Isf Full Form

What is the ISF Full Form

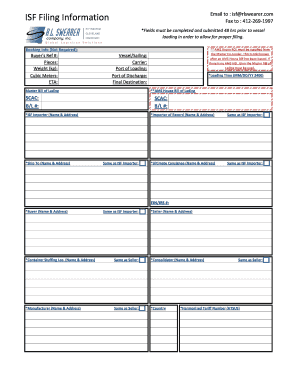

The ISF full form stands for Importer Security Filing. This is a crucial document required by U.S. Customs and Border Protection (CBP) that helps to enhance security and facilitate the flow of cargo into the United States. The ISF must be submitted by importers or their agents for ocean shipments and is typically required to be filed at least 24 hours before the cargo is loaded onto a vessel destined for the U.S. Understanding the ISF is essential for compliance with U.S. import regulations.

Steps to Complete the ISF Full Form

Completing the ISF full form involves several key steps to ensure compliance with U.S. Customs regulations. Here are the steps to follow:

- Gather Required Information: Collect details about the shipment, including the seller, buyer, and cargo description.

- Fill Out the ISF Template: Use the ISF form template to input the gathered information accurately.

- Submit the ISF: File the completed ISF electronically through a customs broker or directly with CBP.

- Confirm Submission: Ensure you receive confirmation of the ISF submission from CBP.

Legal Use of the ISF Full Form

The legal use of the ISF full form is mandated by U.S. Customs and Border Protection to enhance national security and facilitate trade. Failure to file the ISF or inaccuracies can lead to penalties, including fines and delays in cargo release. It is essential for importers to understand that the ISF is not just a formality but a legal requirement that must be adhered to for all ocean shipments entering the United States.

Key Elements of the ISF Full Form

The ISF full form includes several key elements that must be accurately reported. These elements are:

- Importer of Record: The entity responsible for ensuring compliance with U.S. laws.

- Consignee: The person or entity to whom the goods are being shipped.

- Seller: The individual or company selling the goods.

- Buyer: The individual or company purchasing the goods.

- Manufacturer: The entity that produces the goods.

- Country of Origin: The country where the goods are manufactured.

- Harmonized Tariff Schedule (HTS) Number: The code used to classify the goods for tariff purposes.

Form Submission Methods

The ISF can be submitted through various methods, ensuring flexibility for importers. The primary methods include:

- Online Submission: Most importers file the ISF electronically through a customs broker or a direct connection to CBP's Automated Commercial Environment (ACE).

- Via Customs Broker: Importers can also work with a licensed customs broker who will handle the ISF filing on their behalf.

Penalties for Non-Compliance

Non-compliance with ISF filing requirements can result in significant penalties. Importers may face fines ranging from $5,000 to $10,000 per violation, depending on the severity of the infraction. Additionally, failure to file an ISF can lead to delays in cargo release, which can further impact business operations. It is crucial for importers to be diligent in their ISF submissions to avoid these penalties.

Quick guide on how to complete isf full form

Manage Isf Full Form effortlessly on any device

The online management of documents has gained popularity among businesses and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Handle Isf Full Form on any device using airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

Effortlessly edit and eSign Isf Full Form

- Obtain Isf Full Form and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing additional copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Isf Full Form while ensuring excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the isf full form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ISF full form and how does it relate to airSlate SignNow?

The ISF full form stands for Importer Security Filing, a requirement for U.S. Customs and Border Protection. In relation to airSlate SignNow, leveraging this format can help businesses ensure compliance and streamline their documentation process, making it easier to manage international shipments.

-

How can airSlate SignNow help with documents related to the ISF full form?

airSlate SignNow provides a seamless way to create, send, and eSign documents that are necessary for the ISF full form. This means businesses can efficiently handle their imports while ensuring that all required documentation is complete and readily accessible.

-

Is airSlate SignNow suitable for businesses in need of ISF full form compliance?

Yes, airSlate SignNow is tailored for businesses that must comply with the ISF full form. Its features are designed to simplify document workflows, ensuring users can meet compliance requirements without unnecessary delays.

-

What are the pricing options for using airSlate SignNow for ISF full form documentation?

airSlate SignNow offers various pricing tiers to accommodate different business needs, making it cost-effective for those who need to manage ISF full form documents. Whether you're a small business or a large enterprise, there's a plan that can suit your budget and requirements.

-

Can airSlate SignNow integrate with other software for ISF full form processing?

Absolutely, airSlate SignNow can integrate with a wide range of applications to streamline the ISF full form process. This ensures that you can manage your data efficiently across platforms, enhancing productivity while handling import documentation.

-

What features of airSlate SignNow assist in managing ISF full form documents?

airSlate SignNow includes features like customizable templates, real-time collaboration, and tracking capabilities that are vital for handling ISF full form documentation. These tools help ensure that all necessary information is included and easily accessible.

-

How does airSlate SignNow enhance security for ISF full form submissions?

Security is a priority at airSlate SignNow; all documents related to the ISF full form are encrypted and securely stored. This means you can trust that your sensitive shipping information is protected throughout the eSigning process.

Get more for Isf Full Form

- Chapter 13 changes on the western frontier crossword puzzle answers form

- Rx relief timesheet 212649030 form

- Aerial lift written test merrick construction llc form

- 36b certificate of divorce form

- Editable utah involuntary commitment form

- 1111 superior avenue cleveland oh 44114 phone 2 form

- Lorain county department of job and family services form

- Woodgate farms form

Find out other Isf Full Form

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer