Payday Loan Application Form

What is the payday loan application form?

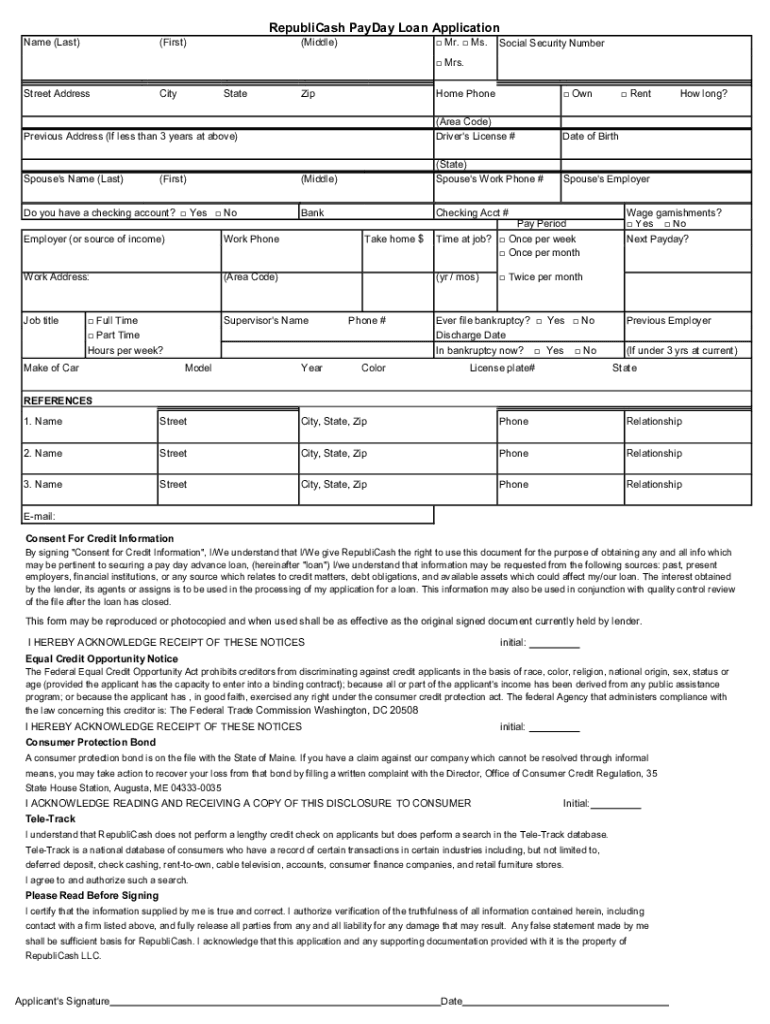

The payday loan application form is a document used by individuals seeking short-term loans, typically to cover unexpected expenses until their next paycheck. This form collects essential personal and financial information, allowing lenders to assess the borrower's eligibility and loan amount. The payday loan application form often requires details such as the applicant's name, address, income, and banking information. Understanding this form is crucial for anyone considering a payday loan, as it lays the groundwork for the loan approval process.

Steps to complete the payday loan application form

Completing the payday loan application form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documents, including proof of income and identification. Next, fill out the form with your personal information, ensuring all details are accurate and up to date. Be prepared to provide details about your employment and financial situation. After completing the form, review it for any errors before submitting it to the lender. This careful approach can help expedite the approval process and reduce the likelihood of delays.

Key elements of the payday loan application form

The payday loan application form includes several critical elements that borrowers must understand. Key sections typically consist of personal information, employment details, income verification, and banking information. Additionally, the form may require a declaration of the borrower's financial obligations, such as other loans or debts. Understanding these elements is essential, as they help lenders evaluate the borrower's ability to repay the loan and ensure compliance with lending regulations.

Legal use of the payday loan application form

To ensure the legal validity of the payday loan application form, borrowers must adhere to specific regulations. In the United States, eSignatures are recognized under the ESIGN Act and UETA, allowing digital forms to be legally binding. It is important for borrowers to understand that submitting a completed form signifies their consent to the loan terms and conditions. Additionally, lenders must comply with state and federal lending laws, ensuring that the application process is fair and transparent.

Eligibility criteria for payday loans

Eligibility criteria for payday loans can vary by lender but generally include a few common requirements. Applicants must be at least eighteen years old and a U.S. resident. They must also have a steady source of income, which can be verified through pay stubs or bank statements. Additionally, lenders may require a valid government-issued ID and a checking account to facilitate loan deposits and repayments. Understanding these criteria helps potential borrowers determine their likelihood of approval before submitting the payday loan application form.

Form submission methods

The payday loan application form can typically be submitted through various methods, depending on the lender's policies. Common submission options include online applications, where borrowers can fill out the form digitally and submit it via the lender's website. Some lenders may also accept applications by mail, allowing borrowers to send a printed form. In-person submissions may be available at physical locations, providing an opportunity for direct interaction with loan representatives. Understanding these methods can help borrowers choose the most convenient option for their needs.

How to obtain the payday loan application form

Obtaining the payday loan application form is a straightforward process. Most lenders provide the form directly on their websites, allowing potential borrowers to download or fill it out online. Additionally, some lenders may offer physical copies of the form at their branch locations. It is advisable to review the specific lender's requirements and policies before obtaining the form to ensure a smooth application process. Having the correct version of the payday loan application form is essential for successful submission and approval.

Quick guide on how to complete payday loan application form

Complete Payday Loan Application Form effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Manage Payday Loan Application Form on any device using airSlate SignNow's Android or iOS apps and streamline any document-based process today.

The easiest way to alter and electronically sign Payday Loan Application Form with ease

- Obtain Payday Loan Application Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and electronically sign Payday Loan Application Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payday loan application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payday loan form?

A payday loan form is a document used to apply for a short-term loan, usually due on your next payday. It typically requires personal information, employment details, and financial data. Using airSlate SignNow, businesses can streamline the process of sending and eSigning these documents quickly.

-

How can airSlate SignNow help with payday loan forms?

airSlate SignNow simplifies the process of creating, sending, and signing payday loan forms digitally. This service allows for a faster turnaround, reducing the time spent on paperwork. It enhances security and provides tracking features, ensuring that all submissions are logged and safe.

-

What are the pricing options for using airSlate SignNow for payday loan forms?

airSlate SignNow offers various pricing plans to accommodate different business needs when handling payday loan forms. Typically, plans are tiered based on features and user counts, starting with a free trial for newcomers. It's best to check their official pricing page for the most current details.

-

Are there any integrations available for payday loan forms with airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with several third-party applications to enhance your workflow for payday loan forms. This includes popular platforms like CRM systems and document storage solutions. These integrations can help automate processes and ensure that your documents are managed efficiently.

-

What features does airSlate SignNow offer for managing payday loan forms?

airSlate SignNow includes a variety of features specifically designed for managing payday loan forms. This includes customizable templates, in-app signing capabilities, and comprehensive tracking options. These features aim to improve efficiency and ensure compliance during the loan application process.

-

Can I access my payday loan forms from any device using airSlate SignNow?

Absolutely! airSlate SignNow is designed for accessibility, allowing you to access your payday loan forms from any device, whether it's a smartphone, tablet, or computer. This flexibility ensures that you can manage your documents on the go, making the loan application process more convenient.

-

Is airSlate SignNow secure for handling payday loan forms?

Yes, airSlate SignNow offers top-tier security features to protect your payday loan forms. With encryption protocols, secure cloud storage, and compliance with data protection regulations, your information is safeguarded throughout the signing and storage process. Safety is a priority when using our platform.

Get more for Payday Loan Application Form

- Gepa statement examples 100362803 form

- Ppb 5 sachet uses form

- Pmi disclosure form

- Oklahoma emt license renewal form

- Consultancy service agreement template form

- Consultant equity compensation agreement template form

- Consultant retainer agreement template form

- Consultant hold harmless agreement template form

Find out other Payday Loan Application Form

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now