Minnesota Estate Form

What is the Minnesota Estate

The Minnesota estate refers to the legal framework governing the distribution of a deceased person's assets and liabilities within the state of Minnesota. This process ensures that the deceased's wishes, as expressed in their will or through state laws, are honored. The estate encompasses all property, including real estate, personal belongings, and financial accounts. Understanding the Minnesota estate is crucial for executors, heirs, and beneficiaries to navigate the complexities of estate administration.

Key elements of the Minnesota Estate

Several key elements define the Minnesota estate process:

- Probate Process: This is the legal procedure through which a deceased person's will is validated, and their estate is settled.

- Intestate Succession: If a person dies without a will, Minnesota law dictates how assets are distributed among heirs.

- Executor Responsibilities: The appointed executor manages the estate, including settling debts, distributing assets, and filing necessary documents.

- Estate Taxes: Depending on the value of the estate, there may be state and federal tax obligations that must be addressed.

Steps to complete the Minnesota Estate

Completing the Minnesota estate process involves several important steps:

- Gather Documentation: Collect all relevant documents, including the will, financial statements, and property deeds.

- File for Probate: Submit the will and necessary forms to the appropriate probate court in Minnesota.

- Notify Heirs and Creditors: Inform all parties involved about the probate proceedings and any claims against the estate.

- Manage Estate Assets: Oversee the estate's assets, including managing properties and settling debts.

- Distribute Assets: After settling debts and taxes, distribute the remaining assets to beneficiaries as outlined in the will or by state law.

Legal use of the Minnesota Estate

The legal use of the Minnesota estate involves adhering to state laws and regulations governing estate administration. This includes ensuring that all documents are accurately completed and filed, following the probate process, and complying with any tax obligations. Executors must act in the best interests of the estate and its beneficiaries, maintaining transparency and accountability throughout the process.

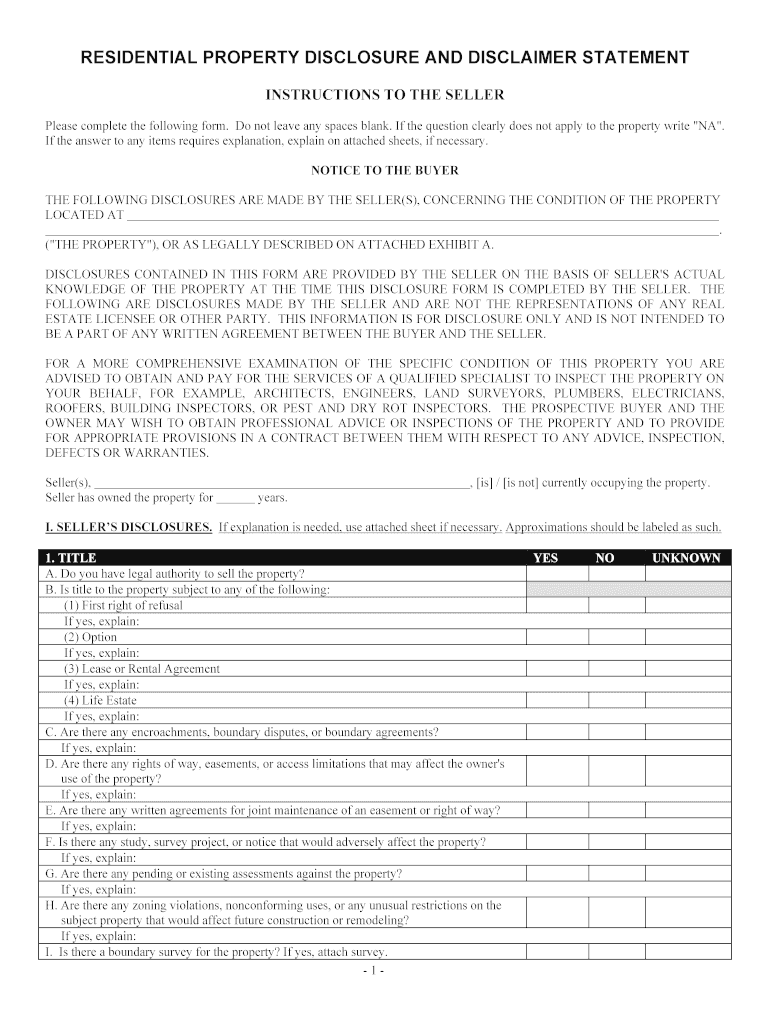

Disclosure Requirements

In Minnesota, certain disclosure requirements must be met during the estate administration process. This includes providing a detailed accounting of the estate's assets and liabilities to beneficiaries and filing necessary disclosures with the probate court. The Minnesota seller's disclosure statement is an essential document that must be completed when selling real estate, ensuring that all parties are informed of any known issues with the property.

Form Submission Methods (Online / Mail / In-Person)

Submitting forms related to the Minnesota estate can be done through various methods:

- Online: Many probate courts in Minnesota offer online submission options for certain forms, making the process more convenient.

- Mail: Forms can be printed and mailed to the appropriate probate court, ensuring that all documents are sent in a timely manner.

- In-Person: Individuals may also choose to submit forms directly at the probate court, where staff can provide assistance and guidance.

Quick guide on how to complete minnesota estate

Complete Minnesota Estate effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly and without holdups. Manage Minnesota Estate on any device with the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The simplest way to alter and eSign Minnesota Estate with ease

- Locate Minnesota Estate and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive content with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form searching, or errors that necessitate creating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Minnesota Estate and ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota estate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Minnesota estate planning?

airSlate SignNow is a user-friendly eSignature solution that allows individuals and businesses to manage documents efficiently. In the context of Minnesota estate planning, it streamlines the signing process for wills, trusts, and other legal documents, making it easier for individuals to ensure their estate planning wishes are fulfilled.

-

How much does airSlate SignNow cost for Minnesota estate-related documents?

airSlate SignNow offers flexible pricing plans that cater to various needs, including those focused on Minnesota estate management. Prices are competitive, and the platform delivers signNow value by reducing operational costs associated with document signing and management in estate planning.

-

What features does airSlate SignNow offer for Minnesota estate management?

airSlate SignNow provides features such as customizable templates, advanced document security, and real-time tracking, specifically beneficial for Minnesota estate documents. These features help clients efficiently manage their estate plans while ensuring legal compliance and document integrity throughout the eSigning process.

-

Can I integrate airSlate SignNow with other tools for my Minnesota estate planning?

Yes, airSlate SignNow integrates seamlessly with various popular applications, enhancing the efficiency of your Minnesota estate planning process. Integration with services like Google Drive, Dropbox, and CRM platforms allows for better document management and easier access across different tools.

-

Is airSlate SignNow legally compliant for Minnesota estate documents?

Absolutely, airSlate SignNow complies with all necessary legal regulations for eSignatures in Minnesota. This ensures that all estate documents signed through the platform are valid and enforceable, helping you to manage your estate planning with peace of mind.

-

How does airSlate SignNow enhance the estate planning process in Minnesota?

airSlate SignNow simplifies the estate planning process by allowing individuals to quickly send and sign essential documents online. This convenience increases efficiency and accessibility, helping residents in Minnesota finalize their estate plans without unnecessary delays.

-

What are the benefits of using airSlate SignNow for Minnesota estate professionals?

For Minnesota estate professionals, airSlate SignNow offers time-saving tools that help manage client documents more effectively. Features like bulk sending and automated reminders streamline workflows, allowing estate planners to focus more on their clients rather than administrative tasks.

Get more for Minnesota Estate

- Transaction cover sheet sale apre all pros real estate form

- Ta06 form

- Form tas 2 the chinese university of hong kong

- 8879 k form

- Musc kidney transplant referral form

- Dse mobile app form

- Info request form alaska department of labor and workforce labor alaska

- New employment for the kdom of saudi arabia contract template form

Find out other Minnesota Estate

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms