Canada Mortgage Loan Agreement 2021-2026

What is the Canada Mortgage Loan Agreement

The Canada mortgage loan agreement is a legally binding document that outlines the terms and conditions under which a lender provides financing to a borrower for purchasing a property. This agreement includes critical details such as the loan amount, interest rate, repayment schedule, and the rights and responsibilities of both parties. It serves as a safeguard for the lender while providing the borrower with clear expectations regarding their financial commitments.

Key elements of the Canada Mortgage Loan Agreement

Understanding the key elements of the Canada mortgage loan agreement is essential for both borrowers and lenders. The primary components typically include:

- Loan amount: The total sum being borrowed.

- Interest rate: The cost of borrowing expressed as a percentage of the loan amount.

- Repayment terms: The schedule detailing how and when payments are to be made.

- Property description: Information about the property being financed.

- Default terms: Conditions under which the lender can take action if the borrower fails to meet obligations.

Steps to complete the Canada Mortgage Loan Agreement

Completing a Canada mortgage loan agreement involves several important steps to ensure accuracy and compliance. Here are the general steps:

- Gather necessary documentation, including proof of income and credit history.

- Review the terms of the loan, including interest rates and repayment schedules.

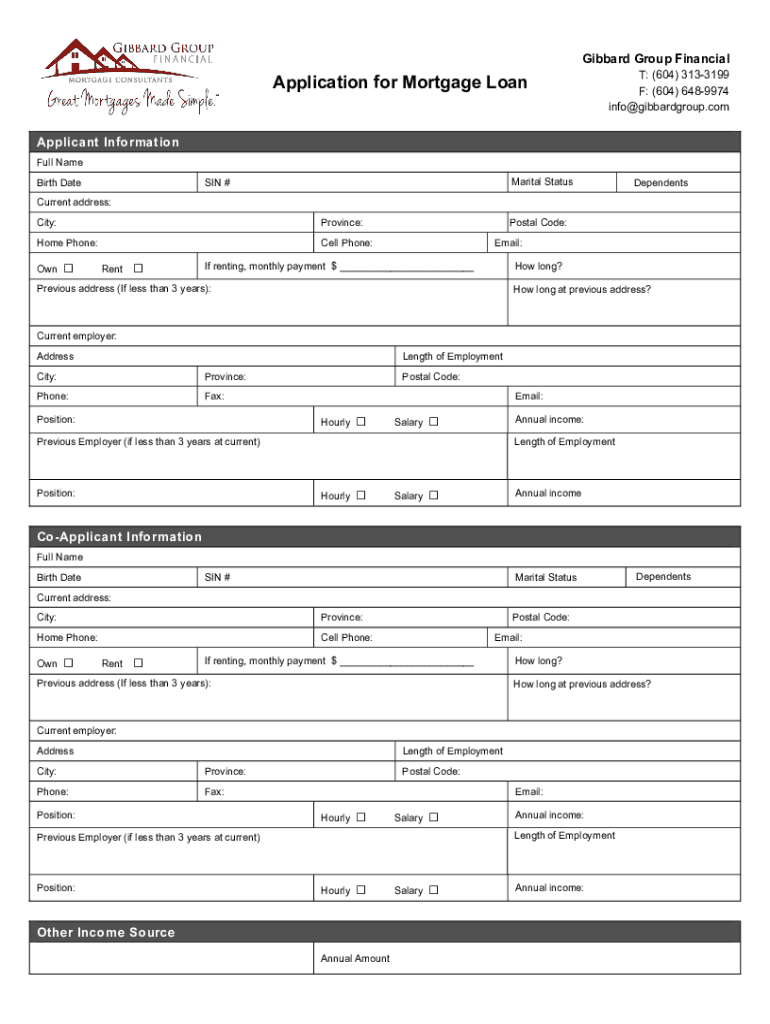

- Fill out the agreement with accurate information regarding the borrower and property.

- Ensure all parties involved sign the document, either physically or electronically.

- Retain copies of the signed agreement for personal records and future reference.

How to use the Canada Mortgage Loan Agreement

The Canada mortgage loan agreement is utilized primarily during the home buying process. Once the terms are agreed upon, the borrower and lender sign the document to formalize the loan. This agreement can be used to secure financing for purchasing a home, refinancing an existing mortgage, or obtaining funds for property improvements. It is vital to understand the implications of the agreement before signing, as it dictates the financial relationship between the borrower and lender.

Legal use of the Canada Mortgage Loan Agreement

For the Canada mortgage loan agreement to be legally binding, it must comply with relevant laws and regulations. This includes adherence to federal and state laws governing lending practices. Electronic signatures are recognized under the ESIGN and UETA acts, making it easier to execute agreements securely online. It is crucial to ensure that all signatures are authentic and that the document is stored securely to uphold its legal standing.

Required Documents

When preparing to complete a Canada mortgage loan agreement, several documents are typically required. These may include:

- Proof of identity: Government-issued identification to verify the borrower's identity.

- Proof of income: Recent pay stubs or tax returns to demonstrate financial capability.

- Credit report: A report detailing the borrower's credit history and score.

- Property details: Information about the property being financed, including its address and legal description.

Quick guide on how to complete canada mortgage loan agreement 612443804

Effortlessly prepare Canada Mortgage Loan Agreement on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the accurate form and store it securely on the web. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any delays. Handle Canada Mortgage Loan Agreement on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Canada Mortgage Loan Agreement with ease

- Find Canada Mortgage Loan Agreement and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that necessitate reprinting document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Canada Mortgage Loan Agreement while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the canada mortgage loan agreement 612443804

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Canada mortgage loan agreement?

A Canada mortgage loan agreement is a legal contract between a borrower and a lender that outlines the terms of a mortgage loan in Canada. This document specifies the loan amount, interest rates, payment schedules, and the rights and responsibilities of both parties. Understanding this agreement is crucial for anyone looking to secure a mortgage in Canada.

-

How does airSlate SignNow help with Canada mortgage loan agreements?

airSlate SignNow streamlines the process of creating, sending, and signing Canada mortgage loan agreements. With its user-friendly platform, you can easily manage your documents, ensuring they are securely signed and stored. This efficiency not only saves time but also provides peace of mind throughout the mortgage process.

-

What are the benefits of using airSlate SignNow for mortgage agreements?

Using airSlate SignNow for your Canada mortgage loan agreement offers several benefits, including enhanced security, ease of use, and cost-effectiveness. The platform allows for quick document turnaround and supports real-time collaboration, ensuring everyone involved is on the same page. Additionally, you can access your agreements from anywhere, making it convenient for all parties.

-

Is airSlate SignNow affordable for creating mortgage loan agreements?

Yes, airSlate SignNow offers competitive pricing suitable for businesses of all sizes looking to manage Canada mortgage loan agreements. With various subscription plans available, you can choose the one that best fits your needs and budget. Overall, the savings in time and resources make it a cost-effective solution for mortgage management.

-

Can I integrate airSlate SignNow with other software for managing mortgage agreements?

Absolutely! airSlate SignNow offers integrations with popular software used in the financial and real estate sectors, providing an efficient way to manage Canada mortgage loan agreements. These integrations help streamline workflows and ensure that all your documents and data are interconnected, enhancing overall productivity.

-

What kind of security features does airSlate SignNow offer for mortgage documents?

Security is a top priority at airSlate SignNow. The platform incorporates advanced security features, including encryption, multi-factor authentication, and secure cloud storage, specifically designed to protect your Canada mortgage loan agreements. This ensures that sensitive information remains confidential and safe from unauthorized access.

-

Can airSlate SignNow accommodate multiple signers for mortgage loan agreements?

Yes, airSlate SignNow is designed to support multiple signers, making it ideal for Canada mortgage loan agreements that involve co-borrowers or other parties. This feature simplifies the signing process, allowing all involved parties to sign documents at their convenience. You can easily track the status of each signer to ensure timely completion.

Get more for Canada Mortgage Loan Agreement

Find out other Canada Mortgage Loan Agreement

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast