Seller Certificate Form

What is the seller certificate?

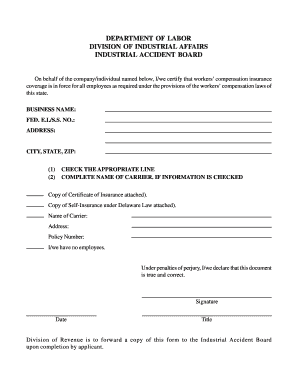

The seller certificate is a document that verifies the seller's identity and confirms their authority to sell a particular property or asset. This certificate is often required in real estate transactions, ensuring that the seller has the legal right to transfer ownership. It serves as a safeguard for buyers, helping to prevent fraud and ensuring that the transaction is legitimate. The seller certificate typically includes important details such as the seller's name, the property description, and any pertinent legal information related to the sale.

How to use the seller certificate

Using the seller certificate involves several steps to ensure that all parties involved in the transaction are protected. First, the seller must complete the certificate accurately, providing all necessary information. Once filled out, the document should be signed by the seller, often in the presence of a notary public, to enhance its legal standing. After obtaining the seller certificate, it should be presented to the buyer during the transaction process. This document can be submitted electronically, streamlining the process and reducing paperwork.

Steps to complete the seller certificate

Completing the seller certificate involves a series of straightforward steps:

- Gather all necessary information, including the seller's details and property description.

- Fill out the seller certificate form accurately, ensuring all fields are completed.

- Review the document for any errors or omissions.

- Sign the certificate in the presence of a notary public, if required.

- Submit the completed seller certificate as part of the transaction process.

Legal use of the seller certificate

The legal use of the seller certificate is crucial in real estate transactions. This document must comply with state laws and regulations to be considered valid. It serves as a legal declaration of the seller's right to sell the property and protects the buyer from potential disputes. When executed properly, the seller certificate can be used in court as evidence of the seller's authority, making it an essential part of the transaction process.

Key elements of the seller certificate

Several key elements must be included in the seller certificate to ensure its validity:

- Seller's Information: Full name and contact details of the seller.

- Property Details: A clear description of the property being sold, including address and legal description.

- Signature: The seller's signature, confirming their intent to sell.

- Notary Acknowledgment: If required, a notary public's signature and seal to validate the document.

State-specific rules for the seller certificate

Each state in the United States may have specific rules and requirements regarding the seller certificate. It is important for sellers to familiarize themselves with their state's regulations to ensure compliance. This may include specific wording, additional documentation, or unique filing procedures. Consulting with a local real estate professional or legal advisor can provide clarity on these requirements and help avoid potential legal issues.

Quick guide on how to complete seller certificate

Easily prepare Seller Certificate on any device

Digital document management has become increasingly popular with both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow offers you all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Seller Certificate on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to easily edit and electronically sign Seller Certificate

- Find Seller Certificate and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Seller Certificate and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the seller certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a seller certificate?

A seller certificate is a legal document that validates a seller's information and capabilities. It often includes details about the seller's identity and the property being sold, ensuring transparency in transactions. Understanding the importance of a seller certificate can help you avoid potential issues in real estate deals.

-

How does airSlate SignNow simplify the seller certificate process?

airSlate SignNow streamlines the process of obtaining and signing a seller certificate by providing an easy-to-use digital platform. Users can effortlessly create, send, and eSign documents, making it convenient to manage all transaction-related paperwork. This efficiency can save precious time in your real estate process.

-

Are there costs associated with using airSlate SignNow for seller certificates?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. Our plans ensure you get access to essential features for managing seller certificates without breaking the bank. You can choose a plan that best fits your budget and document signing frequency.

-

What features does airSlate SignNow offer for managing seller certificates?

airSlate SignNow includes features such as eSignature collection, templates for seller certificates, and document tracking. These tools help you manage your seller certificates efficiently and securely. Additionally, the platform allows for easy collaboration, so all parties involved can stay informed.

-

Can I integrate airSlate SignNow with other tools to manage seller certificates?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and business management tools. This means you can easily incorporate our digital signing capabilities into your existing workflow, enhancing your ability to handle seller certificates and other important documents.

-

What are the benefits of using airSlate SignNow for seller certificates compared to traditional methods?

Using airSlate SignNow for seller certificates offers several advantages over traditional paper methods, including speed, security, and ease of use. Digital signatures are legally binding and can signNowly reduce turnaround time for important documents. This not only streamlines the process but also minimizes the risk of lost paperwork.

-

Is airSlate SignNow secure for signing seller certificates?

Yes, airSlate SignNow employs industry-standard encryption and security measures to ensure that all documents, including seller certificates, are safe. Our platform adheres to strict compliance regulations, allowing you to handle sensitive data with confidence. Your transactions remain secure from start to finish.

Get more for Seller Certificate

Find out other Seller Certificate

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document