Illinois C 2016-2026

What is the Illinois C

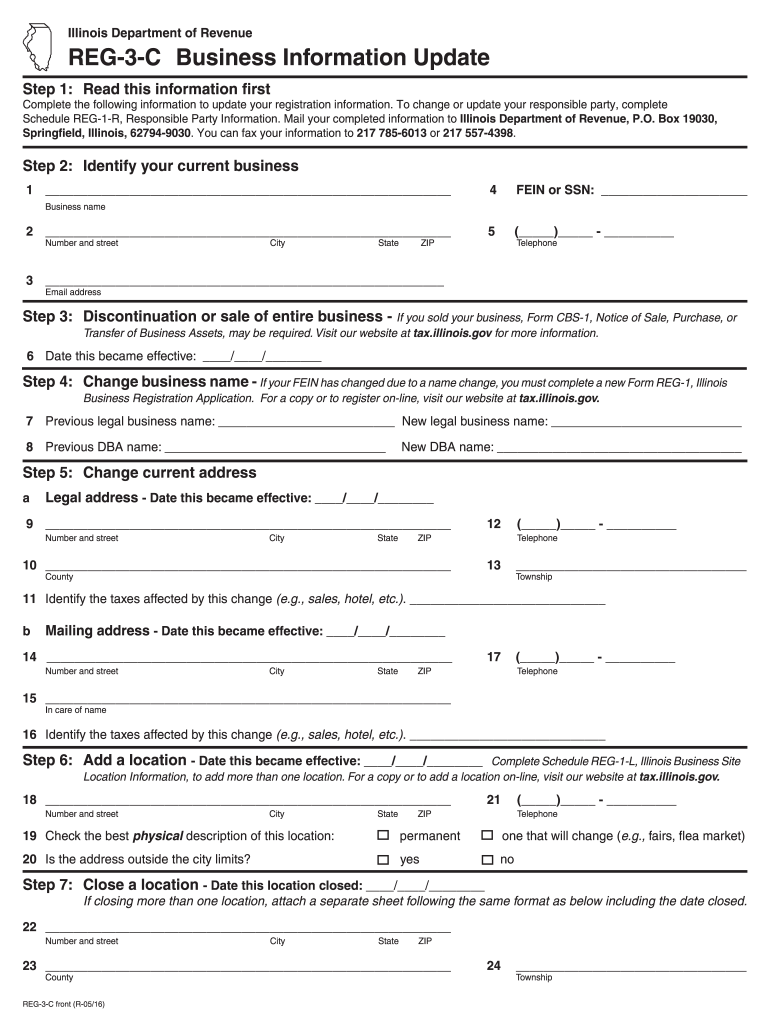

The Illinois C, formally known as the Illinois Form REG-3C, is a document used by businesses in Illinois to update their business information with the Illinois Department of Revenue. This form is essential for maintaining accurate records and ensuring compliance with state regulations. It allows businesses to report changes such as ownership, address, and other pertinent details that may affect their tax obligations.

Steps to Complete the Illinois C

Completing the Illinois Form REG-3C involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business, including the current and new details that need updating. Next, fill out the form with the required information, ensuring that all sections are completed accurately. After filling out the form, review it thoroughly for any errors or omissions. Finally, submit the form according to the instructions provided, either online or via mail, ensuring that you keep a copy for your records.

Legal Use of the Illinois C

The Illinois Form REG-3C is legally recognized as a valid method for businesses to communicate changes to their registration information. It is important to use this form correctly to avoid potential penalties or compliance issues. The form must be filed in accordance with state laws and regulations, ensuring that all information provided is truthful and up-to-date. Failure to comply with these legal requirements could result in fines or other repercussions from the state.

Filing Deadlines / Important Dates

When using the Illinois Form REG-3C, it is crucial to be aware of any filing deadlines associated with business updates. Generally, changes should be reported as soon as they occur to avoid complications with tax filings or compliance checks. Specific deadlines may vary based on the nature of the update, so it is advisable to consult the Illinois Department of Revenue's guidelines for the most accurate and timely information.

Form Submission Methods (Online / Mail / In-Person)

The Illinois Form REG-3C can be submitted through various methods, providing flexibility for businesses. Online submission is often the quickest option, allowing for immediate processing. Alternatively, businesses may choose to mail the completed form to the appropriate address provided by the Illinois Department of Revenue. In-person submissions are also accepted at designated locations, which can be beneficial for those needing assistance or clarification during the process.

Required Documents

To complete the Illinois Form REG-3C, certain documents may be required to support the information provided. This can include proof of business ownership, identification, and any other relevant documentation that verifies the changes being reported. Ensuring that all necessary documents are included with the form can help facilitate a smoother processing experience and reduce the likelihood of delays.

Quick guide on how to complete illinois department of revenue reg 3 c 2016 2019 form

Your assistance manual on how to prepare your Illinois C

If you’re interested in learning how to generate and send your Illinois C, here are some concise instructions to simplify the tax submission process.

To begin, you simply need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to edit, create, and finalize your income tax paperwork effortlessly. With its editor, you can navigate between text, checkboxes, and eSignatures and return to modify responses as necessary. Optimize your tax handling with advanced PDF editing, eSigning, and simple sharing options.

Follow these instructions to complete your Illinois C in just a few minutes:

- Establish your account and start working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Illinois C in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if needed).

- Examine your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that submitting on paper can increase errors and postpone refunds. Certainly, before e-filing your taxes, verify the IRS website for submission guidelines applicable in your state.

Create this form in 5 minutes or less

FAQs

-

Water flows into the tank through two pipes and flows out of the third pipe spontaneously. Pipe A would fill the tank in 3 hours, pipe B would fill in 4 hours, and pipe C would flow out in 12 hours. How long will the tank take to fill?

Pipe A => 1/3 fillingPipe B => 1/4 fillingPipe C => -1/12 emptyingthus:1/3 + 1/4 - 1/12 = 1/t4 + 3 - 1 = 12/t6 = 12/tt = 12/6 = 2 hrs => answer

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue reg 3 c 2016 2019 form

How to make an electronic signature for your Illinois Department Of Revenue Reg 3 C 2016 2019 Form in the online mode

How to generate an eSignature for your Illinois Department Of Revenue Reg 3 C 2016 2019 Form in Google Chrome

How to make an eSignature for putting it on the Illinois Department Of Revenue Reg 3 C 2016 2019 Form in Gmail

How to make an electronic signature for the Illinois Department Of Revenue Reg 3 C 2016 2019 Form from your mobile device

How to create an eSignature for the Illinois Department Of Revenue Reg 3 C 2016 2019 Form on iOS

How to make an electronic signature for the Illinois Department Of Revenue Reg 3 C 2016 2019 Form on Android

People also ask

-

What is reg 3 c and how does it relate to airSlate SignNow?

Reg 3 c refers to specific regulatory requirements for electronic signatures. airSlate SignNow ensures compliance with these regulations, making it a secure and reliable choice for businesses needing to adhere to regulatory standards while utilizing e-signatures.

-

How does airSlate SignNow ensure compliance with reg 3 c?

airSlate SignNow is designed to comply with reg 3 c by implementing advanced security measures such as encryption and authentication. This ensures that all electronically signed documents are legally binding and meet industry regulations for electronic transactions.

-

What pricing options are available for airSlate SignNow for businesses under reg 3 c?

airSlate SignNow offers flexible pricing options tailored to various business needs. Whether you're a small business or a large enterprise, you can choose a plan that aligns with your budget while ensuring compliance with reg 3 c for all your e-signature needs.

-

What features does airSlate SignNow provide for managing documents under reg 3 c?

airSlate SignNow offers a comprehensive suite of features including templates, workflow automation, and audit trails. These tools are designed to help businesses manage document signing processes efficiently while ensuring that they remain compliant with reg 3 c.

-

Can airSlate SignNow integrate with other software while complying with reg 3 c?

Yes, airSlate SignNow can seamlessly integrate with various software applications such as CRM and project management tools. This integration capability allows businesses to maintain compliance with reg 3 c while streamlining their document management processes.

-

What are the benefits of using airSlate SignNow for reg 3 c compliance?

Using airSlate SignNow for reg 3 c compliance offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Businesses can streamline their signature processes while confidently fulfilling regulatory requirements.

-

Is training provided for using airSlate SignNow in relation to reg 3 c?

Yes, airSlate SignNow offers training resources and customer support to help users understand how to utilize the platform for reg 3 c compliance. These resources ensure that your team can effectively manage electronic signatures and documents.

Get more for Illinois C

- You may use dwc form pr 3 or imc form 81556 dir ca

- St 2 steel origin certification non identifiable non structural steel form

- 12th grade book report form be sure to write

- Water system operation report form

- Omb no 1615 0052 form

- Flu shot form 425050238

- Commonwealth of massachusetts department of early education and care certificate of completion this is to certify that form

- Offset agreement template form

Find out other Illinois C

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online