Form M 35h

What is the Form M-35h

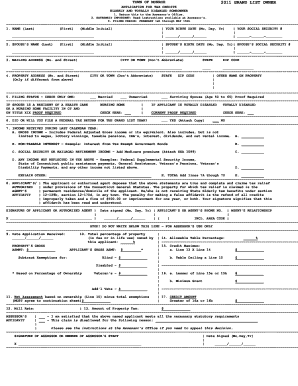

The Form M-35h is a crucial document used in the tax application process, specifically designed for claiming certain tax credits. This form helps taxpayers identify their eligibility for various credits that can significantly reduce their tax liability. Understanding the nuances of this form is essential for ensuring accurate and compliant filing during the tax application period.

How to use the Form M-35h

Using the Form M-35h involves several steps to ensure that all necessary information is accurately provided. Taxpayers must first gather relevant financial documents, including income statements and previous tax returns. Once the form is obtained, individuals should carefully fill out each section, ensuring that all information aligns with their financial records. After completing the form, it should be reviewed for accuracy before submission to avoid any potential penalties or delays in processing.

Steps to complete the Form M-35h

Completing the Form M-35h requires a systematic approach:

- Gather all necessary documentation, including income statements and prior tax returns.

- Obtain the Form M-35h from the appropriate source.

- Fill out the form, paying close attention to each section's requirements.

- Review the completed form for accuracy, ensuring all information is correct.

- Submit the form according to the specified submission methods.

Eligibility Criteria

Eligibility for using the Form M-35h is determined by specific criteria set forth by the IRS. Taxpayers must ensure they meet the requirements related to income levels, filing status, and the type of tax credits they are claiming. Understanding these criteria is vital for maximizing potential refunds and ensuring compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form M-35h are critical to avoid penalties. Generally, the tax day given is April 15, unless it falls on a weekend or holiday. Taxpayers should be aware of any state-specific deadlines that may apply. Keeping track of these dates ensures timely submission and helps in planning for potential refunds or liabilities.

Form Submission Methods (Online / Mail / In-Person)

The Form M-35h can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through authorized e-filing services.

- Mailing the completed form to the designated IRS address.

- In-person submission at local IRS offices, if necessary.

Each method has its own processing times and requirements, so it is essential to choose the one that best fits individual circumstances.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Form M-35h can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits. Understanding the implications of non-compliance is crucial for taxpayers to maintain good standing with tax authorities and to ensure their financial well-being.

Quick guide on how to complete form m 35h

Effortlessly Prepare Form M 35h on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents promptly without delays. Manage Form M 35h on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to edit and eSign Form M 35h effortlessly

- Obtain Form M 35h and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Form M 35h while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m 35h

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are tax credits and how can they benefit my business?

Tax credits are incentives provided by the government that reduce your tax liability. They can signNowly lower your tax burden, providing extra funds for your business. By utilizing features of airSlate SignNow, you can manage related documents efficiently, ensuring you never miss out on valuable tax credits.

-

How can airSlate SignNow help in claiming tax credits?

airSlate SignNow streamlines the document management process necessary for claiming tax credits. With our eSigning feature, you can quickly sign essential forms and contracts needed to apply for these credits. Additionally, our platform securely stores your documents, simplifying audits related to tax credits.

-

Are there any costs associated with using airSlate SignNow for tax credit documentation?

While there are various pricing plans for airSlate SignNow, the cost-effectiveness of our platform is notable. Using airSlate SignNow can save time and resources when preparing documentation for tax credits, ultimately being a worthwhile investment for your business. Explore our pricing plans to find the best fit for your needs.

-

What features of airSlate SignNow are most beneficial for tax credit processes?

Key features such as eSigning, automated workflows, and document templates are especially beneficial for managing tax credit processes. These functionalities ensure that you can prepare and submit documents efficiently, minimizing errors that could delay your tax credits. Our platform's user-friendly interface also facilitates quick access to these features.

-

Can I integrate airSlate SignNow with other software for managing tax credits?

Yes, airSlate SignNow offers integration capabilities with various accounting and tax software. This allows you to seamlessly manage your tax credits and related financial documents within a unified system. Enhance your workflow by connecting airSlate SignNow with your existing tools.

-

What advantages does airSlate SignNow offer over traditional signature methods for tax credit forms?

Using airSlate SignNow for tax credit forms streamlines the signing process compared to traditional methods. It minimizes delays associated with physical signatures and improves efficiency in document transmission. This speed can be crucial for meeting deadlines on tax credits.

-

Is airSlate SignNow compliant with tax regulations regarding eSignatures?

Absolutely, airSlate SignNow is built to comply with all relevant regulations regarding eSignatures, making it suitable for handling tax credit documentation. Our platform adheres to laws such as the ESIGN Act and UETA, ensuring your eSigned documents are legally binding. This compliance helps to safeguard your eligibility for tax credits.

Get more for Form M 35h

- Beal properties maintenance form

- Annexure v csrf 1 form

- Adverse action notice 152996 form

- Online and telephone banking business application form

- S forms sludge reporting missouri dnr download section 4

- Demographic information form 34719052

- Minster evaluation form

- Scott christman department of health care access and form

Find out other Form M 35h

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document