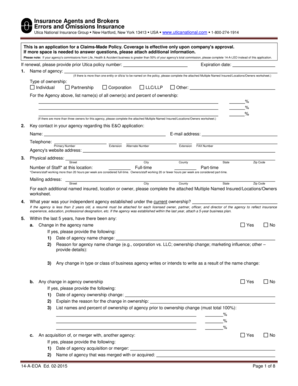

Insurance Agents and Brokers Errors and Omissions Insurance Form

Understanding Insurance Agents And Brokers Errors And Omissions Insurance

The Insurance Agents and Brokers Errors and Omissions Insurance is a critical policy designed to protect professionals in the insurance industry from claims of negligence or inadequate work. This insurance covers legal costs and damages that may arise from lawsuits filed by clients who believe they have suffered financial losses due to the actions or inactions of their insurance agents or brokers. By having this insurance, agents and brokers can safeguard their financial stability and maintain their professional reputation.

Steps to Complete the Insurance Agents And Brokers Errors And Omissions Insurance

Completing the Insurance Agents and Brokers Errors and Omissions Insurance form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details, license numbers, and any prior claims history. Next, fill out the form carefully, providing all requested details. It is essential to review the information for accuracy before submission. After completing the form, submit it through the designated method, whether online or by mail, and keep a copy for your records.

Legal Use of Insurance Agents And Brokers Errors And Omissions Insurance

This insurance is legally recognized as a protective measure for agents and brokers, ensuring they can operate within the legal framework of the industry. It is important to understand that having this insurance does not absolve agents and brokers from their professional responsibilities. Instead, it serves as a financial safety net in case of legal disputes. Compliance with state regulations regarding this insurance is crucial, as different states may have varying requirements and standards.

Key Elements of Insurance Agents And Brokers Errors And Omissions Insurance

Several key elements define the Insurance Agents and Brokers Errors and Omissions Insurance. These include coverage limits, which determine the maximum amount the insurer will pay for a claim. The policy may also outline exclusions, detailing specific situations or actions that are not covered. Additionally, the policy will specify the duration of coverage and any deductibles that may apply. Understanding these elements is vital for agents and brokers to ensure they have adequate protection.

How to Obtain Insurance Agents And Brokers Errors And Omissions Insurance

Obtaining Insurance Agents and Brokers Errors and Omissions Insurance typically involves reaching out to insurance providers that specialize in this type of coverage. Agents and brokers should compare quotes from multiple insurers to find the best policy that meets their needs. It is advisable to consult with an insurance agent who understands the nuances of this coverage. Once a suitable policy is selected, the application process can begin, which may include providing documentation and undergoing a risk assessment.

State-Specific Rules for Insurance Agents And Brokers Errors And Omissions Insurance

Each state in the U.S. has its own regulations governing Insurance Agents and Brokers Errors and Omissions Insurance. These rules may dictate minimum coverage requirements, licensing standards, and the process for filing claims. It is essential for agents and brokers to familiarize themselves with their state's specific laws to ensure compliance and avoid potential legal issues. Consulting with a legal expert or an insurance professional can provide clarity on these state-specific regulations.

Quick guide on how to complete insurance agents and brokers errors and omissions insurance

Effortlessly Complete Insurance Agents And Brokers Errors And Omissions Insurance on Any Device

Web-based document management has become increasingly favored by both companies and individuals. It serves as an excellent environmentally-friendly alternative to conventional printed and signed paperwork, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Insurance Agents And Brokers Errors And Omissions Insurance on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Method to Modify and Electronically Sign Insurance Agents And Brokers Errors And Omissions Insurance

- Locate Insurance Agents And Brokers Errors And Omissions Insurance and click on Get Form to begin.

- Take advantage of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for this task.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, exhaustive form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Adjust and electronically sign Insurance Agents And Brokers Errors And Omissions Insurance and maintain optimal communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the insurance agents and brokers errors and omissions insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Insurance Agents And Brokers Errors And Omissions Insurance?

Insurance Agents And Brokers Errors And Omissions Insurance is a specialized coverage that protects professionals from liability claims resulting from mistakes or negligence in their services. This insurance is crucial for agents and brokers to ensure they are financially safeguarded against potential lawsuits.

-

Why do insurance agents need Errors And Omissions Insurance?

Insurance agents need Errors And Omissions Insurance to protect themselves from financial losses due to claims of negligence or inadequate work in their professional capacity. Without this coverage, agents risk paying legal fees and settlements out of pocket, which can be financially devastating.

-

How much does Insurance Agents And Brokers Errors And Omissions Insurance cost?

The cost of Insurance Agents And Brokers Errors And Omissions Insurance can vary based on factors such as the size of the agency, the types of services offered, and the coverage limits selected. On average, premiums may range from a few hundred to several thousand dollars annually, depending on these factors.

-

What features should I look for in Errors And Omissions Insurance?

When selecting Errors And Omissions Insurance, look for features such as coverage limits, claim defense costs, and the inclusion of sublimits for specific risks. Additionally, ensure that the policy covers both past and future work to provide comprehensive protection for your agency.

-

How can Insurance Agents And Brokers Errors And Omissions Insurance benefit my business?

Having Insurance Agents And Brokers Errors And Omissions Insurance benefits your business by enhancing your credibility and demonstrating professionalism to clients. It also provides peace of mind, allowing you to focus on growing your agency without the fear of unexpected legal claims affecting your finances.

-

Does Insurance Agents And Brokers Errors And Omissions Insurance cover cyber liability?

While some policies may include limited coverage for cyber liability, most Insurance Agents And Brokers Errors And Omissions Insurance does not cover these risks automatically. It is important to review your policy and consider adding a separate cyber liability insurance coverage for comprehensive protection.

-

Can I integrate airSlate SignNow with my Errors And Omissions Insurance processes?

Yes, you can seamlessly integrate airSlate SignNow with your Errors And Omissions Insurance processes. By using our eSigning solutions, you can expedite document signing and storage, ensuring a smoother operational workflow that enhances overall efficiency in your insurance practices.

Get more for Insurance Agents And Brokers Errors And Omissions Insurance

- Enbridge commissioning form

- Seneca college payment receipt form

- Guidelines for completing e vetting invitation form nvb 1 waterfordlismore

- Power wheelchair evaluation form

- Indiana poa 1 form

- Educational leader application packet teach louisiana teachlouisiana form

- Aspirus financial assistance form

- Vermont mutual group personal umbrella renewal questionnaire form

Find out other Insurance Agents And Brokers Errors And Omissions Insurance

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT