13 State Street LLC Form

What is the 13 State Street LLC

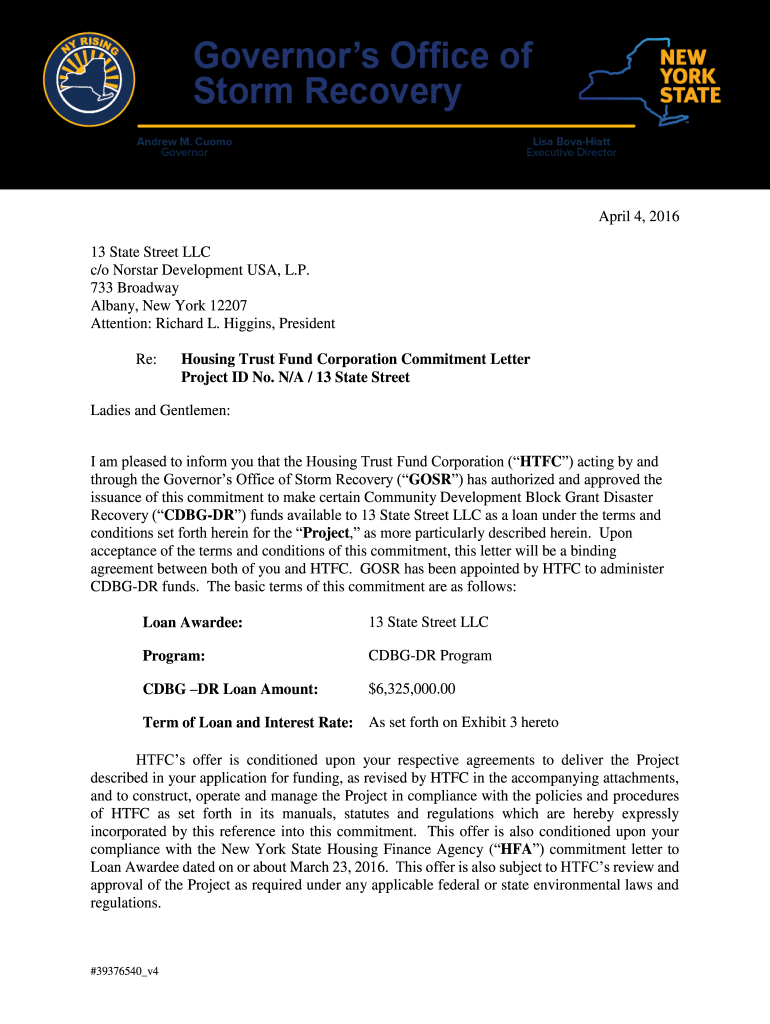

The 13 State Street LLC refers to a specific limited liability company that operates under the regulations governing LLCs in the United States. This type of business structure provides personal liability protection to its owners while allowing for flexibility in management and taxation. The designation "13 State Street" typically indicates a unique identifier for a business entity registered in a particular state, and it may be used in various legal and financial documents.

How to use the 13 State Street LLC

Using the 13 State Street LLC involves understanding its legal framework and operational guidelines. Owners can utilize this structure to conduct business, enter contracts, and manage finances while enjoying the benefits of limited liability. It is essential to maintain compliance with state regulations, including filing annual reports and paying necessary fees. Additionally, using digital tools for document management and eSigning can streamline operations and enhance efficiency.

Steps to complete the 13 State Street LLC

Completing the 13 State Street LLC involves several key steps:

- Choose a unique name that complies with state naming requirements.

- File Articles of Organization with the state’s Secretary of State.

- Obtain an Employer Identification Number (EIN) from the IRS.

- Create an operating agreement outlining the management structure and operational procedures.

- Open a business bank account to separate personal and business finances.

Legal use of the 13 State Street LLC

The legal use of the 13 State Street LLC encompasses various activities permitted under the LLC structure. This includes entering into contracts, hiring employees, and conducting business transactions. Compliance with federal, state, and local laws is crucial to maintain the LLC's legal standing. Additionally, the use of electronic signatures for documents can simplify the process while ensuring legal validity, as long as it adheres to eSignature laws.

Required Documents

To establish and operate the 13 State Street LLC, several documents are required:

- Articles of Organization filed with the state.

- Operating Agreement detailing the LLC's management and operational procedures.

- Employer Identification Number (EIN) from the IRS.

- Business licenses and permits as required by local jurisdictions.

Eligibility Criteria

Eligibility to form the 13 State Street LLC typically includes the following criteria:

- At least one member, who can be an individual or another business entity.

- Compliance with state-specific regulations regarding LLC formation.

- Ability to provide a registered agent with a physical address in the state of formation.

Form Submission Methods (Online / Mail / In-Person)

Submitting documents related to the 13 State Street LLC can be done through various methods:

- Online submission via the state’s Secretary of State website, which is often the fastest option.

- Mailing physical copies of the required documents to the appropriate state office.

- In-person submission at the state’s Secretary of State office, which may provide immediate confirmation of filing.

Quick guide on how to complete 13 state street llc

Effortlessly prepare 13 State Street LLC on any device

Digital document management is now favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage 13 State Street LLC on any device with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The simplest method to modify and electronically sign 13 State Street LLC effortlessly

- Obtain 13 State Street LLC and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Draw attention to important sections of your documents or obscure sensitive data using tools that airSlate SignNow specifically offers for that function.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 13 State Street LLC and ensure outstanding communication at any point in your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

What paperwork do I need to fill out to launch an LLC in the state of WA?

WA Secretary of State - Online Registration Form for LLC - $200https://corps.secstate.wa.gov/ll... ... That will give you a Washington State "Certification of Formation" & UBI (Unique Business ID). But don't forget you also have to register with the federal gov to get an EID (Employer Identification Number). The EID is the number you will use to open bank accounts, etc.You can register for that online as well - Free. http://www.irs.gov/businesses/sm...

-

Which W-8 form should I fill out as an LLC company?

How do they know to request a W-8 instead of a W-9? Are you Foreign?Assuming you need to submit a W-8 instead of a W-9, here are the questions to guide your W-8 decision.Do you have other members in your LLC? If you are the only member, a Single Member LLC is a Disregarded Entity taxed on your personal tax return. So you would submit the W-8BEN.If you have other members, are you subject to the default status or have you elected corporate status?If you are subject to the default status, your LLC is taxed as a partnership so submit the W-8IMYIf you elected Corporate status, submit the W-8BEN-E.https://www.irs.gov/pub/irs-pdf/...Other great answers here. Especially good advice from Carl and Mark, get to a CPA.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

Create this form in 5 minutes!

How to create an eSignature for the 13 state street llc

How to make an electronic signature for the 13 State Street Llc online

How to generate an electronic signature for the 13 State Street Llc in Chrome

How to make an electronic signature for putting it on the 13 State Street Llc in Gmail

How to generate an eSignature for the 13 State Street Llc right from your smart phone

How to generate an electronic signature for the 13 State Street Llc on iOS

How to generate an eSignature for the 13 State Street Llc on Android OS

People also ask

-

What is 13 State Street LLC and how does it relate to airSlate SignNow?

13 State Street LLC is a business entity that can benefit from using airSlate SignNow for its document management needs. With airSlate SignNow, 13 State Street LLC can streamline the process of sending and eSigning documents, enhancing overall efficiency in their operations.

-

What features does airSlate SignNow offer for 13 State Street LLC?

airSlate SignNow provides essential features for 13 State Street LLC, including customizable templates, automated workflows, and real-time tracking of document status. These features ensure that businesses can manage their documentation effortlessly and securely.

-

How can 13 State Street LLC save on costs with airSlate SignNow?

By using airSlate SignNow, 13 State Street LLC can signNowly reduce expenses associated with paper-based processes. The platform offers a cost-effective solution that eliminates printing, shipping, and storage costs, allowing businesses to allocate resources more efficiently.

-

Is airSlate SignNow user-friendly for 13 State Street LLC employees?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for all employees at 13 State Street LLC. The intuitive interface allows users to quickly learn how to send and eSign documents without extensive training.

-

What integrations does airSlate SignNow offer for 13 State Street LLC?

airSlate SignNow seamlessly integrates with various applications that 13 State Street LLC may already be using, such as CRM systems, cloud storage solutions, and project management tools. This integration capability enhances workflow efficiency and ensures a smooth transition to digital document management.

-

How secure is airSlate SignNow for 13 State Street LLC?

Security is a top priority for airSlate SignNow, which employs robust encryption and compliance measures to protect sensitive information for 13 State Street LLC. With features like two-factor authentication and audit trails, businesses can trust that their documents are safe and secure.

-

Can airSlate SignNow help 13 State Street LLC with compliance and legal requirements?

Absolutely, airSlate SignNow helps 13 State Street LLC maintain compliance with various legal requirements by providing legally binding eSignatures and secure document storage. This ensures that all agreements are valid and easily retrievable for audits or legal purposes.

Get more for 13 State Street LLC

Find out other 13 State Street LLC

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF