Form 1099 SFWebsite Dot

What is the Form 1099 SFWebsite dot

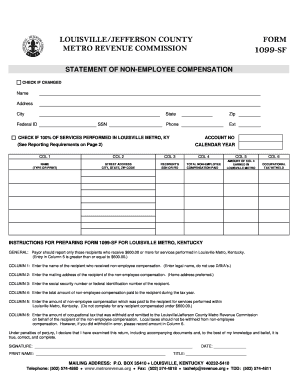

The Form 1099 SFWebsite dot is a tax document used in the United States to report income received by non-employees, such as freelancers or independent contractors. This form is essential for ensuring that all income is accurately reported to the Internal Revenue Service (IRS). It serves as a record of payments made throughout the year and is typically issued by businesses to individuals or entities that have provided services. Understanding this form is crucial for both payers and recipients to ensure compliance with tax regulations.

How to use the Form 1099 SFWebsite dot

Using the Form 1099 SFWebsite dot involves several steps. First, the payer must gather all relevant information, including the recipient's name, address, and taxpayer identification number (TIN). Next, the total amount paid to the recipient during the tax year must be calculated. Once this information is compiled, the payer can complete the form, ensuring that all details are accurate. After filling out the form, it must be submitted to the IRS and a copy provided to the recipient by the specified deadline.

Steps to complete the Form 1099 SFWebsite dot

Completing the Form 1099 SFWebsite dot requires careful attention to detail. Here are the steps to follow:

- Gather the recipient's information, including their name, address, and TIN.

- Determine the total amount paid to the recipient for services rendered during the tax year.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors before submission.

- Submit the form to the IRS by the deadline, and provide a copy to the recipient.

Legal use of the Form 1099 SFWebsite dot

The Form 1099 SFWebsite dot is legally binding when completed correctly and submitted within the required timeframe. It must adhere to IRS guidelines to ensure that it serves its purpose in reporting income accurately. Both the payer and recipient have legal obligations regarding this form. Failure to comply with these regulations can result in penalties or fines, making it essential to understand the legal implications of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 SFWebsite dot are crucial for compliance. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which payments were made. Additionally, recipients must receive their copies by the same date. It is important to keep track of these dates to avoid potential penalties for late filing.

Who Issues the Form

The Form 1099 SFWebsite dot is typically issued by businesses or individuals who have made payments to non-employees. This includes companies hiring freelancers, independent contractors, or other service providers. It is the responsibility of the payer to ensure that the form is completed accurately and submitted on time to both the IRS and the recipient.

Quick guide on how to complete form 1099 sfwebsite dot

Manage Form 1099 SFWebsite dot seamlessly on any device

Digital document management has become widely recognized among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents swiftly without interruptions. Handle Form 1099 SFWebsite dot on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Form 1099 SFWebsite dot with ease

- Find Form 1099 SFWebsite dot and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 1099 SFWebsite dot to ensure outstanding communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099 sfwebsite dot

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1099 SFWebsite dot and how does it work?

Form 1099 SFWebsite dot is a tax document that businesses use to report income paid to non-employees. With airSlate SignNow, you can easily create, send, and eSign your 1099 forms electronically, streamlining the process while ensuring compliance with tax regulations.

-

How can airSlate SignNow help with managing Form 1099 SFWebsite dot?

airSlate SignNow offers a user-friendly platform that allows you to manage your Form 1099 SFWebsite dot effortlessly. You can customize templates, track signatures, and send reminders, making it easier to stay organized and ensure timely submissions.

-

What features does airSlate SignNow provide for Form 1099 SFWebsite dot?

With airSlate SignNow, features for handling Form 1099 SFWebsite dot include customizable templates, real-time tracking, and secure electronic signatures. These features help reduce errors, save time, and enhance the overall efficiency of your document management.

-

Is airSlate SignNow affordable for small businesses needing Form 1099 SFWebsite dot?

Yes, airSlate SignNow is designed to be cost-effective, making it an excellent choice for small businesses handling Form 1099 SFWebsite dot. With various pricing plans available, you can find an option that fits your budget while still accessing essential features.

-

Can I integrate airSlate SignNow with other tools for Form 1099 SFWebsite dot?

Absolutely! airSlate SignNow supports integration with various applications, enabling you to streamline your workflows further when dealing with Form 1099 SFWebsite dot. Popular integrations include CRM systems, accounting software, and other productivity tools.

-

What are the benefits of using airSlate SignNow for Form 1099 SFWebsite dot?

Using airSlate SignNow for Form 1099 SFWebsite dot offers numerous benefits, including increased efficiency, enhanced security, and simplified compliance. The platform allows you to manage all your tax forms in one place, reducing the time and effort spent on paperwork.

-

Is it easy to eSign Form 1099 SFWebsite dot with airSlate SignNow?

Yes! airSlate SignNow simplifies the eSigning process for Form 1099 SFWebsite dot, allowing users to sign documents from any device. The intuitive interface makes it easy for everyone involved to complete the signing process in just a few clicks.

Get more for Form 1099 SFWebsite dot

- Miami dade condo complaint form

- Grade tracker pdf form

- Chapter 6 earth science answer key form

- Eldoret cancer registry form afcrn

- Authorization for prescribing advanced practice nurse health tn form

- Uslegalforms com

- Harold holt membership form

- Use this form for fegli 3999 open enrollment office of personnel opm

Find out other Form 1099 SFWebsite dot

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit