Tax Organizer ORG0 Mkshelbycpa Com 2017

What is the Tax Organizer ORG0 Mkshelbycpa com

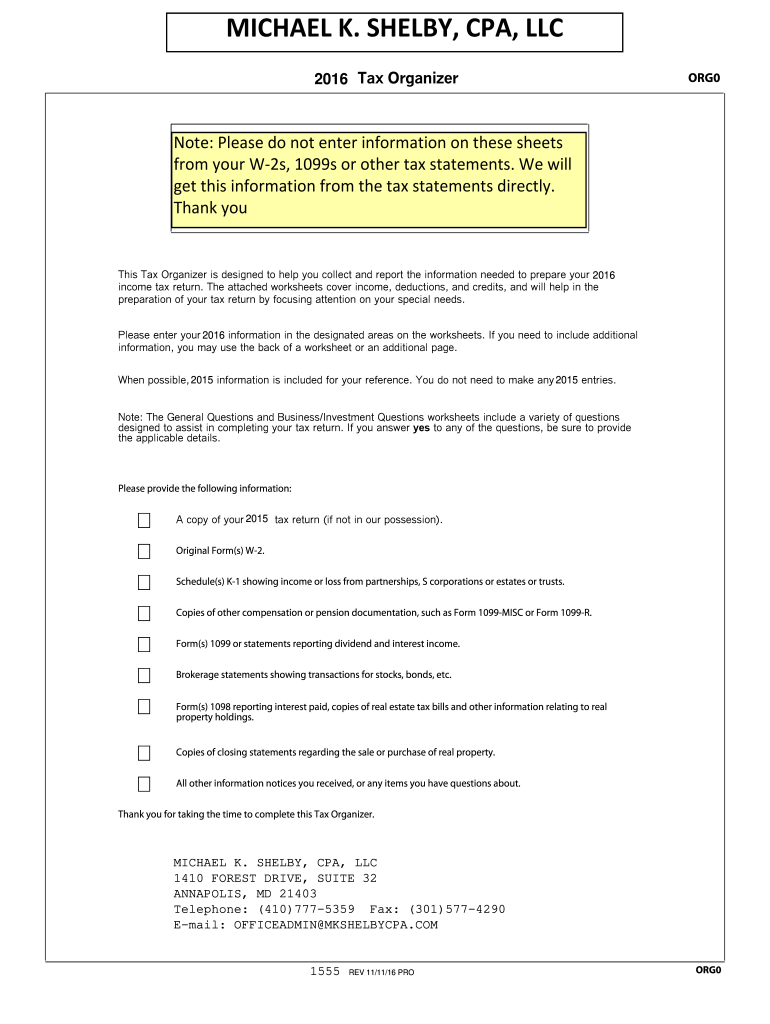

The Tax Organizer ORG0 Mkshelbycpa com is a specialized document designed to assist individuals and businesses in gathering necessary financial information for tax preparation. This form simplifies the process of organizing tax-related data, ensuring that all relevant details are collected efficiently. It typically includes sections for income, deductions, credits, and other pertinent financial information. Utilizing this organizer helps taxpayers streamline their filing process, making it easier to meet compliance requirements.

How to use the Tax Organizer ORG0 Mkshelbycpa com

Using the Tax Organizer ORG0 Mkshelbycpa com involves several straightforward steps. First, download the form from the designated website. Next, fill in the required fields with accurate financial information, including income sources, deductible expenses, and any applicable tax credits. It is essential to review the completed form for accuracy before submission. Once finalized, the organizer can be submitted electronically or printed for in-person filing, depending on individual preferences.

Steps to complete the Tax Organizer ORG0 Mkshelbycpa com

Completing the Tax Organizer ORG0 Mkshelbycpa com requires careful attention to detail. Follow these steps for effective completion:

- Download the form from the official source.

- Gather all necessary financial documents, including W-2s, 1099s, and receipts for deductions.

- Fill in personal information, such as name, address, and Social Security number.

- Detail all sources of income, ensuring accuracy in reporting.

- List all eligible deductions and credits, referencing supporting documents as needed.

- Review the form for completeness and accuracy.

- Submit the completed organizer through the preferred method.

Legal use of the Tax Organizer ORG0 Mkshelbycpa com

The Tax Organizer ORG0 Mkshelbycpa com is legally recognized as a valid tool for tax preparation. When filled out correctly, it serves as a comprehensive record of financial information that can be used to support tax filings. It is important to ensure compliance with IRS guidelines and state regulations when using this form. The information provided must be accurate and truthful to avoid penalties or audits.

Required Documents

To effectively complete the Tax Organizer ORG0 Mkshelbycpa com, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses, such as medical bills or charitable contributions

- Statements for investment income

- Records of any other income sources

Filing Deadlines / Important Dates

Filing deadlines for tax returns are crucial for compliance. Generally, the deadline for individual tax returns in the United States is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS calendar for specific dates and any changes that may occur each tax year. Staying informed about these deadlines ensures timely submissions and helps avoid penalties.

Quick guide on how to complete tax organizer org0 mkshelbycpa com

Easily prepare Tax Organizer ORG0 Mkshelbycpa com on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Tax Organizer ORG0 Mkshelbycpa com on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign Tax Organizer ORG0 Mkshelbycpa com effortlessly

- Find Tax Organizer ORG0 Mkshelbycpa com and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Tax Organizer ORG0 Mkshelbycpa com to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax organizer org0 mkshelbycpa com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Organizer ORG0 Mkshelbycpa com?

The Tax Organizer ORG0 Mkshelbycpa com is a comprehensive tool designed to simplify tax preparation and organization for individuals and businesses. This online solution allows users to gather all necessary financial documents and information in one place, making the filing process smoother and more efficient.

-

How does the Tax Organizer ORG0 Mkshelbycpa com benefit my tax preparation process?

By utilizing the Tax Organizer ORG0 Mkshelbycpa com, users can streamline their tax preparation efforts by having all pertinent information readily available. This reduces the chance of errors and omissions while speeding up the entire filing process, ultimately leading to enhanced accuracy and potential savings.

-

What are the pricing options for the Tax Organizer ORG0 Mkshelbycpa com?

The Tax Organizer ORG0 Mkshelbycpa com offers competitive pricing designed for various user needs, ensuring cost-effectiveness without compromising on features. Prospective customers can visit our website to check the latest pricing plans and select the one that best fits their requirements.

-

Is the Tax Organizer ORG0 Mkshelbycpa com user-friendly?

Absolutely! The Tax Organizer ORG0 Mkshelbycpa com is built with user experience in mind, allowing users to navigate easily through its features. Whether you are tech-savvy or a beginner, you can handle your tax documents with confidence and ease.

-

Can I integrate the Tax Organizer ORG0 Mkshelbycpa com with other software?

Yes, the Tax Organizer ORG0 Mkshelbycpa com offers integration capabilities with a range of accounting and tax software. This functionality ensures that users can sync their financial data seamlessly and minimize manual entry, enhancing overall productivity.

-

Are there any benefits to using the Tax Organizer ORG0 Mkshelbycpa com over traditional methods?

Using the Tax Organizer ORG0 Mkshelbycpa com offers several advantages over traditional tax preparation methods, including improved organization, faster access to documents, and enhanced security features. Additionally, being cloud-based allows for better collaboration with tax professionals.

-

What types of documents can I manage with the Tax Organizer ORG0 Mkshelbycpa com?

The Tax Organizer ORG0 Mkshelbycpa com allows users to manage a variety of documents, including W-2s, 1099s, receipts, and other financial statements. This capability ensures comprehensive documentation for better tax filing.

Get more for Tax Organizer ORG0 Mkshelbycpa com

Find out other Tax Organizer ORG0 Mkshelbycpa com

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract