note insurance cost?

The cost of cover note insurance can vary based on several factors, including the type of insurance, duration of coverage, and the provider. Typically, cover note insurance is more affordable due to its short-term nature. With our solutions, you can quickly assess your needs and manage costs effectively.

-

What are the benefits of using cover note insurance?

Cover note insurance provides immediate protection and peace of mind while waiting for your official policy. It also simplifies the process of obtaining coverage, making it easier for businesses and individuals to stay insured. By digitizing the process with airSlate SignNow, you can streamline document handling and enhance efficiency.

-

Can I integrate cover note insurance management with other tools?

Yes, airSlate SignNow offers integrations with various business tools that can enhance your experience with cover note insurance. Our platform's flexible API allows you to connect with popular applications, making it easier to manage and track your insurance documents. This ensures a smooth workflow without interruptions.

-

Are there any specific requirements for acquiring cover note insurance?

Requirements for cover note insurance typically include providing essential details about the insured item, such as its value and use. Additionally, you may need to fill out an application and make a payment for the coverage period. With airSlate SignNow, you can complete this process digitally, making it quick and straightforward.

-

How long is cover note insurance valid?

Cover note insurance is generally valid for a limited time, often ranging from a few days to a couple of weeks, until your formal policy is issued. The exact duration can depend on the insurer and the type of coverage. Using airSlate SignNow helps you keep track of important dates and ensure continuous coverage.

-

Can I cancel my cover note insurance?

Yes, you can cancel your cover note insurance if your situation changes or if you decide not to proceed with a full policy. However, it’s important to review the cancellation terms outlined in your agreement. With airSlate SignNow, you can manage your insurance documents easily, including cancellations.

Get more for Fillable Online PC Form AG pdf RHB Bank Fax Email Print

Find out other Fillable Online PC Form AG pdf RHB Bank Fax Email Print

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document