CLAIM to RECEIVE SURPLUS PROCEEDS of a TAX DEED Form

What is the claim to receive surplus proceeds of a tax deed

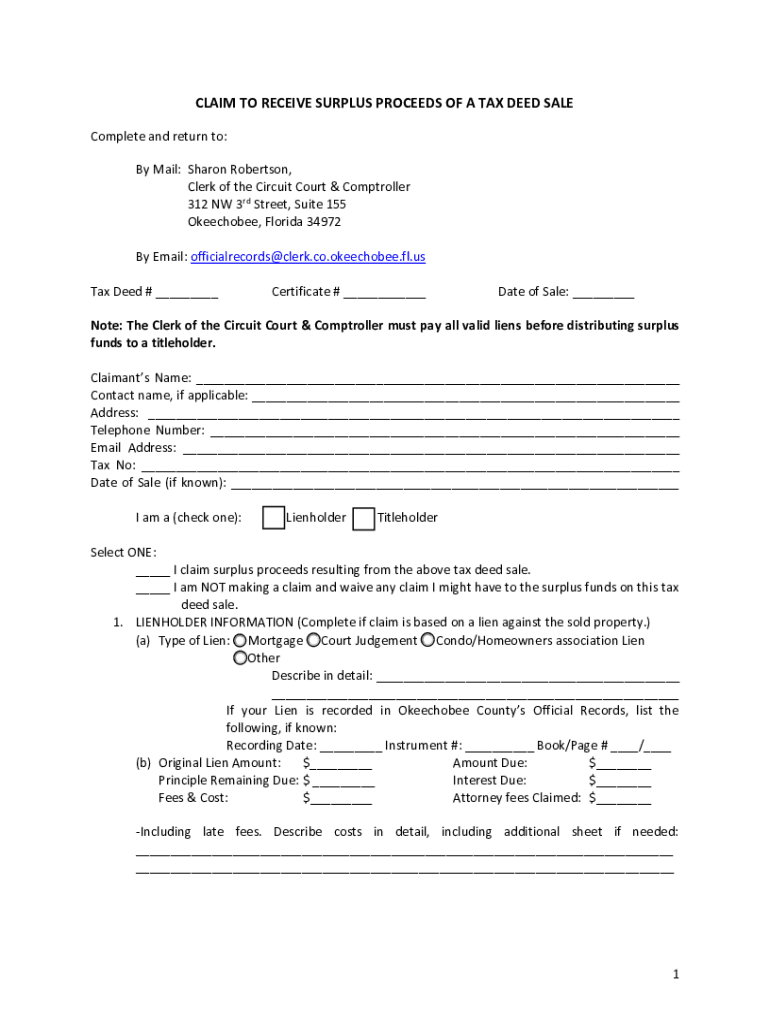

The claim to receive surplus proceeds of a tax deed is a legal document that allows property owners or former owners to request any excess funds generated from the sale of their property due to tax delinquency. When a property is sold at a tax deed sale, the proceeds may exceed the amount owed in taxes, leading to surplus funds. This claim serves as a formal request to recover those surplus proceeds, ensuring that rightful owners have the opportunity to reclaim their financial interests.

Steps to complete the claim to receive surplus proceeds of a tax deed

Completing the claim to receive surplus proceeds of a tax deed involves several key steps:

- Gather necessary information about the property, including the tax deed sale date and the amount of surplus proceeds.

- Obtain the official claim form from the relevant state or local authority.

- Fill out the claim form accurately, providing all required information, such as your name, contact details, and property information.

- Attach any supporting documents that may be required, such as proof of identity or ownership.

- Submit the completed claim form through the designated method, whether online, by mail, or in person.

Legal use of the claim to receive surplus proceeds of a tax deed

The legal use of the claim to receive surplus proceeds of a tax deed is governed by state laws, which outline the eligibility criteria and the process for filing. It is essential for claimants to understand their rights and obligations under these laws to ensure that their claims are valid. The claim must be submitted within specific timeframes, and failure to comply with these regulations may result in the loss of the right to claim surplus funds.

Required documents for the claim to receive surplus proceeds of a tax deed

When filing a claim to receive surplus proceeds of a tax deed, certain documents are typically required to support your application. These may include:

- Proof of identity, such as a government-issued ID.

- Documentation proving ownership or previous ownership of the property.

- Any correspondence related to the tax deed sale.

- Completed claim form with all necessary details filled out.

State-specific rules for the claim to receive surplus proceeds of a tax deed

Each state in the U.S. has its own regulations regarding the claim to receive surplus proceeds of a tax deed. These rules may dictate the time limits for filing claims, the documentation required, and the process for submitting claims. It is crucial for claimants to familiarize themselves with their state's specific requirements to ensure compliance and increase the chances of a successful claim.

Eligibility criteria for the claim to receive surplus proceeds of a tax deed

Eligibility criteria for filing a claim to receive surplus proceeds of a tax deed can vary by state but generally include:

- The claimant must be the former owner of the property sold at the tax deed sale.

- The claim must be filed within a specified period following the sale.

- The claimant must provide necessary documentation to prove ownership or a legal interest in the property.

Quick guide on how to complete claim to receive surplus proceeds of a tax deed

Complete CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any holdups. Handle CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED with ease

- Locate CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your laptop.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the claim to receive surplus proceeds of a tax deed

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED?

To CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED, you need to file a claim form with the appropriate tax authority, providing necessary documentation to prove your entitlement. It's also essential to follow the specific procedures laid out by your local jurisdiction, as they may vary. Using platforms like airSlate SignNow can streamline your document preparation and submission.

-

Are there fees associated with CLAIMING TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED?

Yes, there can be processing fees when you CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED, depending on the local regulations. Additionally, if you use services like airSlate SignNow, there might be subscription or transaction fees involved. It's vital to review all costs beforehand to avoid surprises.

-

What features does airSlate SignNow offer for CLAIMING SURPLUS PROCEEDS?

airSlate SignNow provides features that facilitate easy document signing and sharing for those looking to CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED. You can create templates for your documents, set signing workflows, and track statuses in real-time. These tools simplify the process and ensure your submissions are accurate and timely.

-

Can I use airSlate SignNow to help with any legal documents related to surplus proceeds?

Absolutely! airSlate SignNow can assist you in preparing and eSigning all necessary legal documents to CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED. Our platform supports multiple document formats and provides compliance features, making it a trustworthy choice for managing your documents securely.

-

How can I ensure my document is secure when I CLAIM TO RECEIVE SURPLUS PROCEEDS?

When using airSlate SignNow for your document needs, rest assured that your information is protected with robust security measures. We employ encryption protocols and secure access controls to safeguard your documents as you CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED. Always check the security certifications of your chosen platform as well.

-

Is airSlate SignNow user-friendly for first-time users claiming surplus proceeds?

Yes, airSlate SignNow is designed with user experience in mind, making it incredibly user-friendly for first-time users wanting to CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED. Our intuitive interface and step-by-step guides help simplify the process, ensuring you can navigate easily, even without prior experience.

-

What integrations does airSlate SignNow offer for managing surplus proceeds?

airSlate SignNow integrates with various tools to enhance your workflow when CLAIMING TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED. You can connect with cloud storage services, CRM systems, and project management tools, allowing for seamless document handling and collaboration. Check our integrations page for specifics on compatible applications.

Get more for CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED

Find out other CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors