Form it 2105 Estimated Income Tax Payment Voucher Tax Year

What is the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

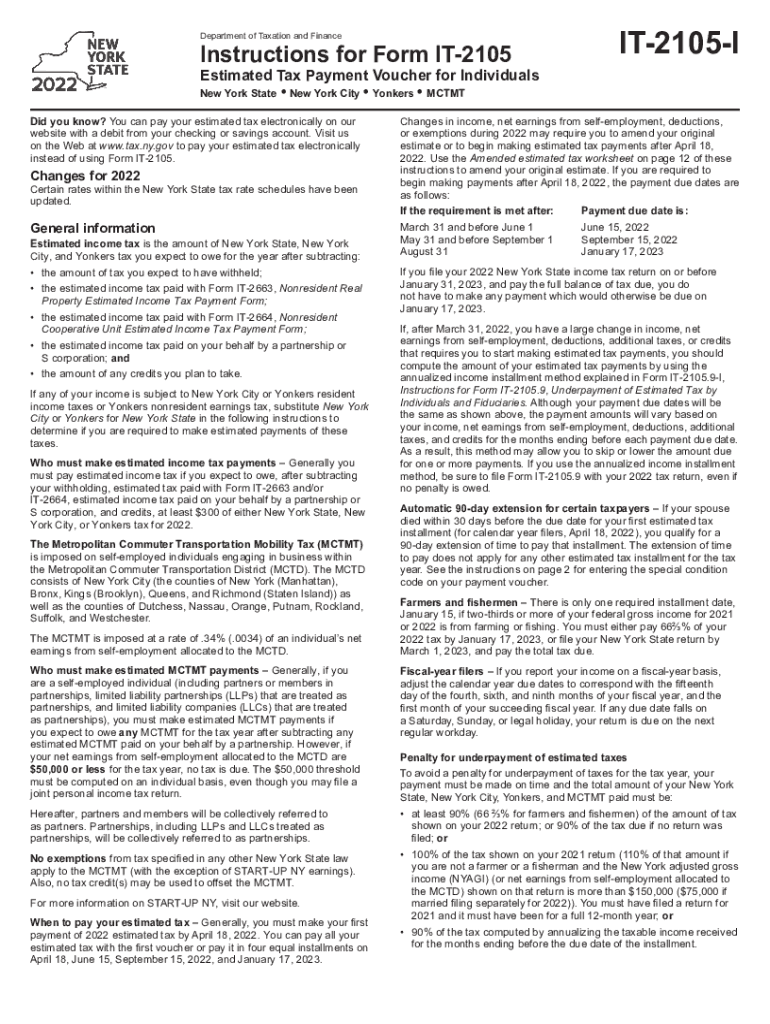

The Form IT 2105 Estimated Income Tax Payment Voucher is a document used by individuals and businesses in the United States to submit estimated income tax payments to the state. This form is particularly relevant for taxpayers who expect to owe tax of $500 or more when filing their annual return. It allows them to make quarterly payments throughout the tax year, helping to manage their tax liability and avoid penalties for underpayment.

How to use the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

To effectively use the Form IT 2105, taxpayers should first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated amount is established, the taxpayer can fill out the form, indicating the payment amount and the relevant tax year. The completed voucher is then submitted along with the payment to the appropriate tax authority, either electronically or via mail.

Steps to complete the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

Completing the Form IT 2105 involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your estimated tax liability for the year.

- Fill out the form with your personal information and payment details.

- Review the form for accuracy to avoid any errors.

- Submit the form along with your payment by the designated deadline.

Key elements of the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

The key elements of the Form IT 2105 include:

- Taxpayer Information: Name, address, and Social Security number or Employer Identification Number.

- Payment Amount: The total estimated tax payment for the quarter.

- Tax Year: The specific tax year for which the payment is being made.

- Payment Method: Indication of whether the payment is being made electronically or by check.

Filing Deadlines / Important Dates

It is crucial to adhere to filing deadlines for the Form IT 2105 to avoid penalties. Generally, estimated payments are due on the fifteenth day of April, June, September, and January of the following year. Taxpayers should confirm specific dates for their state, as they may vary slightly. Keeping track of these deadlines ensures timely submissions and compliance with tax regulations.

Penalties for Non-Compliance

Failure to submit the Form IT 2105 and make the required estimated payments can result in penalties. These penalties may include interest on unpaid taxes and additional charges for underpayment. It is essential for taxpayers to understand their obligations and ensure timely payments to avoid financial repercussions.

Quick guide on how to complete form it 2105 estimated income tax payment voucher tax year

Complete Form IT 2105 Estimated Income Tax Payment Voucher Tax Year seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to find the correct template and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form IT 2105 Estimated Income Tax Payment Voucher Tax Year on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The easiest way to modify and eSign Form IT 2105 Estimated Income Tax Payment Voucher Tax Year effortlessly

- Find Form IT 2105 Estimated Income Tax Payment Voucher Tax Year and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your edits.

- Choose how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Wave goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document duplicates. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Form IT 2105 Estimated Income Tax Payment Voucher Tax Year and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 2105 estimated income tax payment voucher tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 2105 estimated income tax payment voucher tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year used for?

The Form IT 2105 Estimated Income Tax Payment Voucher Tax Year is used by individuals in New York to pay estimated income tax. It allows taxpayers to calculate and remit tax payments on earned income throughout the year, ensuring compliance with state tax obligations.

-

How can airSlate SignNow help with completing the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year?

airSlate SignNow provides an efficient platform to fill out and e-sign the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year. With an intuitive interface, users can seamlessly input their pertinent information, ensuring that all necessary fields are completed accurately before submission.

-

What are the costs associated with using airSlate SignNow for the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year?

airSlate SignNow offers affordable pricing plans tailored to businesses and individuals needing to manage documents like the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year. Plans are designed to fit various budgets while providing access to powerful features without hidden fees or long-term contracts.

-

Are there any benefits of using airSlate SignNow for the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year?

Using airSlate SignNow for the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year benefits users by streamlining the signing and submission process. This not only saves time but also supports paperless transactions, improving efficiency and reducing costs associated with printing and mailing.

-

Can airSlate SignNow integrate with other financial software when handling the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year?

Yes, airSlate SignNow integrates seamlessly with various financial software, making it easier to manage the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year. These integrations enhance productivity by allowing users to sync data, ensuring accuracy and reducing the potential for errors.

-

What features does airSlate SignNow offer for managing the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year?

AirSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage specifically for documents like the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year. These tools allow users to create, send, and manage their tax documents efficiently and securely.

-

How secure is airSlate SignNow when handling the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year?

AirSlate SignNow prioritizes security and compliance, ensuring that the Form IT 2105 Estimated Income Tax Payment Voucher Tax Year is handled with the highest levels of protection. The platform employs encryption, secure access controls, and complies with industry standards to safeguard sensitive information.

Get more for Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

- Shoulder pain and disability index form

- Fax 210 674 7766 gifted and talented education program hsasa form

- Chapter 37 respiration circulation and excretion answer key form

- 0619 form k 30 page 1 of 1 georgia conditional employee

- Sr gl life claimant statement cl g012f original doc form

- Price hvac handbook form

- Change of broker dealerrepresentative authorization form

- Kcc renewal form

Find out other Form IT 2105 Estimated Income Tax Payment Voucher Tax Year

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy