Loan Guarantee Form

What is the Loan Guarantee?

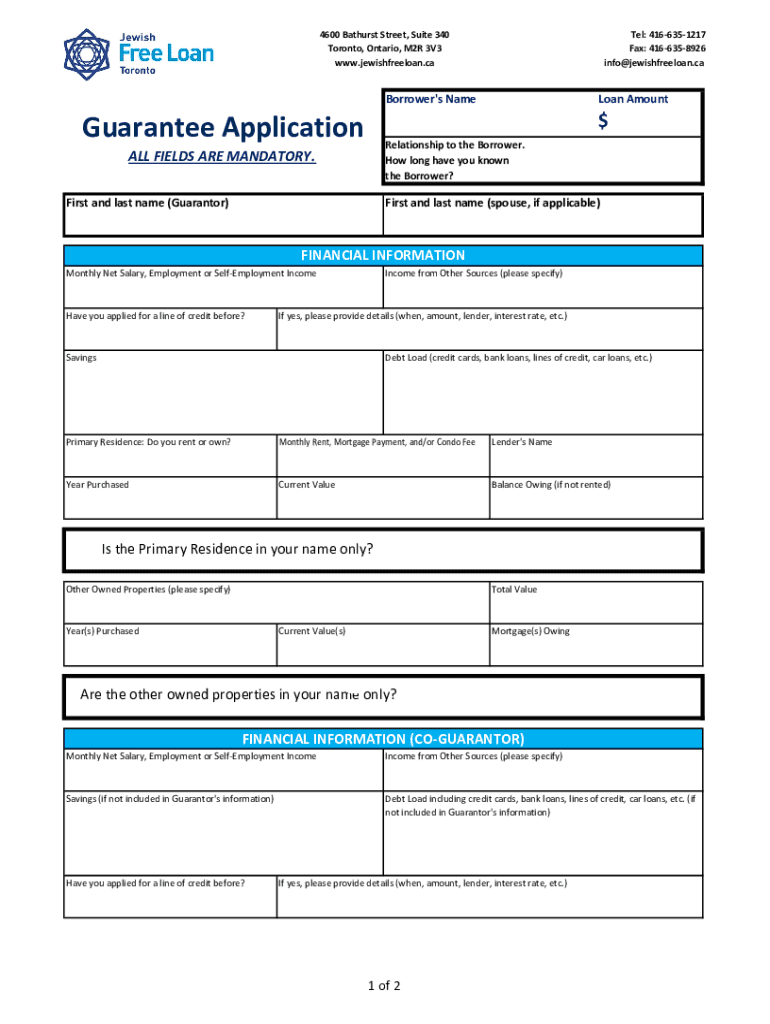

A loan guarantee is a promise made by a third party, often a financial institution or individual, to assume responsibility for a borrower's loan obligations if the borrower defaults. This form serves as a crucial document in various lending scenarios, providing assurance to lenders that they will recover their funds even if the borrower is unable to repay. In the context of a loan guarantor form, the guarantor agrees to fulfill the loan obligations, thereby increasing the borrower's chances of securing financing.

Steps to Complete the Loan Guarantor Form

Completing the loan guarantor form involves several key steps to ensure accuracy and legal compliance. Begin by gathering all necessary personal information, including your full name, address, and Social Security number. Next, provide details about the loan, such as the amount and purpose. After filling in the required sections, review the form for any errors or omissions. Finally, sign the form electronically, ensuring that your signature meets the legal requirements for digital documents.

Legal Use of the Loan Guarantee

The legal validity of a loan guarantee hinges on compliance with specific regulations governing eSignatures. In the United States, the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) establish the framework for recognizing electronic signatures as legally binding. To ensure that your loan guarantor form is legally enforceable, it is essential to use a platform that adheres to these legal standards, providing a digital certificate that verifies the authenticity of your signature.

Key Elements of the Loan Guarantee

Several key elements must be included in a loan guarantor form to ensure its effectiveness. These elements typically consist of:

- Guarantor Information: Full name, address, and contact details of the guarantor.

- Borrower Information: Details about the individual or entity receiving the loan.

- Loan Details: Amount, purpose, and terms of the loan.

- Signature: The guarantor's signature, confirming their agreement to assume responsibility for the loan.

How to Obtain the Loan Guarantee

Obtaining a loan guarantee typically involves a straightforward process. First, the borrower must identify a suitable guarantor who is willing to take on this responsibility. Once a guarantor is secured, both parties can access the loan guarantor form, which is often provided by the lending institution. After completing the form, it should be submitted to the lender along with any additional required documentation. The lender will then review the form as part of the loan approval process.

Form Submission Methods

Submitting the loan guarantor form can be done through various methods, depending on the lender's requirements. Common submission methods include:

- Online Submission: Many lenders allow electronic submission through secure online platforms.

- Mail: The completed form can be printed and mailed to the lender's designated address.

- In-Person: Some borrowers may prefer to deliver the form directly to the lender's office.

Eligibility Criteria

Eligibility to act as a guarantor for a loan typically requires the individual to meet certain criteria. Common requirements include:

- Age: The guarantor must usually be at least eighteen years old.

- Creditworthiness: A good credit score is often necessary to reassure lenders of the guarantor's financial reliability.

- Income Verification: Proof of stable income may be required to demonstrate the ability to cover the loan if necessary.

Quick guide on how to complete loan guarantee

Complete Loan Guarantee effortlessly on any device

Managing documents online has gained widespread popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct format and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle Loan Guarantee on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Loan Guarantee with ease

- Locate Loan Guarantee and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information thoroughly and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and electronically sign Loan Guarantee and ensure effective communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan guarantee

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan guarantor form?

A loan guarantor form is a document that indicates a person who agrees to repay a loan if the primary borrower defaults on their payments. It's crucial in securing loans, especially for individuals with limited credit history. Understanding how to complete and use a loan guarantor form can simplify the borrowing process.

-

How can I obtain a loan guarantor form using airSlate SignNow?

With airSlate SignNow, you can easily create and send a loan guarantor form in just a few clicks. Our platform offers customizable templates that simplify the document preparation process. Once your form is ready, you can eSign and share it securely with involved parties.

-

Is there a cost associated with using the loan guarantor form feature?

Using airSlate SignNow’s loan guarantor form feature is part of our overall pricing plans, which are designed to be cost-effective. We offer flexible pricing options based on your needs, allowing you to access the necessary features without breaking the bank. Detailed pricing information is available on our website.

-

Can I customize my loan guarantor form with airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your loan guarantor form by adding specific fields, signatures, and company branding. This flexibility ensures that the form meets your exact needs and provides a professional appearance for all your transaction processes.

-

What are the benefits of using airSlate SignNow for loan guarantor forms?

The key benefits of using airSlate SignNow for loan guarantor forms include ease of use, time efficiency, and enhanced security. Our platform streamlines the document preparation and signing process, allowing you to focus on your core business activities while maintaining compliance with industry standards.

-

Does airSlate SignNow integrate with other applications for managing loan guarantor forms?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your document management process, including CRMs, cloud storage solutions, and productivity tools. This integration capability ensures that your loan guarantor form and related documents work in synergy with your existing workflows.

-

How secure is the loan guarantor form on airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption technologies and complies with industry regulations to protect your loan guarantor form and sensitive information. You can trust that your documents are kept safe and secure throughout the signing process.

Get more for Loan Guarantee

Find out other Loan Guarantee

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF