FORM IR37B IRAS

What is the FORM IR37B IRAS

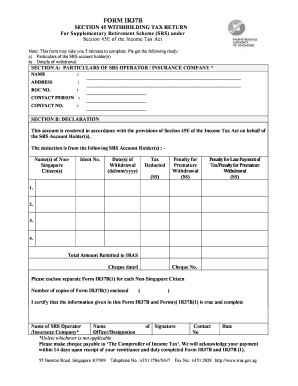

The FORM IR37B is a crucial document issued by the Inland Revenue Authority of Singapore (IRAS) for individuals and entities subject to withholding tax. This form is specifically designed for reporting income that is subject to tax deductions at source. It is commonly used by companies and organizations to declare payments made to non-residents for services rendered in Singapore, ensuring compliance with local tax regulations.

How to use the FORM IR37B IRAS

To effectively use the FORM IR37B, one must first gather all relevant information regarding the payments made to non-residents. This includes the recipient's details, the nature of the payment, and the applicable withholding tax rate. Once the necessary information is compiled, the form can be filled out accurately. It is essential to ensure that all fields are completed to avoid delays in processing. After filling out the form, it should be submitted to IRAS along with any required supporting documents.

Steps to complete the FORM IR37B IRAS

Completing the FORM IR37B involves several key steps:

- Gather necessary documentation, including payment details and recipient information.

- Fill in the form accurately, ensuring all required fields are completed.

- Calculate the withholding tax based on the applicable rates.

- Attach any supporting documents that may be required by IRAS.

- Submit the completed form to IRAS by the specified deadline.

Legal use of the FORM IR37B IRAS

The legal use of the FORM IR37B is governed by Singapore's tax laws, which mandate that companies must report payments to non-residents accurately. Failure to comply with these regulations can result in penalties and interest charges. Therefore, it is vital to ensure that the form is used correctly and submitted on time to maintain compliance with the law.

Required Documents

When submitting the FORM IR37B, certain documents may be required to support the information provided. These documents can include:

- Invoices or statements from the service provider.

- Contracts or agreements detailing the services rendered.

- Proof of payment made to the non-resident.

Having these documents ready can facilitate a smoother submission process and help avoid any compliance issues.

Filing Deadlines / Important Dates

Adhering to filing deadlines is critical when submitting the FORM IR37B. Typically, the form must be filed within one month after the payment is made to the non-resident. It is advisable to check the IRAS website or consult with a tax professional for any updates or changes to deadlines, as these can vary based on specific circumstances or changes in tax regulations.

Quick guide on how to complete form ir37b iras

Complete FORM IR37B IRAS effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to access the proper format and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage FORM IR37B IRAS from any device using airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

How to modify and electronically sign FORM IR37B IRAS with ease

- Locate FORM IR37B IRAS and then click Get Form to begin.

- Utilize the features we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign FORM IR37B IRAS and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ir37b iras

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ir37b and how does it relate to airSlate SignNow?

ir37b is a specific feature within the airSlate SignNow platform that enhances the eSigning process. It provides users with additional functionalities to streamline document management and ensure secure signatures. Understanding ir37b can signNowly improve your experience while using our services.

-

How much does airSlate SignNow cost with the ir37b features?

The pricing for airSlate SignNow with ir37b features varies based on the plan you choose. We offer competitive pricing that ensures you receive maximum value for your investment. Our packages are designed to fit different business needs, making them both affordable and effective.

-

What are the key benefits of using the ir37b features in airSlate SignNow?

The ir37b features in airSlate SignNow enhance user experience by providing a seamless eSigning solution. By utilizing ir37b, businesses can increase efficiency, reduce turnaround times, and ensure document security. This allows for quicker decision-making and improved overall productivity.

-

Can I integrate airSlate SignNow with other tools using ir37b?

Yes, airSlate SignNow can be integrated with a variety of tools and applications using the ir37b functionality. This enables businesses to streamline workflows and enhance productivity across different platforms. The flexibility of ir37b makes it easier to connect your favorite applications seamlessly.

-

How does airSlate SignNow's ir37b ensure document security?

The ir37b features in airSlate SignNow include advanced security measures to protect your documents. With encryption and authentication protocols, ir37b ensures that your sensitive information remains secure during the signing process. This commitment to security helps build trust with your clients and partners.

-

Is ir37b suitable for businesses of all sizes?

Absolutely! The ir37b features of airSlate SignNow cater to businesses of all sizes, from startups to large enterprises. Regardless of your company's scale, ir37b can be tailored to meet specific needs, providing an efficient solution for eSigning documents.

-

What types of documents can I sign using airSlate SignNow with ir37b?

With airSlate SignNow's ir37b features, you can sign a wide range of documents, including contracts, agreements, and forms. The flexibility of ir37b supports various document types, allowing for comprehensive usage in different industries. This versatility ensures that you can manage all your signing needs in one place.

Get more for FORM IR37B IRAS

- Toolbox meeting form date project

- Editable hand sanitiser msds form

- Re certification information iahcsmm

- Webtec form

- Bsiteb health amp safety induction form

- Music teacher contract template form

- Bcia 8372 form fill out and sign printable pdf template

- Partnership for real estate agreement template form

Find out other FORM IR37B IRAS

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online