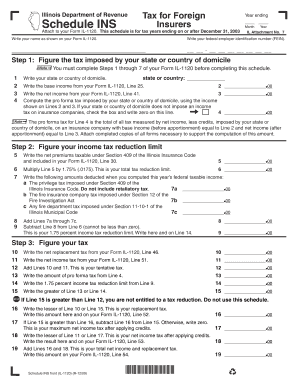

Income Tax State Form

What is the Income Tax State

The income tax state refers to the specific regulations and requirements set by individual states in the U.S. regarding the taxation of income. Each state has its own rules governing how income is taxed, which can include rates, deductions, and credits. Understanding these regulations is crucial for residents and businesses to ensure compliance and optimize their tax obligations. The income tax state can vary significantly, with some states imposing no income tax at all, while others may have progressive tax rates based on income levels.

Steps to complete the Income Tax State

Completing the income tax state form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, determine your filing status, which can affect your tax rate and eligibility for certain deductions. After that, fill out the income tax state form with your personal information, income details, and any applicable deductions or credits. It is essential to review your entries for accuracy before submitting the form. Finally, choose your submission method, whether online, by mail, or in-person, and ensure you meet the filing deadlines to avoid penalties.

Required Documents

When preparing to file your income tax state form, certain documents are essential for accurate reporting. Typically, you will need:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Previous year’s tax return for reference

Having these documents organized will streamline the filing process and help ensure that you claim all eligible deductions and credits.

State-specific rules for the Income Tax State

Each state has unique rules that govern how income is taxed, which can include variations in tax rates, allowable deductions, and filing requirements. For example, some states may offer tax credits for education expenses, while others may not. Additionally, states may have different rules regarding the taxation of capital gains, dividends, and other income types. It is important to research and understand the specific regulations for your state to ensure compliance and maximize your tax benefits.

Filing Deadlines / Important Dates

Filing deadlines for income tax state forms can vary by state, but they generally align with the federal tax deadline of April 15. Some states may offer extensions, while others have different due dates. It is crucial to be aware of these dates to avoid late fees and penalties. Additionally, certain states may have quarterly estimated tax payment deadlines for self-employed individuals or businesses. Keeping track of these important dates ensures timely compliance with state tax obligations.

Penalties for Non-Compliance

Failure to comply with income tax state regulations can result in various penalties, including fines, interest on unpaid taxes, and potential legal action. Common penalties include failure-to-file penalties, which can accumulate over time, and failure-to-pay penalties for unpaid taxes. Understanding these consequences emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens. It is advisable to consult with a tax professional if you have concerns about compliance or potential penalties.

Quick guide on how to complete income tax state

Complete Income Tax State effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Income Tax State on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric tasks today.

Steps to modify and eSign Income Tax State without hassle

- Obtain Income Tax State and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact confidential information using the tools provided by airSlate SignNow designed specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Income Tax State to ensure excellent communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with my income tax state documents?

airSlate SignNow is a powerful e-signature solution that enables businesses to send and e-sign documents efficiently. Whether you're dealing with income tax state forms or any other paperwork, our platform simplifies the process, ensuring your documents are secure and compliant, making tax season a breeze.

-

How much does airSlate SignNow cost for income tax state document management?

airSlate SignNow offers affordable pricing plans that cater to different business needs. Our plans provide robust features for managing income tax state documents, ensuring you get the best value while streamlining your document workflow without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for income tax state filing?

Yes, airSlate SignNow easily integrates with a variety of tools and software essential for managing income tax state filing. This seamless integration allows you to enhance your workflow, making the process of e-signing and submitting your tax documents much smoother.

-

What are the main benefits of using airSlate SignNow for income tax state documents?

By using airSlate SignNow for your income tax state documents, you benefit from enhanced efficiency, improved accuracy, and a cost-effective solution. Our platform not only speeds up the signing process but also reduces errors, ensuring your tax filings are precise and timely.

-

Is airSlate SignNow legally compliant for income tax state documents?

Absolutely! airSlate SignNow complies with all relevant e-signature legislation, including the ESIGN Act and UETA, making it a trusted solution for managing income tax state documents. This compliance ensures that your signed documents are legally valid and enforceable.

-

How does airSlate SignNow secure my income tax state documents?

Security is a top priority at airSlate SignNow. We employ state-of-the-art encryption and secure cloud storage to protect your income tax state documents, ensuring that sensitive information remains confidential and safe from unauthorized access.

-

Can I track the status of my income tax state documents with airSlate SignNow?

Yes, airSlate SignNow provides robust tracking features that allow you to monitor the status of your income tax state documents in real-time. You'll receive notifications as your documents are viewed and signed, giving you confidence in your workflow.

Get more for Income Tax State

Find out other Income Tax State

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word