Www Irs Govpubirs PdfInstructions for Schedule M 3 Form 1120 Rev December

Understanding the partners basis worksheet

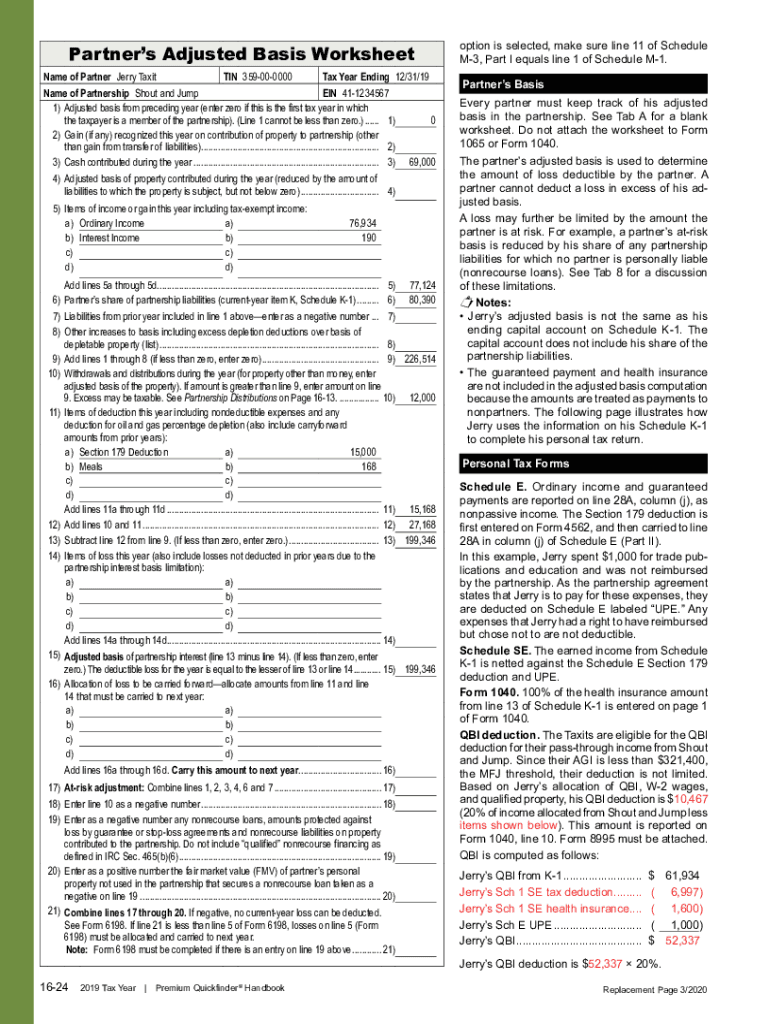

The partners basis worksheet is a crucial document used by partnerships to track the basis of each partner's interest in the partnership. This worksheet helps in determining the tax implications of distributions, contributions, and the overall financial position of each partner. It includes essential information such as the partner's initial basis, adjustments for income and losses, and any distributions received. Accurate completion of this worksheet is vital for ensuring compliance with IRS regulations and for calculating the correct amount of taxable income.

Steps to complete the partners basis worksheet

Completing the partners basis worksheet involves several key steps:

- Gather necessary information, including initial investment amounts and any subsequent contributions.

- Document all income allocated to the partner, including ordinary income and capital gains.

- Record any losses that affect the partner's basis, which may include losses from operations or asset sales.

- Account for distributions made to the partner, which will reduce the basis.

- Ensure all calculations are accurate to maintain compliance with IRS guidelines.

Key elements of the partners basis worksheet

The partners basis worksheet includes several key elements that are essential for accurate reporting:

- Initial Basis: The starting point for each partner's investment in the partnership.

- Adjustments: Changes to the basis due to income, losses, and contributions.

- Distributions: Amounts withdrawn from the partnership that affect the partner's basis.

- Ending Basis: The final calculation that reflects the partner's current investment in the partnership.

Legal use of the partners basis worksheet

The partners basis worksheet is legally recognized as a vital tool for partnerships in the United States. It ensures that partners accurately report their financial interests and comply with IRS regulations. Proper use of this worksheet can help avoid penalties and disputes regarding tax obligations. Partners should maintain accurate records and consult with a tax professional if they have questions about the legal implications of the worksheet.

Filing deadlines and important dates

Partnerships must adhere to specific filing deadlines related to the partners basis worksheet. Typically, the tax year for partnerships aligns with the calendar year, with returns due on March 15 for partnerships that file Form 1065. Partners should be aware of these deadlines to ensure timely submission and avoid penalties. Keeping track of these dates is essential for maintaining compliance with IRS requirements.

Examples of using the partners basis worksheet

Real-world scenarios can illustrate the importance of the partners basis worksheet. For instance, if a partner contributes additional capital to the partnership, this contribution must be documented on the worksheet, increasing their basis. Conversely, if a partner takes a distribution, this must also be recorded, reducing their basis. Such examples highlight how the worksheet serves as a dynamic record of each partner's financial stake in the partnership.

Quick guide on how to complete www irs govpubirs pdfinstructions for schedule m 3 form 1120 rev december

Effortlessly Create Www irs govpubirs pdfInstructions For Schedule M 3 Form 1120 Rev December on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any holdups. Manage Www irs govpubirs pdfInstructions For Schedule M 3 Form 1120 Rev December on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Www irs govpubirs pdfInstructions For Schedule M 3 Form 1120 Rev December with Ease

- Locate Www irs govpubirs pdfInstructions For Schedule M 3 Form 1120 Rev December and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Www irs govpubirs pdfInstructions For Schedule M 3 Form 1120 Rev December and ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the www irs govpubirs pdfinstructions for schedule m 3 form 1120 rev december

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a partners basis worksheet?

A partners basis worksheet is a crucial financial document that helps partners in a business calculate their individual tax basis in the partnership. This worksheet outlines each partner's contributions, distributions, and share of income or losses over the financial year. Using airSlate SignNow, you can easily create and eSign these worksheets to ensure accuracy and compliance.

-

How does airSlate SignNow help with partners basis worksheets?

airSlate SignNow simplifies the process of creating, sending, and signing partners basis worksheets. With its user-friendly interface, you can quickly draft your worksheet and send it for eSignature to your partners, ensuring that all partners have a clear understanding of their financial position. This automation saves time and reduces errors, making your financial operations more efficient.

-

Is airSlate SignNow cost-effective for small businesses needing partners basis worksheets?

Yes, airSlate SignNow offers a range of pricing plans that cater to small businesses looking to streamline their documentation processes, including partners basis worksheets. The platform provides an affordable solution to create and manage eSignatures without sacrificing quality or functionality. This makes it an ideal choice for small business owners looking to save on administrative costs.

-

What features does airSlate SignNow offer for partners basis worksheets?

airSlate SignNow includes a variety of features that enhance the creation and management of partners basis worksheets. These features include customizable templates, cloud storage for easy access, and audit trails for compliance tracking. Additionally, the platform allows for real-time collaboration, enabling all partners to stay informed and engaged throughout the process.

-

Can I integrate airSlate SignNow with other software for partners basis worksheets?

Yes, airSlate SignNow supports various integrations with popular software applications that businesses commonly use. This means you can easily connect it with accounting software or cloud storage solutions to manage your partners basis worksheets seamlessly. Integration enhances the workflow, making it easier to retrieve and edit necessary documents.

-

Are there any benefits of using airSlate SignNow for partners basis worksheets?

Using airSlate SignNow for your partners basis worksheets offers numerous benefits, such as increased efficiency, reduced document turnaround time, and enhanced security for sensitive information. The platform's eSigning functionality eliminates the need for physical signatures, making it convenient for partners to sign from anywhere. This ultimately leads to faster financial decision-making.

-

How secure is airSlate SignNow for handling partners basis worksheets?

airSlate SignNow prioritizes the security of your documents, including partners basis worksheets. The platform employs encryption and secure access protocols to protect your sensitive data. You can rest assured that your financial information is safe, ensuring compliance with privacy standards and enhancing trust among partners.

Get more for Www irs govpubirs pdfInstructions For Schedule M 3 Form 1120 Rev December

- Letter of medical necessity fsa template form

- Af1297 form

- Loan repayment form

- Ptaez check download form

- Electrical engineer performance review examples

- Medicare creditable coverage template form

- Www uslegalforms comform library145143 usssausssa softball waiver form us legal forms

- Northland youth football camp registration form

Find out other Www irs govpubirs pdfInstructions For Schedule M 3 Form 1120 Rev December

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now